Year End 2022 Summary & Learnings

Disclaimer: This is not investment advice! The author takes no responsibility for the accuracy of the information provided. He is long most of the stocks mentioned in this article and can buy or sell at any time without further notice. Please do your own research!

Done! The first calendar year of the Augustustusville portfolio over and while the portfolio is still younger than one year, it is time for a recap and review of what happened so far. For the portfolio, the first year has been extraordinary as the capital was contributed in three tranches, about 30% in March, 30% in June and 40% at year-end. I am expecting no contributions going forward, so the portfolio is expected to (largely) remain stable going forward. The portfolio was up 3.3% in EUR, based on the capital invested in the first two tranches. Given that we just got started this year and overall markets have been down, I find this to be a satisfactory results.

The portfolio composition at year end was quite similar to my update at the end of November with a few additions mentioned here. The five biggest positions are still:

Odet, Fairfax Financial, TIM, Hostelworld and Millicom which I have written up and expect to remain in the portfolio for the time being.

I will focus this post on what went well and what went wrong in 2022 and also include some thoughts on challenges I see for my work given individual circumstances and markets. So let’s look at the

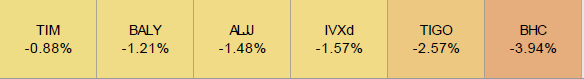

2022 Hall of Shame:

The above shove the performance contribution of my worst six positions as calculated per IB (btw, not sure if IB always calculates theses correctly, but they were major losers for sure).

Bausch Health (BHC) was my worst position in 2022 and I made a number of errors here, basically underestimating the risk of the situation. When I started a position, the shares had come down a lot already, the spin-off of BLCO was happening (BLCO had started trading) and while the debt was high, it seemed manageable given they might sell another slice of BLCO and would generate more cash from the Salix segment. I was hoping to receive spin-off shares in BLCO myself which would be roughly worth my entry price, with the remainder of BHC a cheap option. Boy was I wrong! BHC had a disappointing fundamental performance and crucially, lost a patent case in court on which most of their Salix business was built. This put the ability of the company to generate future cash flows and service its debt into question and the share price of the levered company came crashing down, costing us dearly. BHC was a big mistake of commission on my side. The combination of a levered company with an outstanding, crucial court case may be very toxic. I should have known and done better there.

Unlike BHC, Millicom (TIGO) is still in the portfolio. Its underperformance is also less idiosyncratic as the entire cable industry had a very bad year (look at the 1y charts of LILAK, CHTR, ATUS and you will find little joy). I wrote up TIGO for the blog and I still largely stand by the analysis. So far, while things have been very disappoint from a shareholder perspective, I understand how the company has been acting. If they can deliver against their targets in 2023, the share price should tick higher. One aspect I learned concerned the discounted rights issue: When it was announced at around 10.61$, I oversubscribed for new shares in order to be allotted shares linked to unexercised rights. I should have done so much more aggressively as it was basically free money because you can get the new, cheaper shares without having to buy a subscription right.

Invision is another interesting case. The German provider of sofware solutions for workforce management (e.g. Call Centers) was thrown under the bus of unprofitable tech going out-of-fashion. Unlike other companies in the sector, IVX is not a start-up, it also has seen profitable times in the past but took a decision to sacrifice profits for about 3-4 years in order to grow to a new level. 2022 was not the year to reward such strategy. Also, while Invision has been growing their subscription revenues, that happened at a lower rate than anticipated and there may is some risk of a need for a capital infusion. Feels like I should either give up or increase the Invision position - so far I have not done either.

I started a position in ALJ Regional (ALJJ) after they sold parts of their Faneuil Business and held about 3 USD/share in net cash, hoping for a large dividend or liquidation. This did not materialize, insted the CEO and majority shareholder appears to be using ALJJ as a family-office type of vehicle and made a number of investments. It is feared that this goes dark and shareholders hold this bag for many years. The majority shareholders looks eager, to increase his share. He owns convertible debt at very low strike prices. In addition, the company repurchased >20% of its diluted shares in a tender late 2022. I tried to summarize the Net Asset position here and am hoping for more tenders at higher prices going forward. I am not giving up on this one yet.

I bought Bally’s (BALY) on the buyout speculation last year which did not materialise. After that, the stock drifted on little news and remained volatile throughout the year. I sold BALY in early 2023 during the start-of-year rally to limit the number of positions I am involved in.

2022 Hall of Fame:

Hostelworld was my best contributor in 2022. When the shares of Online Travel Agency (OTAs) picked up as the Covid situation relaxed, Hostelworld was initially left out. As results improved when travel picked up and the company also implemented social network functions to its app, hoping to become more valuable to its customers and reduce customer acquisitions costs, the shares climbed. This week, Hostelworld announced that they will be EBITDA-breakeven in 2022 and I am clearly hoping for profits and cashflow this year as I think this has further to run.

Odet reached the silver rank in my portfolio last year. It ismy biggest position so has a bigger impact on performance. In my initial post, I tried to elaborate on the holding structure of Odet and it is cheap through various layers of holding companies. There were two of positive developments for shareholders in 2022: (1) The sale of the Bolloré Africa Logistics Assets has been concluded as planned. (2) There have been a number of share repurchases within the group, mostly by Odet buying more shares in Bolloré. Given the cash on hand, I am hoping for a further simplification of the group structure this year. Fundamentally, I think Odet shares are worth 3.500-4.000 EUR/share, so there is still a ~60% discount after the run-up.

Donnelly Financial Services (DFIN) is an unlikely winner in a year like the last one. Shouldn’t it be geared to capital markets activity which slowed significantly? Yes and no. My win was partly dure to good/lucky timing upon entry and you can see the slowdown of markets activity in their accounts (mostly in Q3). Yet, even in a difficult environment, DFIN can still generate profits and cash flow, just at a lower level. Management operated a fairly resilient business and was also able to repurchase a good clip of shares in 2022. If there is a deeper market correction in 2023, I will likely look to add to my position.

Twitter was the story of the year. I initially got involved there out of curiosity and in small size and I found there was a good case made for the takeover to ultimately happen, based on legal, rationale thinking whereas the opposite case was more “Elon can do what he wants and he will always find a way out”. The saga has been covered elsewhere ( if you have two hours, this “Risk of Ruin” podcast is great), I will not discuss it here. While I made money, I think I can still improve my trading here. Here is what I did: (1) I bought a small position in shares and call spreads (45/50, Jan23) in June and (2) I bought another position in call spreads (53/54, Oct22) in the last week before close. These were not wrong, but kooking back, I should have sized it bigger and adjusted as the odds of success improved over time. I feel like I could have adjusted faster, been less static, less stoic and more decisive after understanding the situation better. This is of course easy to say with hindsight - I would not claim that there was not risk at all in the situation.

Closing thoughts on the 2023 start of year and concetration

As we enter 2023, I need to invest the new funds in the portfolio. This is not made easier by the market rally of the first two weeks where everybody since some prices have been running away and I got less done than I had hoped for. Therefore, I am genuinely annoyed by everybody and their dog being up 10%+ for the year and bragging in Twitter about this. Fundamentally, the situation has not changed much. Higher interest rates still appear to be here to stay, consequently the housing sector in most countries is in trouble and a recession seems more likely than not. So I am trying to not let FOMO take me over these days and will leave my limit orders where they are, hoping to be filled in one of the next setbacks.

There are a few new positions I have started/would like to start and I recently wrote up Ibersol which is one of them. At the same time, I need to be aware of my position weighting. Sometimes, I have a tendency of having too many and too small positions for my own taste. There are so many interesting companies / situations out there where I like to part of the action. At the same time, I have a day job, two kids and a blog to write, so cannot spend endless time and more positions mean more time spent to cover thema all. In consequenc, I need to enforce a rigorous discipline on myself which means owning no more than 30 shares at a time - less than 25 is even better. So, I am looking to get a leaner, that is a more concetrated portfolio and will report soon how this is going.

I wish my readers a great year and am looking forward to any feedback.