Disclaimer: This is not investment advice. The author holds a position in Delek US Holdings shares at the time of writing. Invesment in these shares is risky and may result in the loss of capital. Author can buy, sell or hold any share at any time. His views may be biased and the information in this post incorrect and his historic performance is oil-related stocks is mediocre at best. Please do your own research!

After portfolio outlooks and performance updates, I wanted to provide a deep-dive in a position which I added to the portfolio in Q4 - Delek US Holdings (Ticker DK). Delek is a sum-of-the parts story which will make some investors turn away because SOTPs have a (not completely unjustified) reputation for being value traps. I do think that in this case, catalysts are likely to come up which may narrow the SOTP discount. Also, the accounting of Delek may be misunderstood by some analysts and accordingly the stock does not screen well.

So what is Delek?

Delek is a downstream energy company that was started in 2001. Over the years, DK acquired and sold a number of downstream assets, i.e. refineries, pipelines, terminals and gas stations, engaging in a lot of dealmaking in the sector. Importantly, in 2012, Delek IPO’d its logistics assets as a Master Limited Partnership (MLP) named Delek Logistics (Ticker DKL), maintaining the majority of the shares/units in it. An MLP is similar to a REIT in that it is a tax-advantaged pass-trough vehicle which needs to distribute pretty much all of the cash flow it generates. Today, DK consists of three segments, Refining, Logistics and Retail:

So let’s take a closer look at each of the three segments and their economics:

(1) Refining: In this segment, DK owns and runs 4 refinieries, two in Texas, one in Arkansas and one in Louisiana. Each of the refineries is rather small with a throughput capacity of 70-80K barrels per day, for a total of 302 bpd. Refineries are interesting assets because, despite the growing consumption in refined products, no new refineries have been built for decades and that seems unlikely to change. Today, there are 135 refinieries in the US and the regulatory hurdles and the project risks for building new ones are immense. Also, growth in capacity has been achieved by improving and modernizing existing refineries. Over the last years, Delek has doubled the capacity of its existing refineries. The refineries are located with good access to the Permian basin, which is also ensured by the pipeline network around them that forms a major part of Delek Logistics.

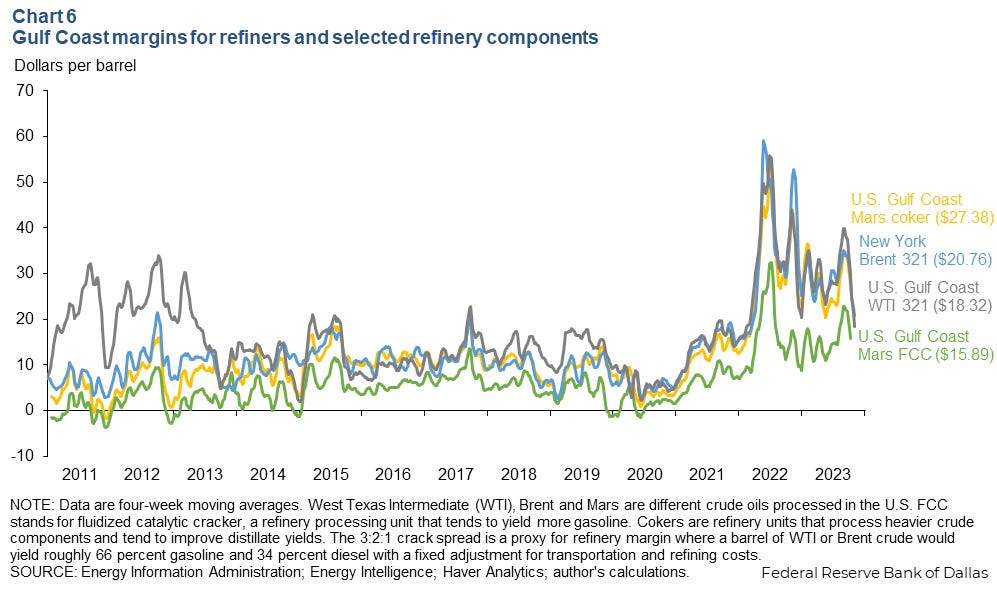

The profitability of refineries largely depends on the difference between the crude oil price and the price of refined producs, which is often referred to as “Crack Spread”. There are various Crack Spread with the most standard one being the 3:2:1 Crack Spread, meaning that 3 barrels of crude oil get transformed into 2 barrels of gasoline and one barrel of distillate fuel oil. Crack Spreads have historically been more stable than the price of crude oil, however, they do move and are also sensitive to external shocks (think Covid). There are different types of crack spreads as there are different types of crude oil, but I will not (and am also not expert enough) to go into details here. Here is a graph showing US Crack Spreads over the last 12 years. It can be seen that Crack Spreads did tumble in 2020, then spike in 2022 and, while still above their historic average, are have been returning to a more normal level. Crack Spread Futures can also be hedged so refiners can to some extent manage their exposur to spot prices.

(2) Logistics:

The Logistics segment consists Delek Logistics Partners (DKL), the publicly traded MLP. DK owns 78.7% in DKL which owns and runs a network of pipelines and terminal is is engaged in gathering, transporting and storing crude oil and natural gas.

DKL typically chares for the throughput volume of its network on a fixed-fee or tarif rates basis. Revenue is largely determined by the volume which is processed through the system and DKL has contracts with its clients, some of which include minimum volume commitments. In 2022, DKL announced the acquisition of 3Bear , an oil & gas gathering and distribution business for 625mm USD, largely financed with debt.

(3): Retail:

Retail is the smallest of Delek’s segments and consists of a network of 250 gas stations and convenience stores in West Texas and New Mexico which are run under the brands of Delek and Alon (Alon was acquired by Delek in 2017). In 2016, Delek had sold its retail related assets to Chilean COPCO, but with the Alon transaction, the retail segment became relevant again. While I like the gas retail segment and have a lot of admiration for companies like Alimentation Couhe-Tard or Murphy USA, the Delek Retail segment is the smallest of the company and may also be somewhat sub-scale compared to competitors. In this respect, it might make sense for Delek to watch out for options for this segment as they are doing already (see below).

Financials and the Consolidation Topic

If we look up DK on TIKR, it does not look all that exciting. The tool shows a Market Cap of 1.6B USD and an Enterprise Value of 3.9B USD. We see losses in 2020 and 2021 slim margins and KPIs which have been all over the place.

Accomplished readers will likely agree that this is nothing to get really excited about. What confuses these numbers is that the company consolidates DKL in its number which is not surprising given the 79% stake it holds but has a big impact on various figures. Since DKL is a much more stable business compared to refining and given the MLP structure, it is also loaded with debt whereas Delek US Holdings is basically debt-free. As I think the consolidated numbers are not meaningful, I compiled a set of separated numbers based on the financial reports of recent years which was somewhat time-consuming because the reporting changed over time. So here is my shot at a history from 2017 - these are not full financial statements but simplified numbers on the basis of Segment EBITDA (from 2020) and Segment Contribution Margin (2017-19):

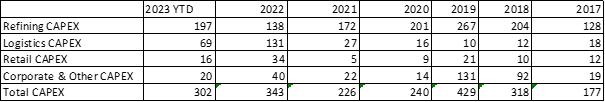

And some CAPEX numbers so we can better assess Cash Flow:

Some aspects I found noteworthy:

Refining results are highly volatile due to the moves in the Crack Spread and was really poor in 2020/21 but strong in 2022/23. Looking back to 2017-19, maybe more normal years in terms of crack spread, indicates that DK was able to generate decent returns during that time.

Refining also takes the majority share of the CAPEX. DK ran big relatively big CAPEX programs to modernize their refineries in 2018-20, then got more cautious when COVID struck. Overall, CAPEX has been close to D&A.

Logistics looks quite stable as expected and managed to grow its EBITDA quite nicely. This includes external growth like the 3Bear acquisition in 2022 which can also be seen in Logistics CAPEX. Logistics maintenance CAPEX appears to be fairly limited

Retail has been relatively flat over the years. Given the modest EBITDA, Delek invested quite a bit into refurbishing its locations. For 2023, Retail EBITDA might hit the 50m USD mark again.

Delek has a history of paying dividends which got only suspended during the Covid phase. The company paid higher dividends in 2018 compared to now. The dividend currently stands at 0.24$/quarter, for a yield of just below 4% (share price around 25$).

DK US Holdings has no net debt. All the net debt shown in the accounts is due to DKL. At the DK level, there is about 900m USD in gross debt fow which the company pays a non-trivial 9% interest rate and about the same amount in cash.

Given the favourable environment, DK has generated significant cash over the last two years. Cash at DK Holding level is generated from operating cash flows from the refining and retail segments and distributions received from DKL. In the first three quarters, this cash has been sufficient to fund (1) the reduction in net debt from about 550m USD to zero, (2) about 300m USD in CAPEX of which the company estimates 23% growth CAPEX and (3) distributions to shareholders of about 110m USD (45m dividends and 65m share repurchases).

The net debt position has significantly improved the financial flexibility and opens the opportunity to return more capital going forward.

Management, Incentives and Capital Allocation

Delek is led by CEO Avigal Soreq (46) who joined the company in June 2022 and previously working as CEO of Israeli’s El Al airline. Before his time at El Al, Soreq spent 8 years at Delek including roles as Chief Operating Officer and Chief Commercial Officer so we can expect for him to know the company well.

Soreq’s compensation package is designed so he should be aligned with shareholders with a relatively modest (800K USD/year) base salary, a 1.1m USD target annual bonus linked to financial and non-financial metrics and a 3m USD target RSU equity plan, linked mostly to share price performance. After Soreq came on in Mid 2022, the company reinstated its dividend and restarted its share repurchase program and also announced explcitly his intention to unlock the “Sum of the Parts” Value of Delek.

So far no concrete actions in this respect have taken place even though the company still reiterates its plan in its strategic objectives (slide below from November 2023).

Unlike in the past, Delek has not made any acquisitions since 3Bear in 2022. Also, the company has hinted towards the public market value of its holdings in DKL and towards “highlighting” the multiple of the Retail segment. Some investors are getting impatient with Sogal since no action towards a segment sale / breakup or spin-off has happened so far. At this point, I am still optimistic that this will come. At the same time, the share repurchases at these prices in my view have created some value and the company could use the favourable environment to delever and strengthen its financial position. A risk and a potential red flag would be a substantial acquisition, in particulare in a segment which where we expect a divestment.

Valuation

As I write this, Delek trades at around 25 USD per share and has 64m shares outstanding for a total market cap of 1.6B USD.

DK also owns 34.4m shares in DKL which trades at 44.5 USD, giving DK’s share in DKL a value of 1.53B USD. Is DKL overvalued? I do not think so. The MLP trades at a 9.2% yield based on the last 12 months (LTM distribution of 4.13 USD) and they have a history of growing their dividend. The business was stable in Covid times and the 3Bear transaction has been accretive.

Of course, it may be justified to argue for a discount for DK’s large stake but then, one might also argue for a majority premium. So for me, the market price does not appear to be off.

Given that DK excl. DKL has a net cash position of zero, if you the DKL market price for fair, the refinery and retail businesses will be valued at less than 100m USD.

The retail segment may generate 50m USD in EBITDA a year. Delek’s presentation gives comparable multiples of 7-10x and I would rather pick the lower end of this range as I think a multiple of 10x may be adequate for established businesses like Murphy or ATD, but not Delek. So maybe 350m USD in enterprise or 5.50 USD/share for this segment could be a good guess.

The refining segment is the most difficult to value due to its highly volatile results so I find it difficult to put a number on it. Also, there is the “Corporate & Other” segment which still needs to be taken into account. Maybe it is fair to say that 500m USD is a midcycle EBITDA for refining while “Corporate" and Other” burns 200m USD a year, bringing the sum to 300m USD. I think that refineries, given the unstable earnings, fairly trade at 4x EBITDA, so Refining including Corp and Other might be worth 1.2B USD. In this scenario, the total value might be something like:

DKL Stake: 1.530m USD

Retail: 350m USD

Refining (incl. Corp and Other): 1.200

Total: 3.080m USD

# Shares: 63.9m

Value per Share: 48.20 USD

Admittedly, the market has been waiting for 18 months to see the SOTP unlocked and nothing has happened so far, apart from some share repurchases. Nobody can guarantee for such an event to happen. But we know that management is incentivized accordingly and incentives normally work. I have also seen the argument that the instability of the refining operations imply that it needs to be supported by stable cash flows from DKL to buffer the business in a weak market. That seems plausible, but it should also be noted that Delek has significantly improved its net debt position and thereby built in such a buffer.

Also, what is a plausible downside from here? Barring a catastrophic event at the facilities or an external market shock (Covid) which woud cause serious cash-bleed and if they do not do stupid M&A (which they have not historically), I think the downside is limited from here because (1) the buffer from the DKL share is visible and (2) even on a consolidated basis, this is trading at unambitious levels even at midcycle refining margins. Here is a company slide from April 2023 on how they see their SOTP Value:

Delek does not get much love from the sell-side. Per Bloomberg out of the 13 analysts whoch cover the company, there are 2 Buy, 7 Hold and 4 Sell Ratings so this seems to be the opposite of a “hot” stock.

How could the SOTP value be unlocked?

At this point, it seems like most people see mainly two avenues to unlock the SOTP value. (1) Sale of the Retail Segment and (2) Sale of the units owned in the DKL MLP and deconsolidate DKL from DK. An outright sale requires a buyer and its success will depend of the dynamics of the M&A market (which was not booming in 2023). I think that beyond these options which have been discussed in the company’s slides and on their conference calls, other alternatives may be available in case they do not work, i.e.:

Sale of the entire company to a strategic who may integrate the operations OR a financial investor who may slice the company and liquidate its parts.

Spin-Off of the retail segment to shareholders. This is how Murphy USA was created.

Spin of some or all of the DKL units to shareholders this might be relatively easy because the units exist and would “only” need to be distributed (I am no expert on the tax implications). This way, DKL could be deconsolidated wihtout having to find a buyer.

Summary:

Delek US Holdings is an unloved stock but I think it is cheap, both in its current shape and on an SOTP basis. The refinery business is cyclical and geared to crack spreads which the company cannot really influence. It is not a high quality business which will compound for the next 10 or 20 years but given the incentive structure, I expect for management to move towards separating the segments and unlocking the SOTP value. They are incentivized to do so. Until it happens, I will collect ~4% in dividends and hope for the net-debt-free holding company to repurchase a large chunk of shares.

One issue I have with DK is that they never explain what the obstacle to unlocking value is. They are quite vague. We would need an activist investor to enter and stir things, don't you think so?

Shell and numerous other oil companies that had captive MLPs just bought them in over the last couple years. Why not just buy the remaining shares as the combined business would have a lower cost of capital and there no longer seems to be much demand for MLPs