Disclaimer: This is not investment advice. The author owns shares of Compagnie de l’Odet. He may buy or sells these or any other shares at any time. His views may be biased and the information presented may be inaccurate and is not to be relied upon. The situation is also complex and there are significant risks involved.Please conduct your own research.

I recently added to my existing position in Compagnie de l’Odet. At the same time, I realized, I have never prepared a proper, full write-up on the company. A short intro is here , but I feel it is somewhat incomplete. Therefore and since I keep on looking up information on Odet/Bolloré, I decided to try and prepare a full write-up. To be fair, I may not be your best author on the complex. There are great French investors like @Foxcastlehold (substack here) who have followed this for longer than me. Also, there are great videos by the French Finance Académie which cover the story in a lot of detail. There is also an excellent write-up on Bolloré at the Valueinvestorsclub which gives a lot of detail and I largely agree with. There is also a great series of articles by in French by Valeurbourse (part 1, part 2, part 3) which gives a great overview on the history and situation. As this is a complicated situation, I am also thankful for any hints on mistakes which my readers may point out.

So I am not exposing a company nobody has written about here and maybe the world does not need this post. There are other companies I own based on the write-ups of other people and some additional fact-checking/verification due diligence. Nobrainer investment ideas, do not have to be complex, sometimes they click right away.

Yet, the Bolloré structure is sufficiently complex to get lost in it before you master it. Sometimes, you need to write something down in order to be sure you understood it. In this post, I will try to shed light on all the relevant aspects of the case, not omitting anything important while not getting lost in the details.

Here is the agenda: I will start by looking at the history, structure and people in the Bolloré complex. The next step will be to look at the various assets held within the structure. After that, there will be a part on the conglomerate holding structure. I will discuss recent events and their implication on valuation.

History and Structure:

Compagnie de' l’Odet’s history dates back 201 years, when in 1822 a paper mill (Papeterie de l’OdeT) was started at the Odet river not too far from the city of Quimper in Brittany/Western France.

The company soon came under the control of the Bolloré family (it was founder by M. Marie whose nephew, the first M. Bolloré took over from him in the second generation). I was run it as a paper mill of the better part of one and a half centuries, for a long time focusing on tobacco paper. This has been a family business for many generations and it still is run for and by the family as becomes very apparent from the exhibition book which Bolloré published for its 200th birthday.

The fate of Bolloré/Odet really took a turn when Vincent Bolloré took over the then-troubled company in 1981 and took it public in 1985. Vincent Bolloré was more of a dealmaker than his ancestors and he pursued a strategy of external growth through various acquisitions across different sectors, including trading, tobacco, banking, agriculture, logistics, building materials, media and energy. You can find a time lapse of the buying and selling of businesses on the company history page.

All these deals led to a very complicated corporate structure. There is a huge number of companies in the Bolloré empire which is the main reason why this feels so complex. One reason for the extremely complex structure is the historic takeover of a the Banque Rivaud Groupe which itself had various entities. Another cause for this structure is that it ensure for the family to keep control of its holdings even when you in fact do not control the majority of its capital. If you own 51% of company A which in turn owns 51% of company B, then you can control company A and company A will control company B. In effect, I will have control over company B, even though, on a fully diluted basis, you will just own 26%. This method is not uncommon to European holding structures. But you will rarely see it as extreme as in the Bolloré case. Here is the holding structure of the Bolloré Galaxy per 30 June 2022, taken from the semiannual report (page 23):

If you look at the chart, you will see four levels of holding companies (Bolloré Participations, Omnium Bolloré, Financiere V and Sofibol). Next is Odet which is listed yet still the main holding company for also-listed Bolloré SE. This company owns the mains assets which are shown at the bottom in green, purple and blue. Bolloré SE also owns shares in a number of other listed and unlisted companies like Financiere Moncey and Compagnie du Cambodge. These companies again have shareholdings in each other and in the various holding companies. I will first focus on the various assets operating assets and deal with the structure after that.

Assets:

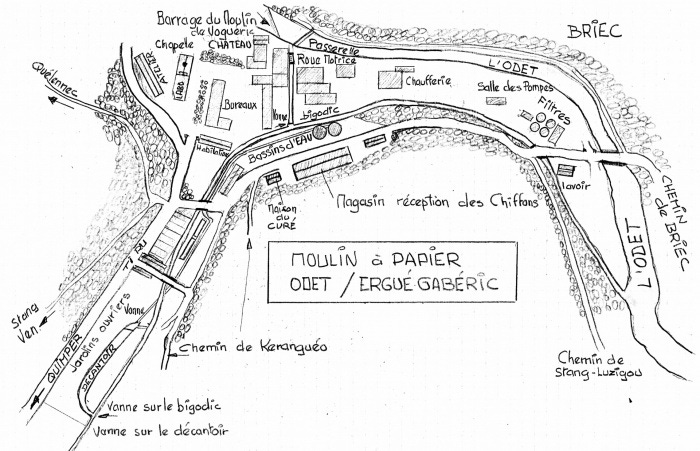

Here is a simplified version of the corporate structure which is supposed to show the main assets:

The main operating assets in the Bolloré galaxy are held by listed Bolloré SE. They include a shareholding in Universal Music Group, in Vivendi (which again owns shareholdings in various companies), the logistics segment Bolloré Logistics and the Oil Logistics segment and the Electricity Storage and Systems segment. Bolloré SE is majority-owned by Compagnie de l’Odet. This perspectives covers the major operating assets. It excludes coporate overhead, net debt/cash and treasury shares. Let’s look at them one-by-one.

Universal Music Group (UMG):

UMG is the world’s leading music label and the global leader in music entertainment engaged in recorded music, music publishing and merchandising. UMG is the owner of music (content) and generates most of its revenues from licensing it. Music is the one of the most important content types in the digital economy, both by itself and as embedded in other products (gaming, fitness, movies and many more). The market for music consumption is growing with more and more people going digital. There are more than 4bn smartphone users in the world and each of them is part of the addressable market for music (many are likely customers). This number is only growing and more and more people participate in the digital world.

How will the licensing fees be shared? There are three major groups who each take a piece of the pie: (1) Artists & Songwriters (e.g. Taylor Swift or the Rolling Stones), (2) Record Labels & Publishers (UMG, Sony Music, Warner Music) and (3) Retailers/Distributers (Spotify, Apple, Amazon). Here is an estimate from a JPM research from 2021:

It becomes apparent that record labels take the lion`s share of revenues generated in the music business. But why? One answer is market structure: The big 3 record labels about 70% of the market (UMG 30%, Sony 20%, Warner 20%). They each own a sizeable catalogue of music rights, typically to the lifetime work of the artists they represent. This catalogue is very important and gives the record labels a strong bargaining position vis-a-vis the retailers. On the other hand, distributors are easier to ditch. If Spotify could not play the music of the artists represented by UMG , many listeners would ditch Spotify for Amazon Music, Deezer, Google, Tidal or another streaming company. So UMG (and the other top labels) have a strong position vs the streaming companies.

How about the relationship to the artists? In the past, one of the main tasks for the labels was to organize the recording. This is not needed anymore. Anyone can easily record music in decent quality and try to distribute it online. Still, labels have a significant power to discover, develop and promote upcoming artists, significantly increasing their chance of success. The artist will likely (at least initially) get a lower share of an (expectedly) higher pot of revenue, still improving her total monetisation. That is why it also makes a lot of sense for artists to work with labels.

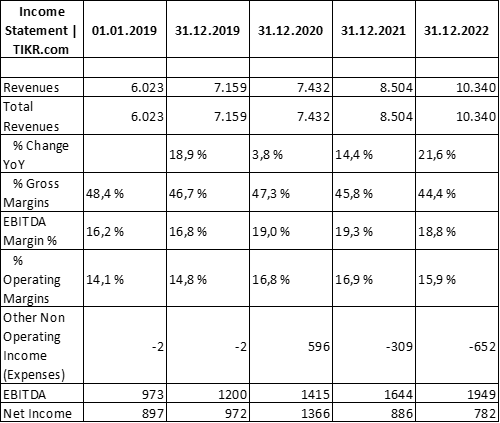

UMG was part of Vivendi Group which, starting in 2020, began to monetize it. Tencent acquired and holds 20%, Bill Ackman’s Pershing Square 10%. Vivendi performed a spin-off of UMG shares in 2021 and today retains 10%, while Bolloré SE and Odet combined have about 18% of the shares. We have superficially addressed the advantageous circumstances of the company: It is royalty stream on a growing digital market in an oligopolistic sector which is advantageous positions versus artists and distributors. Unsurprisingly, the company generates high margins and returns on capital and trades at an elevated multiple. Here is a summary on financials & valuation:

With a market cap of 39 bn EUR and a net debt level of 1.8bn EUR, UMG is trading at an EV/EBITDA of just above 20x. This is not a price I normally pay for any business and I probably would not by UMG as a standalone. Yet, with an expectation for high single-digit annual revenue growth and margin expansion for the years to come, it may still be a decent investment. That is the thesis of Bill Ackman who owns 10% of UMG which he aquired close to the current price.

In summary, because of secular tailwinds, I think that UMG is a nice company to own in the long run and while it does not look cheap at first glance, you have a good chance to do well. For my further calculations, I will assume that UMG is currently valued fairly. Even though there is some margin of safety in the Bolloré structure: If you believe that UMG is way overvalued, then Odet/Bolloré is not be for you because it is the most important position.

Vivendi SE

Vivendi is the second significant participation of Bolloré and unlike UMG, it is even consolidated in Bolloré’s accounts, indicating that Bolloré exercises control over Vivendi. Like UMG, there is a book to be written about Vivendi which started out in 1853 as a water company and was radically transformed into a media company, starting in the late 1990s. Vivendi’s fortunes have been volatile, given the swings in the “New Economy” and there was also a flurry of dealmaking over the last 25 years. Today, Vivendi is a large media, entertainment and communications company which fully owns Groupe Canal+ (PayTV and Film production company), Editis (Publishing company), Havas (PR & Advertising Company), Prisma Media (Magazines) and Gameloft (Video Games).

In addition, Vivendi owns a ~9bn EUR equity portfolio which includes UMG and a number of other media companies:

There is still dealmaking going on with the current focus of interest being a takeover of Lagardère, a listed participation which may be interesting for special situations investors. Also there is some activity around Telecom Italia which is in the process of selling its Italian fixed-line network.

The consolidated accounts of Vivendi are not very meaningful as UMG was deconsolidated in 2020 and there have been large swings on the equity portfolio. As I write this, Vivendi has a market capitalisation of 9.6bn EUR plus 0.9bn in net debt for an enterprise value of 10.5bn EUR.

In my lazy SOTP model, I look at the market prices of the equity portfolio and value the remaining business at 7x EBITA. The calculation results in an SOTP equity value of 13.25bn.

So I think Vivendi is undervalued in the stock market. Capital allocation to me appears strong. Vivendi has been involved in shareholder-friendly action including the UMG spin-off and repurchased a significant number of shares of the last few years. Over the last 3 years, partly funded with proceeds from the UMG partial exit, Vivendi repurchased some 200mm shares and now has about 1 bn shares left outstanding:

I am very comfortable holding Vivendi at this level and would also consider a direct investment at current prices if I were not indirectly invested. For my further calculations, I will conservatively assume Vivendi is worth its market value of 9.6bn EUR.

Bolloré Logistics:

Moving on to the businesses owned 100% by Bolloré SE. Bolloré Logistics is global logistics company and offers air and ocean transport, supply chain management, Customs & Regulatory Services. It operates in about 110 countries and runs 127 warehouses with >1mm sqm in storage space. Bolloré claims to be among the top 10 companies for transport organisation and logistics globally. One peer to Bolloré is Swiss company Kühne & Nagel which however is larger and therefore may have some scale advantages. Both Bolloré Logistics and Kühne & Nagel had extraordinary results in 2021 and 2022. Kühne & Nagel managed to double their operating margins for 2021 and 2022 compared to the years before from 5% to 10%. Bolloré Logistics last year generated 437mm EUR in EBITA on revenues of 7.1bn for an EBITA margin of 6.1%. Where Kuehne&Nagel is valued at 7.3x LTM EBITDA, I will value Bolloré Logistics at 5x LTM EBITDA. The relatively lower multiple versus Kuehne&Nagel shall cater for the lower profitability while the low absolute number reflects a business that might have been overearning last year. So, I will value Bolloré Logistics at 2.2 bn EUR.

Bolloré in 2022 sold its logistics crown jewel, Bolloré Africa Logistics to MSC group for a price of 5.7bn EUR. This business operated a number of ports, mainly in West Africa and in some instances held quasi-monopolies on certain areas of the trade. So BAL was more profitable than Bolloré Logistics. Why did they sell? For one, they appear to have received a decent offer by MSC. Rumour has it that the business largely relied on the contacts and connections of Vincent Bolloré who is 71 years old these days. What strikes me is that there is so much happening in various parts of the Bolloré empire and that there is more Empire Monetization (UMG, Bolloré Africa Logistics) than Empire Building (Lagardère).

Bolloré Energy:

Bolloré Energy is an Oil Logistics and Distribution company in France, Germany and Switzerland. It owns oil storage depots and a pipeline and distributes petroleum products in France, maybe somewhat comparable to DCC Plc . While this may seem a boring business, the shock waves of a looming energy crisis which ran through much of Europe last year shows that energy infrastructure and storage is important and even strategic from a security perspective. Bolloré Energy last year generated revenues of 3.6bn EUR and an EBITA of 141mm, strongly up from the previous year. The business is not high margin, but in my view steady and defensice. I am assigning a 7x multiple here for a valuation of 850mm EUR

Battery/Electricity Storage & Other

Over the last 15 years, Bolloré has invested hundreds of millions of Euros in research on batteries and electricity storage solutions. So far, their major result has a Lithium Metal Polymer battery which is the heart of the 100% electric Bluebus, likewise developped by Bolloré. Both the batteries and buses have been sold, yet the business to is loss-making.

Bluesystems, owned by Bolloré SE, comprises of various activities around smart mobility. The largest one appears to be IER Group which is involved in electronic ticketing and track and trace, e.g. for public transport. IER owns Automatic Systems, a company focused on automated entry control.

Electricity Storage and Bluesystems together generated 370mm EUR in revenues and an EBITA loss of 125mm in 2022. These divisions have some future potential but are presently burning cash. There is a risk that they may never turn a profit, on the other hand, they are active in sector with a significant future potential. For now, I will value them at zero.

Finally Bolloré owns shares in publicly listed Socfin, its subsidiaries Socfinaf and Socfinasia and Videogame company BigBen Interactive. Based on their share prices (shares are illiquid), I expect these share to be worth about 200mm EUR.

Adding up the Numbers

I just briefly touched upon all the various components of the Bolloré empire and gave a brief description including a conservative estimate of their values. On this basis, I get to a value of 14.86 bn EUR for the various components of Bolloré.

Now, Bolloré may be trading at around 5.65 € and has 2.95 bn shares outstanding for a valuation of 16.8bn EUR. So it iss not really cheap, right? Nope. At this point we have not included the effects of self-holdings and net cash at the various companies in the complex. This is where the real fun part of this analysis begins.

Making sense of the Alhambra of Brittany

I was really struggling the best method to deal with the web of companies and their self-holdings and tried various approaches but will only present the one I think is the most accurate.

It rests on the concept of equation systems with multiple variables. Most readers will have learned this at school. If you have as many equations as variables, you can often solve the system. Fortunately, we have Excel which helps with complex systems. If you try to build this yourself, I suggest you activate Iterative Calculations to avoid circular references. Here is my equation system:

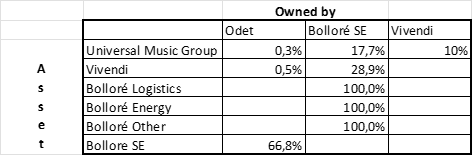

The columns show what a company owns in other companies and in net cash/debt. For example, Odet owns 0.3% in UMG, 0.5% in Vivendi, 66.8% in UMG, 15.3% in Moncey, 37% in Cambodge and has 498mm EUR net debt. If you add and multiply this for all the companies in the equation system, you can estimate a value for all of the companies. Beyond Vivendi and UMG, there ar no less than eight publicly listed companies in the cascade. These are: Odet, Bolloré SE, Financière Moncey, Compagnie du Cambodge, Financière de L’Artois, Forestiere Equatoriale, Chemins de Fer et Tramways du Var et du Gard and Compagnie de Tramways de Rouen.

You can buy and sell shares in each of these companies, the liquidity is however limited beyond Bolloré SE and Odet. Still, each of these public companies publish their accounts and some even hold considerable net cash.

What stands out:

(1) Unsurprisingly, if you look at the holdings chart, the extent of self-holdings is really mind-boggling, both in terms of compleyity

(2) There are some more significant assets at the level of other companies in the structure. For example, Cambodge holds about 1 bn EUR in net cash. 37% of that billion belongs to Odet and 62% to Terres Rouges. But then 67% of Terres Rouges belongs to Bolloré and 67% of Bolloré to Odet…

(3) The structure with so many public companies does not make sense (at least to me). The share owned by the public for Cambodge, Moncey, Artois and Rouen is between 0.8% and 6%. It would make sense to collapse many of these companies.

(4) Given the complex structure, it is well possible that I am missing some assets (thankful for any hints!)

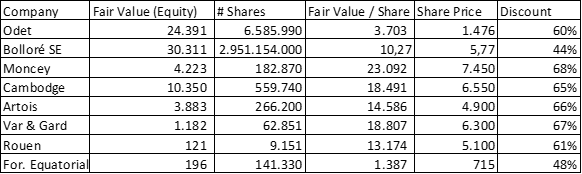

With the remarks out of the way, here are my results for the equation system. I have used the values for UMG, Vivendi, Bolloré Logistics as per and calculated Fair Values and Discounts for the listed entities of the Bolloré Group.

Based on the assumptions I have made above and find conservative, all the public entities trade at discounts between 44% and 68%. The biggest doscount in my model applies to Moncey, the smallest to Bolloré SE.

Conglomerate Discounts are not unusual and in many cases, they have a justification. One reason is that while the value may be there, you depend on the controlling shareholders/management for it to be crystallized. What is the points of owning a treasure trove full of gold which you cannot open because someone else has the keys?

In some instances, we have seen activists engage in these situations and their recipes are normally:

Spin out divisions/holdings so there stand-alone value becomes apperent: We have seen this not just in cases like Stellantis/Exor/Ferrari or Volkswagen/Porsche but also Bolloré/Vivendi/UMG. So check, this has been happening.

Sell assets: Notable assets recently sold were parts of UMG prior to the spin and Bolloré Logistics Africa, both of which generated a lot of cash for the group

Buy Back your own shares: This is being done not only by Vivendi, but also by Bolloré in 2022. Given the holding structure, the share purchase can be excuted by any company in the group. In 2022, Odet bought about 3.5% of the Bolloré shares (which have the biggest public float). In March, Bolloré proposed a tender of of to 10% of its shares (almost 30% of its float). If shares can be bought at a discount, the intrinsic value increases. This opportunity the generate value for shareholders exists and it is pursued by the group. If the tender was fully executed, my estimate for the value of an Odet share would increase from 3.703 to 4.073 EUR.

Summary:

This is a lengthy post on the Bolloré structure, one of my favourite investments. The story is complex, but in essence, the company has material holdings in two businesses which consider high-quality, UMG and Vivendi. These businesses will generate cash and grow over the next decade. By investing in the publicly listed entities of the Bolloré group, you can get access to these at a discount. You also get some other activities in above-average industries (Logistics & Distributions) and a free option on some other activities (baterries/Bluesystems). Moreover, the group has in its recent past allocated capital skillfully and in a shareholder-friendly way. It is currently seizing the opportunity to repurchase shares at a discount to intrinsic value.

What could go wrong? The value is largely concentrated in UMG, so if there were a permanent impairmen in that business, you might lose money on Bolloré/Odet. The other risk is succession. Vincent Bolloré is 71 and has four kids who are all involved in the business. They have a great role model, but there is a risk of this generation doing worse than Vincent.

Hello Carsten,

Nice analysis. I did something similar last year (with similar outcome), but one thing I struggled with are the cash positions.

Firstly, I am not certain that the the cash positions for the illiquid subsidiaries (cambodge, rouen etc) are not also consolidated into Bollore/Odet, so that you may be counting them twice in your analysis. But you probably have more financial understanding than me to determine if this is the case.

Secondly, it would be very interesting (needed, actually) to look at the cash positions of the other companies as well. Their annual reports must be available somewhere (at the French depository of company accounts?).

For instance, I found an annual report of Terres Rouges, which stated 291M€ net cash in 2021, and also indicated that Terres Rouges has a direct holding in Odet (size unspecified) which is not in your schedule.

Thanks for this excellent write-up. The group structure is indeed extremely complex and probably the main reason for the big discount to the net asset value. My guess is that the discount at the Bollore SE level is not even fully understood by the professional investment community.

While share buybacks are certainly value accreditive, they are not really helping in this regard. You made a fair point that collapsing some of the holding layers would be helpful to increase visibility.

But which of the layers could be eliminated without a loss of control and potentially negative tax consequences for the Bollore family?

And more importantly, what would be the potential tax consequences of such transactions for minority shareholders?

The spin-off of UMG for example was treated like a dividend distribution for French minority shareholders at the Vivendi level, while it was tax free for Bollore SE because it's holding was above 5% and therefore tax exempt. So interests seem not fully aligned here.