Disclaimer: This is not investment advice. The author at the time of writing owns shares in Compagnie de L’Odet. His views may be biased. Please do not rely on the information provided herein and always do your owns research.

It has been more than a year since I published my piece on the Bolloré Universe in which I undertook an initial attempt to dissect the “Alhambra of Brittany”. To me, the financial complex is one of the most fascinating structure in the investment world. In the Quartlerly Letter by East72, you will find that I am not the only one. Given that a lot has happened in more than a year, I thought it is time for an update. The complex strikes me as a building which as an investment combines a number of special situations, fundamentally high-quality businesses and a deep discount. Also, while there has been a lot of movement over the last year, the price of Odet shares has not moved that much.

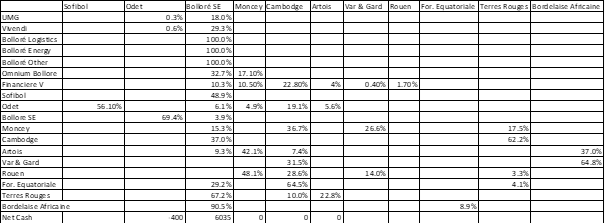

In my initial write-up, I presented an overview of the group structure. Here is an updated one from the Bolloré H1 presentation for you orientation.

Next, here is a recap of the most significant events:

Bolloré SE closed the sale of its remaining logistics operation to CMA CGM for a net price of 4.85b EUR. After the sale, Bolloré (excl. Vivendi) is reporting a net cash of 6.03b EUR.

Vivendi SE announced 4-way split , to be acieved by spinning off Canal+ (PayTV), Havas (Advertising and Public Relations) and Louis Hachette Group (Publishing) while retaining its financial participations. I have never experienced split into 4 different companies so far but it is a clear commitment to eliminate the Vivendi conglomerate discount (e.g. JPM estimates a 50% upside).

Vivendi has also been in the focus for its efforts to take over Lagardère, a leading publishing and travel retail company. This is a story which will go beyond this piece and I will refer to the East72 Letter for those interested.

The group is pushing a simplification of its structure, an encouraging sign that they are looking to simplify. Compagnie the Cournaille, previously an intermediate holding company for the UMG and Vivendi stakes, has been collapsed into Bolloré SE in July 2024. Moreover, the company has announced plans to merge Société des Chemins de Fer et Tramways du Var et du Gard into Compagnie du Cambodge and the Compagnie des Tramways de Rouen into Financière Moncey. This will reduce the number of significant companies “below” Bolloré SE from 9 to 6 (the remaining ones being Cambodge, Moncey, Terres Rouges, Artois, For, Equatoriale and Bordelaise Africaine). The mergers are supposed to happen as all-share deals.

The buyback machine across various group companies is alive and kicking. Last year, Bolloré SE was active buying 3.36% of its capital in a tender. Bolloré SE still has a buyback program in place and recently reminded its shareholders of it.

Moreover, there have been

purchases of Bollore SE shares by Odet in August 2024,

purchases of Odet shares by Sofibol and Imperial Mediterean in Q1 2024

share repurchases by Vivendi

and purchases of Universal Music Group by Bolloré in July 2024

In summary, there is a lot of different activities happening in the group at the oment and, in my view, they are creating value to shareholders.

The biggest single holding and value driver fot Bolloré remains UMG. UMG along with most quality stocks had a great run until it reported Q2 results in late July when this happened:

The sharp drop was driven by a miss in streaming/subscription revenue growth, driven in particular by weak revenues from TikTok and Facebook/Meta. To many analysty and investors, the expected stable growth of the world’s largest music label appeared in jeopardy . Other articles were a bit more relaxed, suggesting that the harsh reaction may have been overdone. Interestingly, Bolloré put some 200m EUR to work at prices close to 21.4 EUR/share. In my view, UMG will remain a stable business, essentially a royalty on people listening to music, so I am not too concerned. It was trading at a fairly rich multiple which made it vulnerable to any kind of diappointment summer markets can by volatile and choppy as we have all just experienced.

I have run an update of my value estimates of the universe based on updated market prices and shareholding percentages with the same methodolgy used for the exercise performed last year. Here are my inputs:

Asset Values:

Shareholding:

Compared to the previous exercise, I have not assumed any net debt/cash on the entities below Bollore as I believe I had some double-counting. Some of the shareholding percentages have increased. Vivendi and UMG are marked at current market prices while the split for Vivendi might imply some upside.

On this basis, my estimate of the SOTP value, after eliminating all the cross-holdings comes down to:

So in my view, there is a lot of upside left and it could be even more. The Vivendi split and a potential UMG recovery might push the Fair Value per share. The bigger levers, in my view, are however what will happen with the 6b cash Bolloré SE has amassed. If this is used to buy back shares across the galaxy, potentially resulting in a clean-up of the smaller companies and a merger Odet/Bolloré, tremendous value could be created. At current prices, Bolloré has the cash to buy back all the outstanding shares not owned by Odet. And we see that the group is tackling the topic of simplification, even though starting at the smaller companies. Of course, this is not the only possible capital allocation, e.g the money could also be used to invest more in one of the Vivendi spin-offs. Given the company’s history, I have some trust in the capital allocation and believe that value will be created, given the abundant opportunities.

The investment in Rubis is also intriguing given the overlap with the Bolloré energy business...

The Vivendi split will enable Bolloré to blast through the 30% levels at 3 split companies without requiring a mandatory bid, I think this is significant - given their history of slowly creeping up their stakes across their holdings this offers great opportunities. And who knows how they'll deal with the Vivendi remainco and its prized treasure: the big block of UMG shares...