Happy New Year! I hope the year has started well for my readers and wish you a peaceful, healthy and properous 2024. Hopefully, the year has started as well for you as it has for sine I was lucky enough to spend a few days in marvellous Tyrolia, with a lot of snow and some skiing.

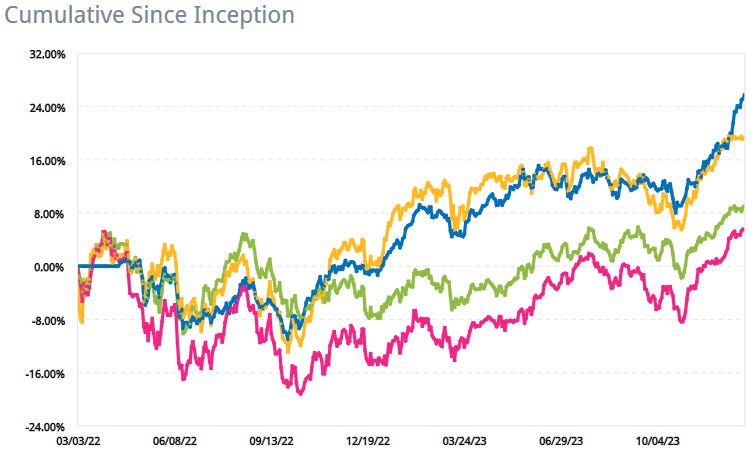

Now that I am back, it is time for the performance review and some thoughts on what went well and badly in 2023: The Augustusville portfolio was up 26.4% pre tax and in EUR in 2023 which I consider a satisfactory overall result. I have not defined a specific benchmark for Augustusville, but for this post will compare the results to SPYY (SPDR MSCI ACWI UCITS ETF in EUR), DJES (Dow Jones Euro STOXX Index in EUR), and IUSE (iShares S&P 500 EUR-H in EUR). I take the freedom to invest globally where I see the best opportunities and am also not fixated on small, medium or large caps, so the SPYY might be the best benchmark, but DJES and IUSE are interesting comparisons nonetheless since they represent benchmarks people loo at anyway. Personally, I find it a bit weird if you run a global smallcap portfolio and, for example use DAX30 as a benchmark as I have seen in Germany a few times. But then, benchmarks are not that important to me and I do not intend to participate in what Buffett called the “relative performance derby”.

Here are the results by months for Augustusville (Account U86) and its comparables:

Or, if you prefer pictures, you this would be the one:

So it is fair to say that the portfolio held up fairly well against the other indices and even outperformed them. Also, the Augustusville portfolio has been slightly less volatile, i.e. tended to be less exposed to overall market swings than the indices. At the same time, the difference so far is fairly moderate and can easily be erased by two bad months. Moreover, 20 months is a fairly short time when it comes to tracking performance and so I think that not too much should be read into these numbers.

Winners & Losers:

So where did the returns come from? I have compiled a table with the biggest winning and losing contributors for 2023 and included everything with an impact >0.30%

Interestingly, none of the losers is part of the portfolio anymore. I cut my losses on both United Mobility and Endor after accounting/reporting problems, Both are German microcaps trading outside of the main market and in my view, corporate governance for these companies leaves a lot of room for improvement. I also sold out of NXDT which I found more obscure the longer I looked and the longer the expected catalyst (dividend increase after REIT conversion) did not play out. None of the 5 listed losers were high-conviction ideas in the first place and once problems ocurred, I did not feel comfortable enough to hold for longer. All of these were mistakes because I was attracted by certain parts of the story without researching the full picture enought and was accordingly caught by surprise. This can happen if you build a diversified portfolio in a relatively short time, but still, I should have been more selective in terms of demanding a long-term track record in terms of profitability, sustainable business model and/or a hard catalyst.

When it comes to the winners, the majority of names is still in my selection for 2024. I was bought out of TIM and will soon be bought out of Logistec. In addition, I sold both Hostelworld and Lastminute.com as I found both close to fully valued and more growth expectation needed to justify a higher share price. Both names currently trade close to where I sold as does First Pacific, which in my view remains cheap. I sold because I was not certain on how the SOTP discount would disappear, unlike Odet where I see clear actions towards value creation. Admiral was exited since I found some of the operating developments disappointing, in particular the expansion into non-UK markets has so far not yielded the results I had hoped for. The share is up about 10% since I sold.

In 2023, I did relatively well on special situations, with positive returns on Liquidia, Spirit Airlines and Burford. The Yet Another Value Podcast has been a great source of these ideas, so a big thanks goes to Andrew Walker and his guests. While I one reason to invest in these situations is the uncorrelated nature, they all performed quite well in December which was generally a strong month in the market, drinving the portfolio outperformance in this period.

Comment & Outlook 2024

2023 concludes the first full year for the Augustusville portfolio and I consider the result satisfactory, in particular given the number of mistakes I made. The portfolio is now close to fully invested and I have worked on gradually improving its quality. What does this mean? Compared to one year ago, I own more position which I would gladly hold for a longer period of time as I believe they represent strong businesses with a reasonable moat which I expect to generate good margins and growth and are therefore likely to compound well over a number of years. Owning these positions is of great benefit because (1) it makes the investor sleep well and (2) it reduces the maintenance of the portfolio and thereby frees up some resources. Of course, you still need to monitor and follow the companies, but you get to know them ever better and there is no need to change them. There was recently an interesting debate on Fintwit on whether it makes sense for the private and knowledgable investor to trade more and always seek the next ultra-cheap company with a catalyst ahead.

There is not just one strategy which works in investing, but in my view, the answer is no. From a financial perspective, is clearly preferable to owns great businesses for an extended period of time. Yet it is also very difficult to hold for long enough to get, say a 100bagger. Just sitting their and doing nothing can be incredibly boring and requires both patience and endurance, in particular if the market gets rougher. In that sense, I think that I am clearly trading too much. Sometimes, I think that for a lot of people, investing is not so much about generating returns but rather about entertainment and activity. They need to “do” something because of FOMO or because someone else bought or sold something and posted about it. This behaviour is very human, but I am not sure it is rational. In order to satisfy my personal need for activity, I am glad to have the “event-driven” / “self-liquidating” bucket in my portfolio. These situations tend to move faster and in a shorter time-frame that classic value or compounding plays. So I expect more action here.

Apart from this, the more I feel comfortable with my portfolio, the more I will try to reduce activity going forward. Of course, there may be situations where more trading will be needed. My favourite concept is to take the “crocodile approach” to investing. This implies analyzing calmly the situation while quietly hiding in the waters and not doing much but snapping decisively once the opportunity occurs. So, I will try to make 2024 the year of the Crocodile.

Doing nothing is the hardest part.

Happy new year to you!

Thanks Carsten for generously sharing all your move and performance in a very detailed fashion. I like the special situation bucket for keep you active... while waiting for trees to grow.- I might copy you on this and assigned a 5% allocation to this to keep me busy. The opportunistic crocodile analogy is amazing.