Two new positions

Deep Contrarianism on TeamViewer and WW International

Disclaimer: This is not investment advice. The author of this post owns shares of TeamViewer and WW International Inc. He may buy or sell shares of these or any other companies at any time. Please do not rely on the information provided herein but always do your own research.

As we are approaching the year-end, I have recently posted a portfolio update and a performance update. While we have made some money at Augustusville this year, it has by no means been an outstanding year and I will provide a deeper analysis and thoughts about potential consequences at a later point.

The attentive reader of the history of portfolio updates will realize that a few positions have changed and I am writing this post to discuss some thoughts on two new additions, WW International Inc. and TeamViewer SE. What these companies have in common is that they are contrarian bets. We have all learned (from Warren or from someone else) that most turnarounds never turn, one should not catch a falling knife and one of my favourite podcasts (in German) recently discussed how it is a systematic disadvantage to pick microcaps from the 52-week low list.

My own investing experience is somewhat different. I have from time to time been successful in companies which were so hated by the market that nobody could or wanted to own them (think Bayer a year ago). Normally, Q4 is a good time of the year to pick up shares in these “losers” because it is tax-loss selling season some funds perform window-dressing prior to the year-end, i.e. they do not want to show the losers in their portfolios on 31/December. With that short pretext, let’s dive in:

TeamViewer SE

What does TeamViewer do? Here is the business description from TIKR:

TeamViewer SE, together with its subsidiaries, provides remote connectivity solutions worldwide. The company offers TeamViewer remote, a remote access, control, and management solution; TeamViewer Tensor, an enterprise connectivity solution for remote support, control and management of enterprise IT, smart devices, and industrial equipment; TeamViewer Frontline, a digital workflow, instruction, and assistance for smart frontline operations; and TeamViewer Dex, a real-time diagnostics and remediation, monitoring and analytics for insights and AI-driven automation. It also provides augmented reality and mixed reality-based solutions for manual processes in logistics, manufacturing, and aftersales operations.TeamViewer SE was founded in 2005 and is headquartered in Göppingen, Germany.

The company I work for uses TeamViewer, it is a software which is installed on all our PCs and if I have an IT issue which requires user action, the helpdesk can - via TeamViewer - take control of my PC and perform an installation, change a setting or whatever is required.

TeamViewer has a relatively wide adoption across Europe and describes itself as a market leader, even though there is clearly significant competiton from both niche players and market giants (AnyDesk, Microsoft solutions, Splashtop, ConnectWise). It operates as a subscription-based (SaaS) model which over time has generated a lot of cash. While TeamViewer is operating in a competitive landscape, to my knowledge it has a reputation to be a technically solid and reliable solution. Also, the service TeamViewer offers is mission-critical and there are switching costs associated with moving to another platform. TeamViewer has a large installed base of individual, small-business and enterprise clients across industries and countries. The company has recently put more efforts into the enterprise segment which has grown by 30% p.a. from 2021 to 2024. Overall, TeamViewer has grown their revenues by about 10% p.a. from 2021. The company has consistently generated gross margins >85%, EBITDA margins >40% and EBIT margins >25%

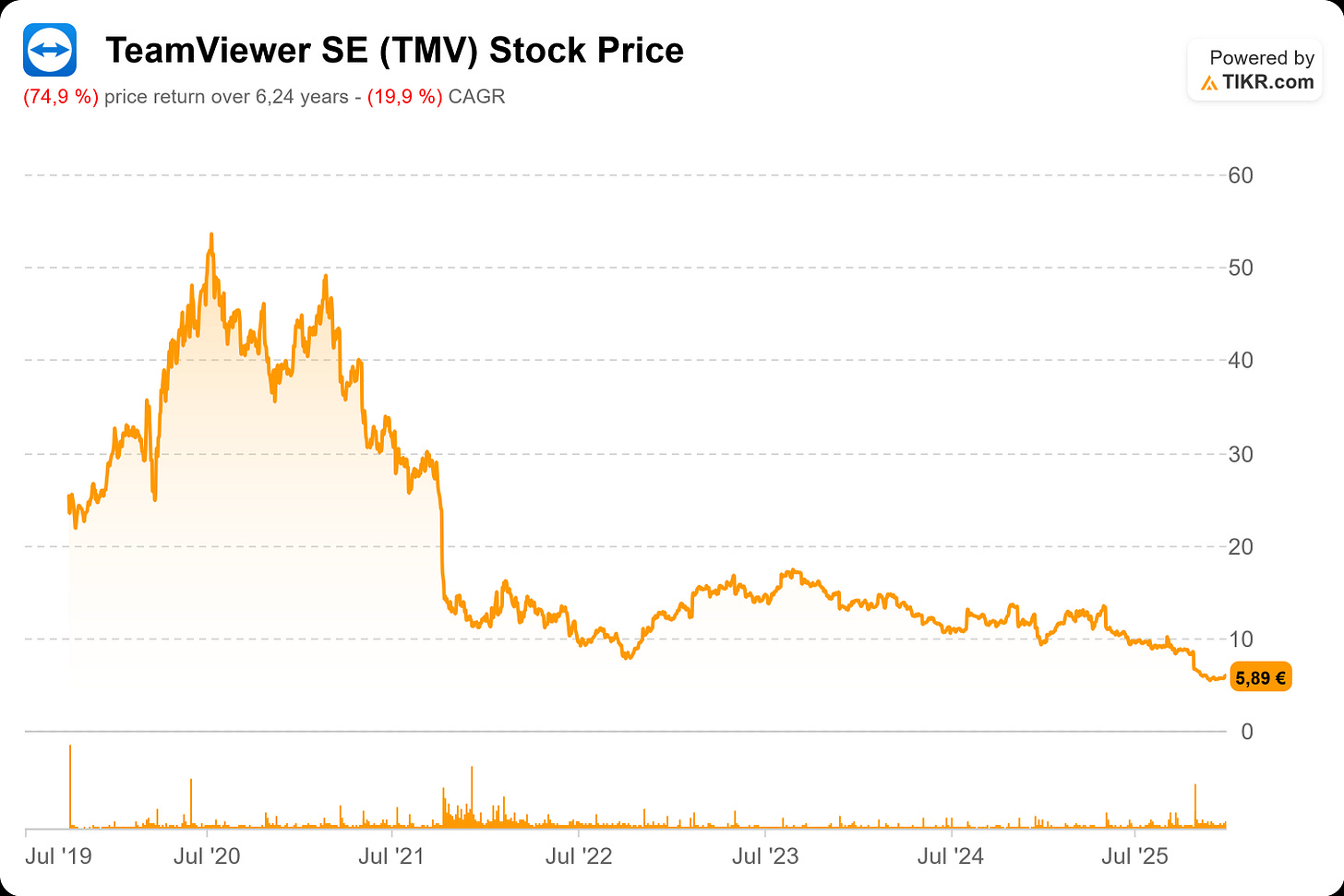

TeamViewer has been public since September 2019. Its IPO proved timely given that Covid happened in early 2020, boosting anything related to “remote solutions”. Within the first 9 months of its listing, the share price doubled, reaching a high in summer 2020. Ever since, there has only been one direction: South. Ain’t that chart beautiful?

Today, TeamViewer trades at a market cap of ~925m EUR and an enterprise value of 1.88b EUR.

So how could a company with a relatively stable (or so I like to think) business model fall from grace and the price drop so hard?

One part of the answer is questionable capital allocation. TeamViewer became main jersey sponsor of Manchester United in 2021, paying 275m EUR for 5 years. I have not seen any a rational explanation for this move, in particular since (1) football sponsoring is a questionable move if you are looking to acquire enterprise customers and (2) the contract value is more than half of TeamViewers revenue in 2021.

The ManU deal was a red flag for any reasonable investor and has become famous (or rather infamous) to shareholders of TeamViewer. The company later bowed out of the deal, but at a significant cost.

After some criticism of the deal, TeamViewer wanted to prove its shareholder friendliness and initiated a share repurchase program. From 2022-24, the company bought back about 600m EUR at prices significantly above current levels. Once again, from today’s perspective, this has been value-destructive behaviour from the perspective of today’s shareholders since the purchases were conducted at a wrong price.

In 2024, the company may hae performed a third major mistake on capital allocation when it acquired 1E, a Digital Employee Experience (DEX) management software company, in order to boost its enterprise segment. TeamViewer paid about 700m EUR (almost 10x EV/Sales) for 1E, largely financed by debt. So far, 1E has not yet delivered much for TeamViewer and the company in its latest presentation has conceded that so far, the results of the 1E acquisition have been disappointing while the integration is ongoing. In my view, it is very possible that we may see a goodwill impairment at TeamViewer which may also bring their (accounting) equity into negative territory.

Three consecutive misses on major capital allocation decisions of that magnitude probably mean that the guys at the top need to go, right? Wrong! CEO Oliver Steil has been in charge since before the IPO and so far has not been replaced by the board, despite the disastruous verdict by capital markets. His contract will run until 2028 and he holds 1.7% of the company and has from time to time been buying more shares.

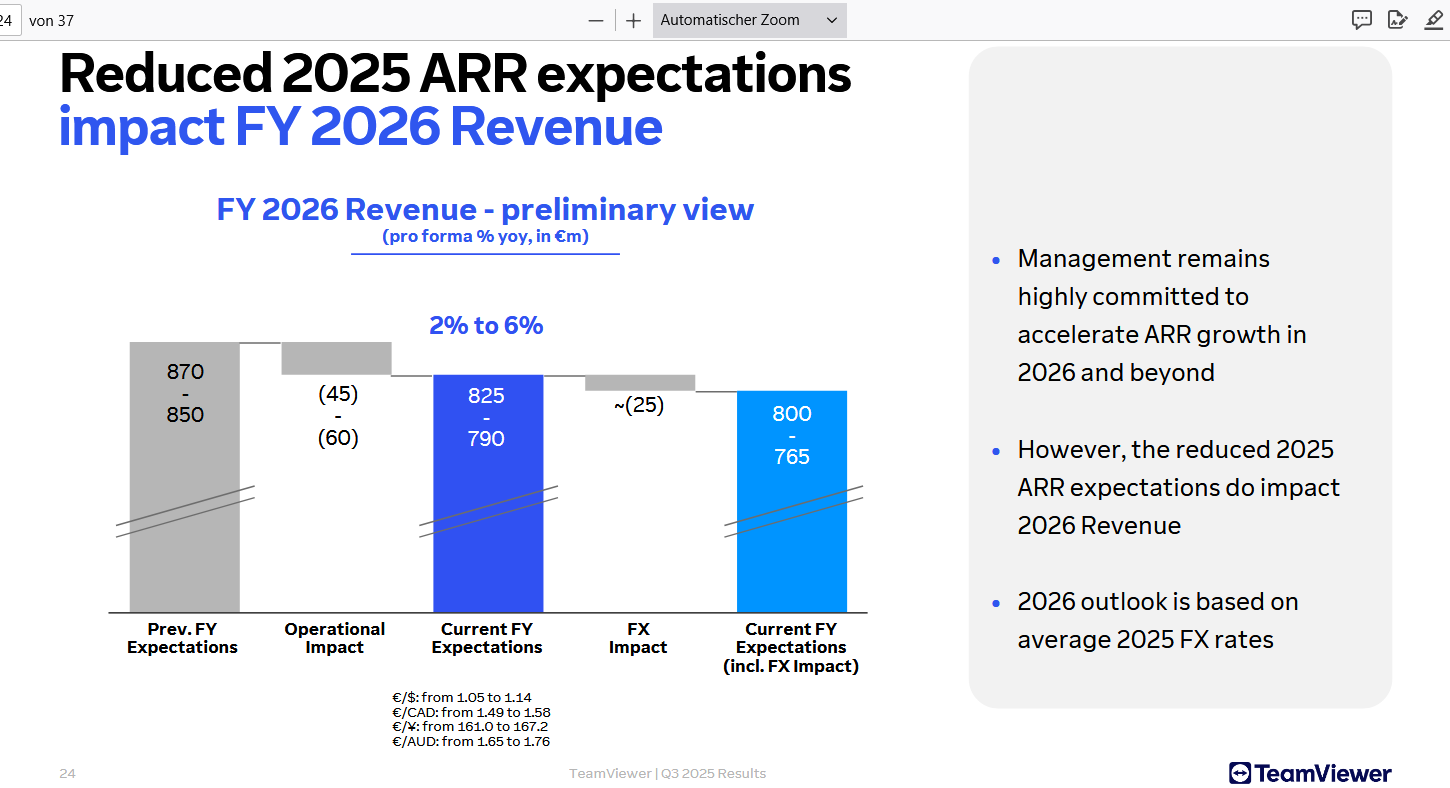

So we have a company with a decent business model, but its stock market performance has been hampered by poor capital allocation decisions and the management team responsible is still in charge. In addition, in its Q3 presentation TeamViewer lowered its 2025 revenue guidance by about 10% (to be fair, some of that is credibly coming from the weak USD) and was cautious on 2026 revenue aswell.

The company’s balance sheet is significantly weakened after the debt-financed acquisition with Net Debt/Adj. EBITDA now standing at 2.8x. At least, there is no space to do dumb sponsoring deals from here onwards, since the company will have to spend its cash to reduce the debt stack - a 2.0x leverage ratio for the end of 2026 has been set.

So why would anybody in their sane mind invest in TeamViewer? Well, in my case for two reasons:(1) Because everybody hates it which makes it cheap. And (2) because its core business is running stable and profitable. That business is subscription-based and there is little CAPEX need beyond R&D. For 2025, I expect TeamViewer to generate 340m EUR in EBITDA. This is expected to grow next year, so I estimate 370m EUR for 2026. If we get 200m EUR in free cash flow by the end of 2026, net debt might shrink to 750m EUR by that time and the company may reach its target 2.0x Leverage Ratio. In the case of TeamViewer, a debt reduction should improve the value of the equity investor. Even today, we are trading at an EV/EBITDA of just below 6x - not a lot for a business of that quality.

There is also some optionality: What if 1E unexpetedly works better than we can now foresee? What if management gets replaced? Maybe, if they reach a leverage of less than 2x, they might instate a dividend / share repurchase?

On the flipside, what might derail the thesis could be either another round of stupid capital allocation such as an equity raise at current prices or evidence that the business is consistently losing customers and revenue and turning into a melting ice cube.

At this stage, given the extreme pessimism reflected in the price, we like the odds and have caught the fallen knife while staying tuned for 2026.

WW International Inc.

WW is the company you all know as WeightWatchers. Most people will have heard of WeightWatchers, but if you don’t, the company provides weight management products and services in the United States and internationally. It offers various nutritional, activity, behavioral, and lifestyle tools and approaches for individual weight goals.

After the business model came under pressure with the emergence and increased popularity of GLP-1 products WW filed for voluntary bankruptcy in May 2025, as announced here (there is more reporting on the circumstances, e.g. here ). WW’s share price had increased strongly since Oprah Winfrey’s investment in the company in 2015 (acquiring about 10%). Around the time, WW began modernising with digital app offerings, community features (“Connect”), and points-based programs updated with nutritional insights.

At its peak, the share price hit an all-time high of about 105USD in 2018, valuing the company at about 6b USD at the time. WW generated 1.5B in revenue and reached 4.6m customers at this time.

Since then, the business has been in steady decline. It is no longer a modern, fresh brand. Covid hit the community meetings which are part of the WW program. The number of subscribers declined to about 3m in 2024, revenues to below 800m USD. The company’s marketing spend proved ineffective to stop the churn. Oprah Winfrey left WW in 2024. The company was heavily levered and had to stem about 100m in interest expense alone in that year. Beyond spending on marketing, WW tried to rescue itself by purchasing Sequence, now WeightWatchers Clinic, a telehealth service that helps users get prescriptions, for 106m USD in 2024. In September 2024, CEO Sima Sistani resigned and Tara Comonte, a board member and former ShakeShack executive took over as CEO.

The company soon thereafter announced it was looking into strategic alternatives and in May entered into pre-packaged bankruptcy during which they reduced their debt by 1.1b USD. Creditors received 91% of the equity in the reorganized company whereas former shareholders got 9%. Following the reorganization, WW’s financial debt was reduced to 465m USD with a tenor of 2030. WW pays a coupon of 10.8% on this debt and will mandatorily have to use any unrestricted cash exceeding 100m USD to repay the loan at the end of Q1 of every year. As of the latest 10Q, unrestricted cash stood at 170m USD, so there would be 70m USD for debt repayment and we can hope for this number to grow in Q4.

For the total year 2025, WW is expecting about 695-700m USD in revenues and 145-150m in EBITDA. At this point, they are spending 50m USD p.a. on interest, a number that will hopefully decrease fast. At this point, WW reports two segments, “Behavioural” for people who download the app, follow the program and attend workshops etc. “Clinical” for patients of the WW Clinic. At this point, “Behavioural” is 84% of total revenues with revenues trending down (-16% YoY) whereas “Clinical” is the smaller segment, yet has been growing by 35% YoY.

Initiatives since emerging from bankruptcy:

While the company reorganization has improved the debt burden to a manageable level, WW cannot be an attractive investment if we knew that it was a melting ice cube. To be clear, the risk is there, in particular with subscriber numbers still falling. However, there are some indicators that the future might be different from the 2018-24 period:

WW not only cut its debt level but also its cost basis during the reorganization process and has established measures that it estimates will save 100m USD in costs per annum

WW recently updated its brand identity and digital experiences and while I do not claim this to be an “Oprah joins the company” moment, the relaunch is a positive signal of ambition by WW. Of course, we have yet to see how this gets adopted by customers.

WW also launched its new “Weight Watchers for Menopause” product directed at a new and potentially relevant client segment. Again, we will have to see the effects, but the company is hopeful.

GLP-1 is the elephant in the room as it comes to weight-loss programs. Why going through cumbersome dietary programs if you can just take an injection or - better yet - a pill. WW is not questioning or fighting the trend, but rather trying to cooperate with both Novo and Lilly to accompany the adoption. Notably, WW is in a position to offer the oral version to offer WW’s Wegovy . It is also positioning its program as a way to accompany patients who take GLP-1: Rather than taking drugs on an ongoing basis, WW’s pitch is to offer GLP-1 as initial step towards weight-loss while the WW program will make this process more sustainable, longer-lasting and potentially cheaper. WW has also launched a separate platform for GLP-1 patients. Again, the jury is out as to whether these efforts will bear significant fruit. But I like they are proactively working on this and think they have a good shot.

Finally, the company launched new executive incentive program in December with significant potential rewards to CEO Tara Comonte, mostly tied to the company’s share price.

In summary, WW seemed like a company whose downfall was guaranteed at the start of this year. Now, it appears like they have a realistic shot to do relatively well. This is still a very risky situation. If revenue trends continue, 50m in annual interest expense may kill the company. The share price has lost about 25% since its relisting, most likely due to former creditors liquidating their shares which they may not have the mandate to hold for long.

The company’s equity is currently valued at 300m USD while net debt also stands at 300m USD, so WW trades at about 4x EV/EBITDA. The company. With any cash it generates, the company will first cut its expensive debt which might drive shareholder value.

be aware that a change from injectable to pill will contribute far more to Rx compliance than any behavior tweak, so WW boost will be marginal if even measurable.

enjoyed the write-up, but the long dismal history of these are exactly what i want to avoid in the value space.

Thanks Carsten, those are definitely two names I haven't heard mentioned elsewhere.