I have not posted for a while, since I have been busy ramping up the Augustusville portfolio. Markets have definitely been a rollercoaster over the last months – with some sectors / asset classes even melting down (is crypto an asset class?).

All the while, I started building of the portfolio which currently looks approximately like this:

As you can see, there are currently 13 positions in the portfolio and the remaining cash position leaves the opportunity to start a few more (2-3) - or to add to existing positions. Position sizes are 5-10% and tend to be smalle for special situations. The portfolio is a mix of companies that I expect to be Long-Term Compounders, some firms which in my view are high-quality yet currently get little appreciation from the market and some liquidation/spinoff/merger situarions summarized as “special situations”.

For firms I hope to be long term compounders, I expect high long-term returns on capital, a skillful capital allocation, skin in the game from top management and a reasonable entry price.

In this thread and maybe some that follow, I will write up the positions one-by-one according to their size. From my experience as a reader, these write-ups are typically more valuable than discussion of investment philosophy or macro views. In this post, I will start with Fairfax and Odet and try to post more frequently going forward on other positions.

Fairfax:

Fairfax Financial is probably a standard bearer for many value investors that it needs little introduction. For anybody wishing to follow the company, I can recommend “The Corner of Berkshire and Fairfax” forum which is a great treasure on information on Fairfax as well as other investment ideas. Despite having been an ardent reader of that board, I only invested recently into Fairfax. Why?

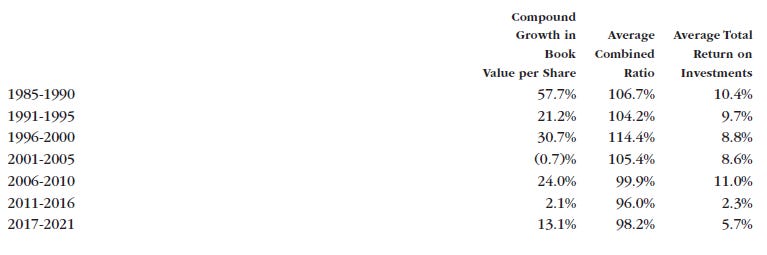

Long-Term Track Record: Since 1985, the first year the company was public under the helm of vurrent CEO Prem Watsa, Fairfax has compounded its book value by 18.2% and its share price by 15.7%. As of 31 March 2022, the book value per share stood at 626 USD, while Fairfax trades at 540 USD per this writing for a P/B of 0.86x. Fairfax has two major value drivers, insurance operations and investment income. The below table from the Annual Report summarizes the effects of each driver:

Insurance: Fairfax is first and foremost an insurance company which holds six major P&C and specialty insurers in the US/UK and various insurance companies around the world. In my view, Fairfax is a skilled underwriter which is also currently benefitting from a rather “hard” insurance market. In 2021, the company achieved a combined ratio of 95% (88% without catastrophe losses). This is much better than their long-term track record, suggesting that they have improved in underwriting over time.

Over the past years, we have see improvements in the Combined Ratio over time and we may well see an improvement to the low 90s in 2022. At the same time, Fairfax has grown gross written premia by a factor of 3x over the last few years, in part by expansion into emerging markets (India, Africa, Eastern Europe).

In my view, there may be less competition in some of these countries and Fairfax has built a reputation as an Emerging Markets insurer which might help it find new opportunities for growth. The insurance units are run by experience managers with long-term experience who are incentivized well. Capitalization of the insurance business looks strong with available capital for the insurance subsidaries being well above statutory requirements.

Investments: While insurance has performed well, investment returns have been unsteady and somewhat subpar. Fairfax has been sceptical of equity markets for years and over the last years bull market put on expensive equity and inflation hedges which bitterly hurt its performance. All off these hedges were taken off last year - actually right before inflation rose and markets became choppy. In my view, over time, there will be tailwind to equities and it therefoemakes no sense to try and time the market by running a short /neutral strategy. I am therefore glad the hedges were unwound.

Another headwind for Fairfax has been a low interest rate environment which has suppressed interest income for all insurance companies. Fairfax has positioned its fixed income portfolio with a short duration. While bond price have been tanking recently, the impact on Fairfax so far (in Q1 2022) has been very moderate with its book equity (adjusted for the dividend) actually up in that quarter. At the same time, Fairfax gets to invest bond redemptions at a higher interest rate going forward. Given the position of 20 bn USD in Cash and ST investments, Fairfax may make 200mm USD on a 1% rise in ST interest rates. I am therefore reasonably optimistic that the company will be able to present improving interest income.

Let’s take a look at the Fairfax equity portfolio:

As of 31 December, Fairfax as per the Annual Report had 11.4 nb USD invested in common stocks. The biggest positions are Atco (container ship owner/operator), Eurobank (Greek bank), Quess (Indian outsourcing/business services company) and Recipe (restaurant operator). Fairfax tends to invest less in high-quality GARP companies (like Berkshire) and makes more contrarian, in part deep-value purchases. They missed the tech hype (there tech investment in Blackberry went disappointingly) and were too early in certain situations such as but also equity in Greek (Eurobank). Still, I like the fact that Fairfax went big in situations whiche many considered “uninvestable” (like Greece at peak crisis). They also own a number of hard-asset and commodity-linked companies which I otherwise avoid (RFP, Exco) Fairfax also ventured into emerging markets, in particular focusing on India and even span out its Indian holding company “Fairfax India” which now trades separately.

In addition, Fairfax has proven to be creative in the structuring of transactions. A great example is Eurobank. Its shares were acquired by Fairfax at prices much higher than today, probably too early in the Greek crisis. Fairfax also acquired Greek real estate company Grivalia and merged it with Eurobank, therefore eanbling a very creative “stealth recapitalisation” as the combined entity had more equity and the low RWA real estate assets helped solve the capital issues. Eurobank has been the first Greek bank to overcome its capital / NPL issues and is poiised to grow and benefit from any Greek recovery. Another example ist the effective repurchase of own shares through a Total Return Swap (TRS). Overall, Fairfax has at various times demonstrated its outsider thinking and coming up with creative solutions for financial puzzles.

Valuation: So what’s it worth? At a price of 540 and with 23.9mm shares outstanding, Fairfax is valued at almost 13bn USD. I believe that the company will in the next 1-2 years benefit from a hard insurance market with ongoing underwriting profits (combined ratio in the mid 90s), higher interest rates and its equity investment allocation (diversified acrossindustries and regions, tilt to traditional value). Furthermore, skillful capital allocation might help further. With that in mind, I expect Fairfax to be able to compound book value by about 10% p.a. (they achieved 9%, 10%, 6% and 11% over the last 20,15,10 and 5 years). In addition, the dividend 10 USD/year gives another 2%. For a company returning 12% on investment which - in my view - also benefits from above average stability, a P/B of 0.86x seems too low and investment returns may be higher than 12% if the multiple expands.

Summary: While Fairfax is not the most creative of ideas, there is a lot to like about the company. The business model is proven and conservative, the team is incentivized well and the valuation appears to be on the cheap side. As I stated in my last post, one of my main targets in investing is to sleep well at all times and I can certainly do just that with a major Fairfax position. This is why I make Fairfax one cornerstone of the Augustusville portfolio.

Odet: Compagnie Financiere de L’Odet is a holding company controlled by the French magnate Vincent Bolloré (VB). Named after a river in Brittany, western France, it is part of a fairly complex structure of companies, some which are listed. The most well-known entity is certainly Vivendi, but Bolloré SA and Odet also trade with decent liquidity (at least for my purposes). The holding is not covered by a lot of professional analysts but quite well on fintwit (@foxcastlehold , @FRValue ).

The Corporate Structure looks like this:

I was honestly struggling when trying to figure out the structure but also have a soft spot for puzzles and worked my way through it.

The top holdings are mostly to make sure that control if the holdings sits with the Bolloré family (and maybe some tax reasons). It gets more interesting at Odet and Bollore SE, both of which are listed. Odet owns a majority in Bollore SE and Bollore SE owns participations in the Transport&Logistics, Media/Communication and Electric Storage sectors. Analyzing Odet/Bollore means analyzing these participations. This will be step one of the write up.

Furthermore, the holding structure shows a lot of cross-holdings within the group. Odet owns a majority in Bollore SE. Bollore in turn owns a good chunk in Sofibol which is the majority owner of Odet. While these cross-holdings feel really puzzling, their main effect is that these companies own a part of themselves, similar to treasury shares. This will need to be considered since the economic interest of one publicly outstanding share will be bigger than it appears at first glance. Analysis of this aspect will be the second part of the write-up.

Bollore SE Holdings:

The Transport & Logistics segment consists of Bollore Logistics, Bollore Arica Logistics and Bollore Energy.

Bollore Logistics is a freight logistics company with 600 offices in 111 countries and organizes the transport of goods around the globe, mainly by sea and air transit. Bollore Logistics generated a revenue of 5 bn EUR in 2021.

Bollore Africa Logistics is the leading logistics firm on the African continent and generated a revenue of 2.2 bn EUR in 2021. Both logistics companies combined achieved an EBITA of 700 mm EUR (breakdown is unclear to me). Bollore agreed the sale of Bollore Africa Logistics for 5.7bn EUR (Enterprise Value) in March 2022. The sale is expected to close by Q1 2023.

Bollore Energy runs an Oil Distribution an Logistics network across France and parts of Germany and generated sales of 2.5bn EUR and EBITA of 71 mm EUR in 2021.

Let’s take a look at the Media & Communications segment next. Most of Bollorés holdings here are minority stakes in listed companies. For many years, Bolloré has been invested in Vivendi a media conglomerate with about 10mm EUR revenues and owner of television and cinema firm Canal+, advertising frim HAVAS, print publishers Editis and Prisma and videogame producer Gameloft. Also, Vivendi owns minority participations in Telecom Italia and Lagardere. Vivendi was once integrated with Universal Music which however was spun out over the last 2 years and attracted investment interest from both Chinese media giant Tencent and Bill Ackman’s SPAC. Bolloré still owns a stake in Universal Music which is the biggest music label in the world.

Finally, the companies is building an Electricity Storage and Systems segment which includes the development of batteries, buses and plastic films, as wells as self-service systems. This segment produced revenues of 370 mm EUR and an EBITA loss of 117mm EUR last year. I will ignore when it comes to valuation. This segment is an option on the future given the electric revolution currently happening. Probably, the segment is worth something today. On the other hand it is still loss-making and currently a cash consumer.

Sum Of the parts valuation of Bollore SE:

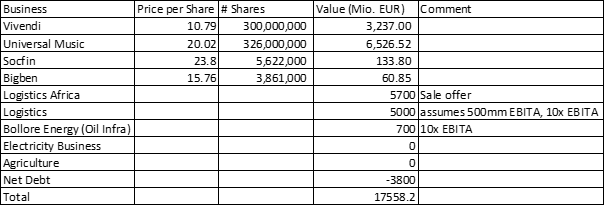

So what is Bollore worth? Here is an SOTP valuation of the business, using market prices where available and otherwise being as conservative as possible:

So a conservative valuation provides a valueof 17.5 bn EUR for Bollore. I may well be lowballing Logistics & Oil Infra when compared to Logistics Africa but then Logistics Africa may command a strategic premium and the sale has not closed yet. Agri and Electricity, valued at zero, also have upside from here. But let’s work with 17.5mm and compare it to a market cap of 14mm EUR for Bollore. That seems like the usual 20% conglomerate discount and nothing to get excited about, right?

Well, the twist is that intra-group holdings in effect mean that there are far less shares really outstanding and the real market cap is lower.

Intragroup and cross-holdings of shares

As of 31 December, Odet held 64.3% of Bollore SE. If Bollore SE is worth 17.5bn EUR, 11.3 bn EUR can be assigned to Odet.

At the Odet level, 56% is owned by a company called Sofibol and 34% is owned by Bollore SE subsidiaries. Then, Bollore SE also owns 48.9% Sofibol, while 51.1% is owned by Financiere V. And - you guessed it by now - Odet owns 48% in Financiere V.

What is the effect of this? Imagine Bollore SE is worth 1000 EUR and all of that could be distributed. Odet (64.3% stake) would get 643 EUR and distribute that to its shareholders. Of that money 34% (219 EUR) would go back to Bollore SE and 56% (360 EUR) to Sofibol. Of the Sofibol money, 48% (173 EUR) are owned by Bollore SE. So, looking at these levels only, 390 EUR of the 1000 EUR distribution have been kicked back to Bollore and can be distributed again (with Odet receiving 64%).

Across the holding structure, I believe that 53% of Bollore SE is self-owned, i.e. 53% of any distribution would belong to Bollore SE. If Bollore’s assets of 17.5bn EUR are distributed, 9.2 bn EUR would comeback to Bollore. Distribute these, and 4.9 bn come back. After a few rounds, you end up at around 37 bn for Bollore SE, 2.65x the 14 bn market cap.

Bollore SE versus Odet

I do believe that Bollore is cheap, but still prefer to own Odet. For one, the discount still looks bigger. Odet’s public shareholders own a total of 490K shares, representing 7.45% in Odet and 4.79% in Bollore. The value attributable to them is 1.782 bn EUR or 3.630 EUR a share. Shares trade at 1.160 EUR (factor 3.13x). Also, there are some assets at the Odet level which are not even considerd in this calculation, such as 0.3% in UMG.

More importantly, I expect that the Bollore family will take some action to simplify the corporate structure and unlock value. This UMG spin was the first big action in this direction, highlighting the value of that business. The second stepis the sale of Logistics Africa. There is a number of further assets which may be spun out from or sold by Vivendi and Bollore. More recently, there has been further acquisition of shares in Bollore SE by Odet (to the tune of 150 mm EUR), maybe to prepare for an asset distribution. I also feel that Odet is a step closer to the Bollore family than Bollore SE who are the ultimate insiders calling the shots here.

Summary

Odet is a holding to conglomerate Bollore SE. I believe the group is generally well positioned in the critical infrastructure and logistics segment which may be a decent asset to own in an inflationary environment. The media segment of the company also looks very interesting. While some parts of the business in this segment may be more cyclical (think Havas), both Vivendi and UMG are great assets to own in the long run.

The holding structure may well be misunderstood by the market which is why we can buy the assets at a big discount to fair value. More importantly, there are signs of change in the group, highlighting/realizing the value through asset sales / spins / repurchases.

Overall, I feel confident enough to make Odet one of my biggest positions.

Thank you for starting the blog, seems very interesting! I had Millicom on radar for a while and recently bought when the price got too low. Especially telecom seems very unpopular right now. What’s your opinion on the rights offering? I was surprised by the dilution.

Great post, just a question, I don’t quite understand your reasoning regarding the EUR 17,5bn in value of Bollore’s assets turning into EUR 37bn. The amount of distributable assets doesn’t change with a complex ownership structure so in my reasoning the maximum distribution remains EUR 17,5bn or am I missing something?