2025 Review

Performance of 12.2% (EUR), Drivers and thoughts on positions

Disclaimer: This is not investment advice. Authors is long the positions mentioned in the below post and may buy or sell at any time. Views expressed may be biases. Please do not rely on the information presented and do your own work.

The Augustusville portfolio ended 2025 with a total return of +12.2% (in EUR), a result which I consider to be mixed at best. While we managed to outperform the MSCI World, we lagged behind most large European indices, like DAX and European Small Caps. Since Augustusville went online in March 2022, the cumulative return is +52%, in line with a 12% CAGR and the result of last year. Again, this not a disaster, even though it will make you will an inferior investor when you look at Fintwit.: A consistent 12% p.a. return means doubling the capital every six years (it will take longer due to costs and taxes). Our performance has been less volatile than the overall market and we did not participate in any craziness of the last few years, from cryto to AI.

Still, our results so far have been below the ambition level of achieving at least 15 % p.a. and while I believe there are some positions which Mr. Market does not appreciate enough yet, there is also mistakes on committed by me, your portffolio manager, which have prevented us from doing better.

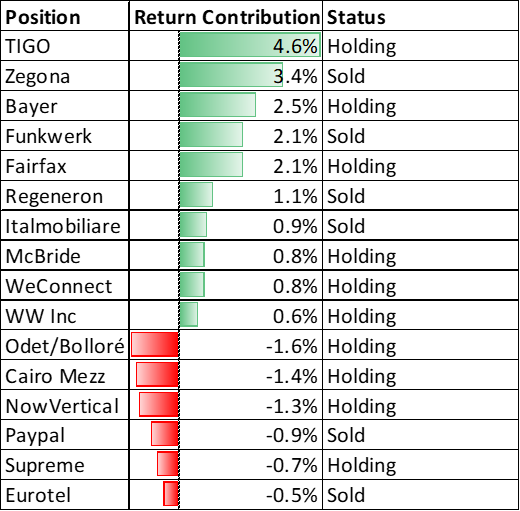

Our portfolio still looks pretty much like it in the 19 December 2025 update and the performance is also online. Let’s look at the big winners and losers in terms of return contribution (anything that had in impact of more than +/-0.5%) :

If you add up the returns, you will get to 12.5%, i.e. these positions pretty much explain the entire performance of the year.

Winners:

It was a great year for TIGO. The company operationally has been firing on all cylinders with results improved in most of its geographies, the tower sale-leaseback executed and the expansion into new markets with the acquisitions in Uruguay and Ecuador. Millicom has instated a dividend of 3 USD/share and paid a special dividend related to the Tower sale. It was interesting that the market adopted slowly to the dividend announcement and for some time, TIGO was avaliable at at dividend yield of >10%. This is now closer to 5-6% and depsite the rise in share price, TIGO still trades at reasonable levels (10xEBIT / 6xEBITDA). I have reduced the position and taken some profits, but remain confident with a ~5% position going forward.

Zegona Communications is the second large telecom winner in the portfolio. The company acquired the operations of Vodafone Spain in Mid 2024 and the transaction may serve as a case study for a perfectly executed the LBO. Zegona secured a cheap price and highly advantageous financing conditions from Vodafone which included redeemable preference shares making up 67% of all outstanding shares. These redeemable pref shares often blurred the share count but could and have been redeemed at notional value plus a fixed return. The company also announced a share repurchase program and a dividend. This dividend alone more than repays the original investment into Vodafone Spain. I have decided to take our chips of the table since it seems to me like the easy money has been made, even though I keep Zegona’s management in high regard and will watch what the company and the team are doing. Zegona has been covered by Alluvial Capital’s which is where I found the idea. So thanks and big shoutout to Dave Waters.

Bayer AG was a contrarian position I took on last year, after the supposed blue-chip company had suffered a more than 80% drawdown and based on the thesis they will not go bankrupt, nor have to perform an overly punitve capital raise. Bayer remains burdened by the litigation proceedings following its infamous Monsanto acquisition and by a large debt burden. However, in 2025 they made some progress in working through the litigation cases, their pharma pipeline looks more hopeful than before and the agri segment is hoping for growth going forward. The company has also shedded several thousands jobs and cut its cost basis significantly. These factors combined led to improved sentiment of the stock and a ~75% increase in share price. The company’s situation at this moment remains challenged. For years, the financial statements have been coined by “special items” and the gap between what Bayer reports as “Core Earnings” and actual IFRS earnings remains huge. If Bayer can in 2026 continue to solve its legacy issues, the turnaround could gain steam which is why we remain invested.

Funkwerk AG, German producer of radio-equipment and software for the railroad sector has been on a great run in 2025. The company has benefitted from European investments in rail infrastructure and its great products and people. As there is currently a lot of sceptiscism on German businesses and success stories appear to be rare, Funkwerk is a great example of an innovative engineering and tech company which can compete well in its sector. So the share price followed suit and rose from <20 EUR to the mid 30s by Septmember. What happened then is a shameful and unworthy example of how minority shareholders in German capital markets can be taken advantage of. Hörmann, the majority shareholders decided to delist the shares from the market (Munich Freiverkehr). Disgracefully, this is possible without having to make take-private offer. So while you can remain on board as a shareholder of Funkwerk, there will be no organized trading and the company can also go dark(er) on its reporting. Since this is not a position I like for Augustusville, I decided to exit the share - with a tear in my eyes as I truly believe in the potential of this great company.

Fairfax Financial has been a core holding since the beginning of Augustusville and the biggest weighting in the portfolio. In 2025, the company has been firing on all cylinders and I expect it to earn >200 USD/share for the year. Capital allocation decisions by Fairfax have largely been successful such as the overweight on the Greece economy (via Eurobank and Metlen), as well as other investment decision (e.g. Orla). Moreover, the core of Fairfax, its insurance operations look as rock-solid as ever (tracking towards another year of >95% combined ratio). Fairfax has been receiving more attention recently because of its inclusion in the S&P/TSX index and the recently published book “The Fairfax Way” by David Thomas. We never bought nor sold Fairfax shares this year and anticipate to hold our position for a long time.

Of the remaining smaller winners, I have recently written about WW International Inc (Weight Watchers). The one position I find interesting and am considering to add to is WeConnect, a French IT distributor. Driven by its acquisition of MCA, the company posted a significant rise in sales and net profits in H1 2025 (notably the profit increase has been driven by extraordinary factors). WeConnect also acquired Exertis France and Exertis Iberia in 2025 at a symbolic price from DCC, another holding of ours. This acquisition will bring revenues from a level of 300m EUR to 500m EUR. While the tech segment has been the lowest-margin one at DCC and has therefore rightfully been sold, there may be synergies between WeConnect and Exertis. I expect for some restructuring to become necessary but if WeConnect can keep this level of revenue and achieve its long term average operating margin of 4%, we may look at a debt-free company generating an EBIT of 20m EUR for a current market cap of 72m and enterprise value of 80m. This could in my view get very interesting.

Where we celebrate the winners, it is also important to look at our losers and see what lessons we can learn.

Our largest negative position in 2025 has been Odet/Bolloré. I look at these as a combined position which currently makes about 9% of the portfolio after I added in 2025. The planned simplification of the group structure via the contemplated squeeze-out of Compagnie du Cambodge, Financiere Moncey and and Financiere de l’Artois was challenged by the French regulator AMF since Bolloré had offered an iadequate price and tried to take out the minorities for cheap. While this is per se positive, it also means that the planned simplification has been abendoned (for now). Let’s see if they will take another shot next year.

While the Vivendi split went ahead, the market performance of all the newly established companies (Canal+, Havas, Louis Hachette Group and Vivendi itself) has been disappointing while I found the opreating results fairly decent. My impression is that the market has been watching to see what Bolloré will do with their stakes as their potential decision to exit/reduce might produce an overhang. Moreover, the largest operating asset, UMG has lost in market value in 2025 even though its results have been decent. UMG trades at an earnings multiple of around 20 while there should be visibility on the ability to grow by 8-10% for many years. This means UMG trades a lot cheaper than e.g. Spotify.

A major overhang for Bolloré has been the uncertain situation with respect to Vivendi. The AMF argued that Bolloré had to make a mandatory bid to the remaining shareholders of Vivendi. The market feared for some that this would mean Bolloré having to liquidate UMG shares or other holdings in order to finance this bid. However, the AMF position has been dismissed by the courts and we can assume that Bolloré can deploy their 6b EUR cash pile as they like. The company (at a modest pace) bought back shares in 2025. 2026 will likely see the listing of UMG at the US stock exchange. So as usual, there are a lot of moving parts for Bolloré, but there is also a lot of optionality. I remain confidednt for a better 2026 after 2025 felt like a lost year, based on (1) potential valuation uplift for UMG based on reduced overhang fears, (2) clarity on Vivendi, (3) hopefully further efforts to simplify the structure, (4) buy backs and (5) potential improvement on the in 2025 lacklustre battery and energy businesses. Bolloré/Odet is a big hope for 2026.

Cairo Mezz is another big hope. I received excellent feedback on my nerdy deep-dive thesis published in summer and have spent a lot of time following the developments. For those not aware, Cairo Mezz holds mezzanine and junior tranches in 3 securitizations of non-performing loans (NPLs) called Cairo1, Cairo2 and Cairo3. These loans were originated by Eurobank and dure to the waterfall/tranching, the any cash flows from the loans are first used to pay interest and principal for senior, the mezzanine, then junior tranches. When I wrote the article in summer, I was particularly hopeful for one securitisation called Cairo3, since it had come the longest way in terms of amortizing their senior tranche. This has continued and in the last two quarters since the write upa, the outstanding senior tranche notional has come down from 241m EUR (March 2025) to 186m EUR (September 2025). More interestingly, doValue launched the sale process for 2 portfolios “Alexandria” and “Giza” consisting of loans included in the three Cairos. On 16 December, news came out that in the auction process for the portfolios US PE investor Apollo Global had emerged as the preferred bidder and that a satisfactory price was expected for the portfolios, sufficient to pay down the entire remaining senior tranche of Cairo3. At the same time, we do not know what price Apollo will be paying, nor have we seen confirmations of the deal closing. We can expect that the sale price will initially be used to pay down the senior tranche and the servicers fees. The remainder should go to the mezz tranches of which Cairo Mezz owns 75%. There may also be some cash left in the Cairo SPVs which has the potential to be released. Cairo Mezz trades for 128m EUR. At this point, we wait for the announcement on a daily basis and hope for a jackpot and not a loser’s ticket.

NowVertical was hit very hard in the last year and is now reduced to a 1.5% position in the portfolio. I will have to make to call to either exit it or increase the position. Actual results by the company have been disappointing, however als Christian Schmidt and Sven Klass have generously explained, these apparent disappointments are explainable and the original thesis is still largely intact.

Paypal over the last year became a battleground stock with ups and downs. While I like the improvements the company has achieved in terms of capital allocation, including introduction of a dividend and a massive share repurchase program, I am not entirely convinced of the competitive position. Paypal is a larger player and in my direct environment gets used a lot. On the other hand, I think that challenges by ApplePay, GooglePay and others are real and credible. There is also a relatively weak consumer environment and Paypal may be vulnerable to that. For now, the position has moved from the portfolio to the watchlist.

I cleared out two Polish small-cap positions Eurotel and Text SA at a loss. Both are companies which I found cheap and liked based on quantitative metrics. I never had the conviction for a larger position though and would have done better not touching them. I also feel that this is the typical case where the strategy of a relatively large diversification has been hurting. We will probably do better with 15 positions which we know well than with 25% we know so/so. If we think that a company is not good for at least a 4% position, we should rather not invest at all. It is therefore the plan to reduce the number of positions and spend more time on position-weighting. Whenever capital becomes free, we shall first ask if it is better used to increase an existing position than invest in a new one. This should lower the tracking work for the portfolio.

For 2026, the goal is to run a more concentrated portfolio and move towards 15 positions. While I am overall fairly bearish on the market after three years of very decent returns, I am looking hopeful at the portfolio which I hope is positioned defensively enough to weather potential storms. Overall, while scope for optimization remains, it is a portfolio I can sleep well with.

Thank you for reading and any feedback is appreciated.

Reg. "the strategy of a relatively large diversification has been hurting. We will probably do better with 15 positions which we know well than with 25% we know so/so."

There is truth to that statement.

But also an issue, since I believe we mostly conclude that we did not know a position well enough when we realize a loss. Had the same position resulted in a ein, we would mostly not conclude that we did not know it well enough, and would have no issue with it at all!

All the best for 2026!

Always appreciate your honesty and frankness with your reviews Carsten, best of luck for the New Year!