Disclaimer: This is not investment advice. The author owns shares in Cairo Mezz PLC and Fairfax Financial and may buy or sell shares at any time. Investing in the securities mentioned may result in a complete loss of capital. Please do your own research and do not rely on the information presented here.

The investment publication I have enjoyed reading most so far this year has been the “Weird Shit Investing Manual of Ideas”. Swen Lorenz, the author of Undervaluedshares.com and himself a highly creative thinker in investments off the beaten track has assembled a list of presenters and ideas for this conference and the result is a long list of ideas which are quite interesting and inspiring.

The manual includes ideas I probably would not touch with a 10-feet pole and others I have no access to, but some are worth serious consideration and all are interesting. So, if you have not yet done so, I suggest you get the manual - it is free but you need to leave your contact data.

While Augustusville did not participate in the conference, we are today presenting an idea which however might have qualified. It is a bit nerdy and somewhat technical and clearly not something a lot of people are looking at. At the same time, we have enjoyed researching this idea and will happily share it here. We hope that, while some readers may put it on the “too hard pile”, we can at least do a good job explaining a fairly complex topic and why we can see merit as an investment here.

Background: The Greek Crisis and Bank NPLs

The idea originates in the Greek Depression of the 2010s. At that time, the Greek government defaulted on its debt and the EU imposed severe austerity measures and sturctural reforms on Greece which caused a lot of pain and suffering among its population. The country’s Euro membership was at risk. I have had a lot of sympathy with Greece because I thought the way the country was humiliated at that time was terrible. Some of my older German readers may remember the below absolutely disgusting cover from the leading German yellow press newspaper “Bild”

The Greek Depression was a severe as the 1930s Great Depression even though limited to one country. Any Greek asset plunged in value, businesses had to close down, jobs were lost, unemployment spiked.

Unsurprisingly, during this time, Greek banks, though traditionally well-run, came under severe pressure. Not only were they large investors in Greek government bonds, but also lenders to businesses, home buyers and consumers, all whom now found it difficult (or impossible) to repay. In consequence, the Non-Performing Loans (NPL) ratio of these banks skyrocketed and they had to hugely increase provisions for their loan books. In consequence, this banks had to be capitalized and their balance sheets restructured. There are four major banks in Greece, Alpha, Piraeus, NBG and Eurobank and, prior to the crisis, they ran a fairly profitable oligopoly and did quite well.

When the most acute stage of the Greek debt drama was over, the banks were still left with piles of NPLs on their balance sheets, limiting their ability to lend into a potential recovery. Just to give an idea of the magnitude of the problem: A typical bank has an NPL ratio (i.e. share of NPLs to loan portfolio) of a low single-digit percentage, i.e. 1-3%. An NPL ratio of 5% can be happen in an adverse environment or to a racy business model while a 10% NPL ratio is normally unsustainable. The NPL ratios of Greek banks in 2018/19 stood at 30% and more.

Securitisation and the Hercules Structure

In order to resolve the issue, Greece established an “NPL securitisation scheme” calles “Hercules” or “HAPS” (Hellenic Asset Protection Scheme) for its banks. Under the scheme, a participating bank would (1) transfer a portfolio of its non-performing loans to a new company (called a Special Purpose Vehicle - SPV - or Designated Activity Company - DAC - ). This company would do nothing but hold and service these loans. The DAC’s liability side would consist of notes which it issues in three tranches, the “Senior”, “Mezzanine” and “Junior” Notes. These tranches represent various risk buckets. The cash which gets generated out of the transferred loans will first be used to pay costs, after that Senior, then Mezz, then Junior Notes. Senior Notes would therefore represent the “safest”, Junior Notes the “riskiest” portion of the portfolio (NPLs is general have to be considered fairly risky). The Greek state would support this securitisation by granting a guarantee on the Senior tranche and the NPL portfolio would be managed by an independent servicer. Here is an overview of the scheme which I took from this KPMG presentation:

The senior notes would typically be issued to the same bank which transferred the NPLs. With the state guarantee, the senior notes would be considered “safer” assets in the bank’s accounting and regulatory capital calculation. The mezzanine and junior notes, on the other hand, would largely need to be transferred to other investors than the issuing bank - otherwise the NPLs might not be derecognized from the balance sheet. This goal was achieved by (1) finding actual investors for the junior and mezz notes, typically the servicers (debt collection companies like Intrum or doValue) and (2) distributing these economic rights to these notes to the shareholders of the bank for free. All four large Greek banks participated in this scheme which was a way to dramatically reduce their NPL stacks in one go. Various securitisations were structured and established, but we shall focus on the Cairo transaction by Eurobank.

Athens - Cairo - Dublin

Eurobank participated in the HAPS scheme and defined three NPL portfolios which were transferred to three DACs named Cairo No. 1 , Cairo No. 2 and Cairo No. 3 . All of these companies are based in Ireland and have no operations other than holding the loans. Eurobank’s loan servicing company called FPS was merged with doValue SPA and doValue became the Servicer of Cairo No. 1-3. The Cairo transactions were put together in 2019 and became effective in 2020.

Each of the three Cairos issued Senior, Mezzanine and Junior Notes as per the Hercules Scheme described above. More specific, here is an overview of the Notional amount of the three vehicles and the tranching:

Note that the gross notional is 7.5b EUR compared to total assets of Eurobank of about 62b EUR in June 2019, so about 12% of the balance sheet. The Senior Tranche (Class A) of each of the three Cairos benefits from a Guarantee issued by the Hellenic Republic. Class A Notes earn an interest rate of 1.875% p.a., Mezzanine Notes 3M-Euribor+5% and Junior Notes 3M-Euribor+8%. However, the coupons for mezzanine and junior notes are currently capitalized.

Now, who owns these notes? As described in the Hercules structure, the bank retains all the senior notes as well as 5% of the mezzanine and junior notes. The service doValue SPA purchased 20% of the Mezz and a majority of the junior exposure and the rest - 75% of the mezzanine and 44.9% of the junior exposure was transferred to a new company which in the below table is called Marianus Ltd.

Marianus Ltd. is based in Cyprus and has been renamed to Cairo Mezz plc (“PLC”). It has no other business apart from holding the junior and mezzanine notes from the three Cairo securitisations. PLC is a public company, listed on the Athens Stock Exchange. Its shares were distributed to shareholders of Eurobank, the original owners of the loan portfolio in default. Like in a normal spin-off, all Eurobank shareholders received the PLC shares without being asked if they wanted them. Accordingly, typical spin-off dynamics are in place here.

For clarity, here is the priority of payments for the Cairo securitisations, i.e. the “waterfall” which defines how any incoming cash from the NPL portfolio is used. It is very clear that costs and senior claims are paid first. PLC will only benefit from payment priority #7 onwards.

So with PLC shares, you have the chance to buy subordinated claims on a portfolio of Greek Non-Performing Loans, mostly originated in the 2010s. Does this qualify for the “Weird Shit” category? For sure. Does it sound like a promising investment? Not so much, right? Well, let’s dig deeper…

So what is inside the Cairos?

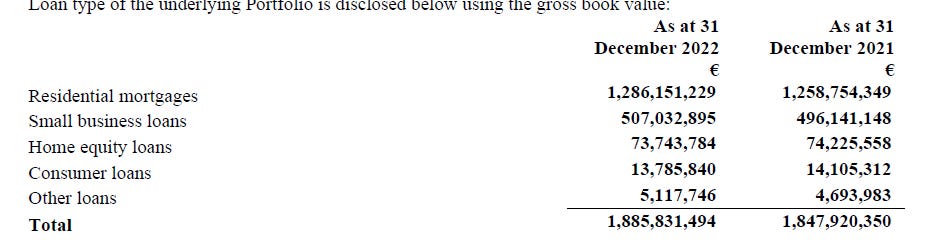

So Cairo No. 1-3 contain Non-Performing Loans which the originating bank wanted to get rid of. Under standard regulation, a bank has to declare a loan to be non-performing if the borrower has either declared insolvency or is behind with his payments by more than 90 days. As a loan is declared NPL, this does not automatically mean that all is lost for the lender. Loans can be renegotiated and restructured so that they are serviceable for the lender. Also, most loans are granted against a certain collateral, quite often real estate. If you happen to have a mortgage for your house and stop making payments, the bank can foreclose and repossess the house and recover some of the value. On the other hand, there are types of loans which will have a fairly low recovery. Unfortunately, as far as I am aware, there is no file or presentation showing all the underlying assets of Cairo No. 1-3. Since they are Irish companies, we checked in the Irish registry for their financia statements. Interestingly, the latest available financial statements are as of 31/12/2022 (and only approved in February 2025). These statements contain some statistics of the respective loan portfolios:

Cairo 1:

Cairo 2:

Cairo 3:

So we see that Cairo 1 is more weighted toward residential mortgages whereas Cairo 2 more toward Small Business Loans whereas for Cairo 3 we do not know that split. All the NPL portfolios are to a large extent collaterilized, mostly with real estate.

When a country goes through a deep recession with incomes shrinking and businesses going bankrupt, you would expect real estate markets to crash and this is what happened in Greece. In the last years however, there has been a recovery in real estate prices. If you are interested in the Cairo situation, I suggest you read this excellent write-up on VIC by orphanedsecurities which includes the below graph:

So unsurprisingly, with the overall recovery real estate prices in Greece, apartment and most likely overall real estate price have come back which is generally good news if you hold real estate collateral, i.e. the three Cairos. However, this is guesstimating and we do not really know how precisely Cairo 1-3 as of now, even thought there are some more datapoints to consider

Repayment of the Senior tranches

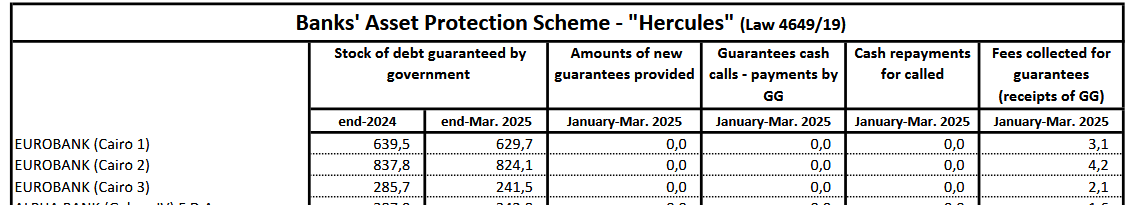

The attentive reader will have understood that the “waterfall” requires full repayment of the senior tranches prior to any cash for mezz and junior. Now, here we can gather an interesting piece of information. Since the senior tranches are guaranteed by Greece, they are part of the periodic reports of the Greek Public Debt Management Agency (PDMA), the most recent of which is here. The last page shows the amount guaranteed by the Greek state for various Greek securitisations, including Cairo 1-3.

The PDMA numbers for the guarantees do match the senior tranche notionals of Cairo1-3 per the end of 2022, so I guess these numbers provide a quite recent picture of how much is repaid/outstanding on the seniors. Note that after senior has been paid off (if it happens), all cash will flow to mezz, of which PLC owns 75%.

So we can see that No. 1 has been the slowest in terms of senior amortization, with nothing happening by 2023, and just 50m since. No. 2 has come a bit further with 16% of the senior tranche amortized while for No. 3 we already stand at two thirds. Note that repayments can be lumpy and one should be careful to extrapolate but it could be quite possible to see Cairo 3 senior fully amortized over the next 2-3 years. Note that Cairo 3 has the shortest legal maturity date (2035) versus 2054 for Cairo 1 and 2062 for Cairo 2.

As a reminder, here are the notionals of mezz and junior owned by PLC - and I have also added an approximate number for deferred interest.

It is notable that for the Cairo securitisations coupons have been paid on the Class B (mezzanine) notes, unlike for other Hercules securisations like Phoenix Vega. This results in a faster paydown of the senior notes and later cash flows to PLC. For the deferred interest, I have assumed a tenor of 6 years and a 3M-Euribor level of 1%, just very rough estimates.

Book Value of the Cairo Securitisations

PLC annually publishes its financial statements, audited by Deloitte, including a model-based estimate of the assets heald which are accounted at Fair Value through Profit and Loss . Here is the history of the asset values as per the PLC financials:

Note that the Junior Notes were assigned a Fair Value of Zero at any point in time. So we can see a poor development of the values for Cairo No.1 and No.2, in particular in 2024, even though during that year, the first significant senior paydowns happened. We have not seen the model and do not know how good it is and how well the parameters get adjusted, but it seems like the performance of the loans and/or the repayment speed is worse than expected for Cairo 1 and 2 but better for Cairo 3. The fair values confirm that perspective of receiving of cash for Cairo 3 is improving.

An interesting counter-check are the financial statements for Cairo 1, Cairo 2, Cairo 3, which show fair values for the same notes on the liability side, audited by KPMG. Unfortunately, we do not have these numbers for any year after 2022 and there is also no breakdown by note type. Still, it seems an interesting datapoint to me. Note that in the below table I am making the assumption of the senior notes being valued at Par which may be wrong. Note however that the Cairo Senior notes pay 1.85% fixed while at the end of 2022, Euro risk free interest rates (ECB rate and 10y German bunds) traded at around 2%, so the senior tranche should not trade massively above par.

Interesting, right? So while PLC put the fair value of its assets at the end of 2022 at 56m EUR (and recorded a massive gain in 2023 and 2024), Cairo No.1-3 put the fair value of those liabilities (under the above assumptions) held by Plc at 600m EUR at the same time. What does that tell us? Mostly that model-based valuations are to be looked at with the utmost caution. However, in particular for Cairo No. 1 and No. 2 , it gives me some hope that these assets might indeed hold some value to PLC.

Who is involved in Cairo and Greek RPL Market

At the time the securitsation was planned and executed, Eurobank underwent a significant corporate restructuring in order to achieve derecognition of the NPL portfolio (see pages 35-40 of this presentation). 80% of the loan servicing department FPS was subsequently acquired by Italian doValue SPA, a publicly listed company. doValue also holds the majority of the junior notes and 20% of the mezz and is servicing all the Cairo DACs. This is clearly a positive as it aligns doValue with PLC - both would see cash inflow if junior and mezzaninie notes were to pay out. doValue is marking its Cairo Notes at a mere 12m EUR as of 31 December 2024, much lower than Cairo Mezz PLC. On the other hand, doValue is generating significant servicing fees, for Cairo No. 1-3. For 2022, this amounted to 60m EUR in total. On the other hand, they have to pay their staff for the servicing. So is doValue decently incentivized to get good results for the PLC assets? I believe so. Their business is to get good results for their clients and they would realize a windfall themselves once a mezz tranche starts paying. If you like to play the theme and believe in the Cairo upside, an investment in the shares of doValue could also an alternative. doValue is however more complex and involved in many different topics.

A third of PLC is owned by an long term holding of the Augustuville portfolio: Fairfax Financial. The Canadian insurance company has been an investor in Eurobank for a long time and apparently has not sold its shares in PLC after they were distributed, maintaining about a third of the company. While PLC is a relatively small investment for Fairfax, it is probably relevant enought for them to make sure PLC is treated adequately and doValue do their job well.

Finally, there let’s not forget that Eurobank is still around and much stronger than it was some 5 or 7 years ago. It has managed to stabilize its capital base to an extent that it has resumed sizeable distributions to shareholders while entering a path of growth at the same time. There has been some talk of Greek banks reacquiring portfolios of formerly NPLs which by now have been cured and are re-performing again. Note that a borrower has to behave well for three years for the loan to be classified “performing”, so the improved economic performance will only show up gradually. There has been an article about this interesting prospect, authored by the Chairman of doValue Greece. If such a transaction was to occur, it would certainly happen at a discount to the gross book value of the loans but there would also be a lot of cash coming and, in case of the Cairos, the seniors (and eventually the mezz) could be redeemed faster. In consequence, a RPL transaction might occur and if it does, it will accelerate payments to Cairo Mezz, which now appear to be at least 2 years away (for Cairo 3; longer for No.1 and No.2)

Valuation

As I write this, PLC trades at around 140m EUR versus Book Value of 240m EUR, derived from a model-based valuation, stemming mostly from the Cairo 3 Mezzanine, for a Price/Book of 60%.

I have performed a secnario analysis based recovery rates in the various vehicles, i.e. how much of the exposure is getting repaid (and passed on to investors). Since the PLC exposure is mostly in mezzanine, we see a pretty high sensitivity once the mezzanine starts paying, as illustrated by the below table showing recovery rate on the respective pool and Payout to PLC. From 35% recovery rate on, it starts getting interesting. Also, the market may find it difficult to express such a wide range in outcomes in a single number, i.e. the share price of PLC.

If we go with a 40% recovery rate, we might get a total return of 444m EUR, or a 3.5x from the current market cap. Alternatively, if Cairo No. 3 pays fully, but No.1 and 2 nothing at all, we would look at 560m EUR (incl. capitalized interest), which is 4.2x the market cap.

There is a large Time Value of Money Component at play here. If no sale of a loan portfolio happens, we may not see any cash coming through over the next 2-3 years. On the other hand, In general, I expect faster repayments than in the last years as more loans perform and a larger exposure becomes duel. Let’s also not forget that the underlying assets are entitled to earn some interest and interest does accrue on the mezz notes. And if the result were a 4-bagger, we could wait a couple of years and still get a decent return.

Again, we have no visibility here regarding the individual loans, their tenor, their performance and it is therefore impossible to estimate the specific outcome. That being said, at 140m market cap, I do like the risk/return here because the upside is considerable.

Summary

Cairo Mezz PLC is an obscure and orphaned security which probably is off-the-radar or uninvestable for many investors. It is not a real company, but rather an SPV holding asset-backed securities (backed by defaulted Greek loans) and its shares were spun off from its originating bank. In this article, we have tried to peel back the layers of the structure and the exposure and while PLC remains obscure, there is a lot to like:

Pool of (gross) notes backing PLC is about 20 times the current market cap (excl. capitalized interest. To be clears, these are NPLs, so large chunks will be lost.

Greek economy and asset values (like real estate) have recovered after the disastruous shock of the 2010s crisis. Most of the underlying loans are collateralized.

Significant senior note amortization can be observed in particular for Cairo No. 3. Once the senior tranche has been paid down, the waterfall should pour into PLC’s bucket.

Knowledgeable, decently (not perfectly) incentivesed servicer (doValue) and Fairfax Financial as a 33% owner.

Potential of fast repayment if a reforforming loan sale happens.

Trades below book value in PLC’s accounts and below book value in Cairo No. 1-3 (as of 2022), but above fair value in doValue’s books.

On the flipside, we must note that

Cash Flow to PLC is still at least 2 years away (unless there is a reperforming loan sale)

Situation is somewhat binary. In an adverse economic environment, it is possible that this ends up worthless.

In summary, we do like the risk/reward here and have initiated a long position in our “weird shit” bucket. Hope you found the post insightful/entertaining. Please let me know if anything relevant has been missed.

Are you aware that Cairo Mezz was actually presented as an idea at last year's "Weird Shit Investment Conference"? Would be a funny coincidence if this rather unknown and obscure company is selected twice for the purpose haha

Ah Cairo Mezz, good old memories 😁. Received the shares via the spin-off. Was a really opaque situation (still is). Have the shares now some liquidity? Sold them during 2020 and it was a real headache because of the abysmaly low liquidity.

Thought doValue would be more interesting because servicing is better than owning assets.