Legal & General Group

A Pension Risk Transfer Company with great numbers and a not-so-easy story

Disclaimer: This is not investment advice. The author holds shares in Legal & General Group. His views my be biased and he buy or sell shares of any company mentioned at any time. The information provided may be inaccurate ans is not to be relied upon. Please do your own research.

You will rarely find large caps in my portfolio. I ignore them for various reasons:

(1) They are more complicated. It is fairly easy to understand what a small company like Funkwerk is doing but much more difficult to understand all the segments and activities of Siemens or General Electric.

(2) Large Caps are more widely analyzed. Beyond the complexity, there are busloads of professional analysts covering big listed companies. DOW30 Companies will often have 50 sell side equity analysts who cover them. Add to that the buyside, debt analysts, rating agencies and it will be hundreds of very clever people dedicating their time. So it is very tough to get an edge here.

(3) The multibag potential is lower. Small companies often have better growth runways. They are more flexible, often in less saturated markets, and good capital allocation has a bigger impact. I really like Warren and Berkshire Hathaway and I think they will to well, but it will be tough for them to go from 700bn market cap to 7tn. On the other hand, there are 100mm companies which might become 1bn in my imagination.

L&G Background & Overview

In this context, my position in Legal&General (13.8bn GBP market cap) is a bit of an exception. It may still be worth sharing my thoughts here and I promise I will write on small caps again next time. Many readers will likely put a business like L&G on their “Too Hard Pile” and maybe I should have done the same. Also, I have to warn you that some insurance-specific aspects are quite complicated to generalists (like myself) and want to encourage feedback from knowledgable insurance experts. And while this may not be an easy one for many readers, it may still provide interesting food for thought.

New Law Life Assurance Society was founded in 1836 by six London lawyers as alife insurance company for the legal profession. The company later also wrote policies for the general public and changed its name to Legal&General (L&G). The company went public in the 1970s and expanded in the US in the 1980s. The company today is organized across four business areas: LGRI (Retirement Institutional), Retail (Life Insurance and other Insurance Products), LGIM (Investment Management) and LGC (Capital Investment). Here is how the company decribes their activities:

One way to think about the for segments is that LGRI and retail are more about writing insurance contracts (the liability side of the balance sheet) while LGC and LGIM deal with asset management and investment, i.e. the asset side.

The core: LGRI & the Pension Risk Transfer business

LGRI, in my view the core of L&G, is the UK market leader in Pension Risk Transfer (PRT) with a 25-30% market share. PRT providers address the problem of defined-benefit plans. In the second half of the 20th century, defined-benefit plans were a very popular scheme which many companies offered to their employees. For each year of service, the company would promise to pay their employee a certain amount in monthly pension. For this promise, the company would book a liability (pension obligation) on their balance sheet. The company would then need to manage this liability, i.e. set aside some money and invest it in order to make future promised payments. Importantly, the company would guarantee to pay a certain amount for as long as the retired employee lived. If the money initially set aside and the returns earned on it would be insufficient to make the pension payment, then the company would be on the hook. So it would bear the investment risk as well as the longevity risk, i.e. for how long the pension would be payablem which depends on the employee lifetime.

Defined-benefit plans created a lot of problems for the companies which initiated them: The company has to take investment management decisions. If the defined-benefit plan was underfunded (i.e. more pension liabilities than assets covering them), it would reduce the company’s equity and the company would need to make payments into their pension plan to improve its “funded status”. The pension obligation values fluctuate with interest rates and inflation. Longevity is a very difficult risk to assess/manage. For all these reasons, there are very few active defined benefit pension plans today. The current standard is a “defined contribution” plan in which the company makes regular payments to a trust/fund for the employee’s benefit, but that’s it: The investment and longevity risks sit with the employee.

While there are few active defined-benefit plans left, the obligations from those issued in 1970-2010 are still there. And this is where L&G/LGRI comes in: They take over the risks of defined-benefit plans from companies looking to get rid of them. The potential here is huge: I do not know a single company which likes their pension obligations and to some, they are a pressing problem. Finding a solution here means to reduce a difficult-to-control and non-operating risk, free up resources, both in terms of management & staff capacity and balance sheet. So L&G (and their competitors) offer to solve a very important problem for their clients.

How is the risk transferred? There are various ways: In a “Buy-Out”, L&G will take over the entire pension scheme and the company can discharge the pension liabilities from their balance sheet. The company will pay an upfront premium to L&G for this and has nothing to do with the pension plan anymore.

Another solution is a “Buy-In” where the pension plan continues to exist but L&G, for a premium will take the liabilities “back to back”. So economically, L&G is taking and managing all the risks, but the pension plan remains in place. There are also “smaller” solutions, such as longevity swaps, in which the investment risk remains with the company, but the longevity risk is transferred.

In summary, PRT means the transfer of a long-dated run-off portfolio of contractual liabilities with an unknown duration. The present value of these liabilities depends on a lot of different factors and is difficult and complex to compute. This uncertainty needs to be priced in when the PRT occurs. Overall, PRT providers will need to price in some “margin of safety”, i.e. request a price higher than present value of the liabilities and expected costs to manage them. They may try to hedge out some risks when they enter transactions. And their capital investment returns are crucial to the overall success of their transactions.

Every year, there is more certainty on the liabilities and the duration of the pool shortens. LGRI needs to find new deals or your portfolio will shrink. Over the last 4 years, the PRT in the UK business has picked up significantly. It seems that more and more UK companies and also workers representatives are warming up to the concept of PRT. Also, higher interest rates are helping, reducing the present value of laibilities and reducing the hit corporates need to take in a PRT. Outstanding defined benefit obligations are still assessed to be worth more than 2 trilion GBP, so there is a lot of potential for new deals remaining for the next decade or so.

Market & Competitors

L&G is active in the UK and the US. They are also starting to look into the Dutch PRT business.

The US is the biggest market globally but L&G is a relatively small player here and it would be surprising to see the do multibillion deals like the large IBM PRT transaction done last year by Prudential and MetLife. In 2022, a pension transfer volume of 53bn USD was reported for the US.

The core market is the UK. In 2022, a total of 25 bn GBP was reported for PRT transactions. L&G has about 25% of the market and is has been around for the longest time. Main competitors include Aviva, Phoenix and unlisted Pension Insurance Corporation. A decent overview on the 2022 market in the UK can be found here. As you can see from the IBM transaction, the volume is lumpy and a single transaction can account for 30% of the total volume in one year. L&G can offer all products related to PRT and has the ability, capital and expertise to quote on “whale” transactions (say 10bn GBP).

While there are a number of competitors, I do not think the PRT market is “easy” to enter for the following reasons:

(1) High capital requirements: Insurers have to pay pensions for a very long time (say 40 years), so the Solvency II capital requirement is quite high. Given the high capital requirement and “risk margin” to be set aside, it takes some years to generate free cash flow and become self-funding. L&G reached the self-funding status years ago.

(2) Expertise: The pricing of PRT transactions includes an assessment of inflation and longevity risks, both of which are non-trivial. This requires actuarial expertise as well as a good understanding of the circumstances of a business and a database from other transactions. The need for expertise poses a barrier to entry for newcomers while L&G has been in the business for years.

(3) Trust from employee representatives: A PRT transaction often requires the approval of employee representatives who have their on matters relating to the defined-benefit plan. They will likely prefer to work with an established player rather than a newbie. They will also look at the credit risk/rating of the insurance company to guarantee workers’ pensions in the future. Again, L&G is a reputable player with a long history and a good credit rating (Single A issuer ratings, Double A insurance financial strength ratings).

(4) Asset Management/Investment capacity: A major task for any financial institution is to match the duration of financial assets and liabilities. In the case of L&G, the challenge is to find enough long-duration assets. L&G, through LGIM and LGC is trying to get access to these assets, with LGIM focusing on traded and listed assets while LGC is focusing on illiquid and alternative assets. We shall look at both below.

Retail

L&G Retail provides life insurance and retirement products to individuals in the UK. These include pension products, insurance, later life mortages and investment products. The Retail division is significant in terms of profit contribution. In its nature, the exposure L&G takes on here is quite similar to their PRT business, i.e. they promise pension/annuity payments in the far-distant future against receiving today. Again, this is a stream of positive and negative cash flows, which to some extent are uncertain due to longevity, interest rate and inflation risks. How you invest the premia in the interim is key here aswell. The main difference is that L&G is dealing with individual customers rather than corporates and the stream of new business is more steady.

Asset Management

L&G has two divisions focused on asset management, LGC and LGIM.

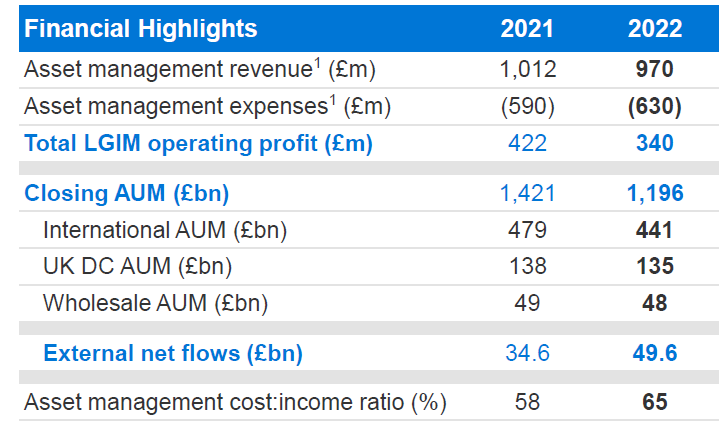

LGIM is a more traditional asset manager focusing on public markets and making investments in listed securities. They largely invest against the assets originated by the PRT and retail divisions but also offer investment funds to the general public. This business is similar to, say MEAG / MunichRe or M&G/Prudential. LGIM is one of the biggest, if not the biggest asset manager by AUM in the UK. They offer various fund products across all asset classes and regions. Most of the capital they manage is external: As of the end of 2022, their AUM stood at 1.2 trn GBP, while the total investments by the L&G Group reached 445 bn GBP (some which is managed by LGC). So LGIM in itself is an AM business with a good scale which, even without the L&G assets. At the same time, LGIM is mostly offering fixed income and passive (index) funds at low fees which results in low fee rates and low revenues when compared to their AUM. For the last two years, LGIM reported revenues around 1bn GBP, which means less than 10 bps on their AUM. This appears so low that it might mean they are not charging on their own assets, but even then it seems quite low. While the AM business has faced cost pressure, even LGIM remains solidly profitable and still generates decent opering income year after year. 2022 was a difficult year for the business which lost more than 200bn GBP in assets due to the bear market in equities and rising bond yields.

LGIM is trying to expand internationally and focus on the more profitable sector. In my view, it is a candidate to be spun off at some point. As I generally like asset managers as investments (steady business, high returns on capital), I think the segment is actually a plus.

LGC is L&G’s inhouse alternative asset manager. It is focused on illiquid and long-dated private assets which include real estate (affordable homes, built-to-rent), infrastructure and clean technologies/renewables. LGC is trying to “create” assets to match the long-dated profile of pension liabilities. Unlike LGIM, LGC is overwhelmingly investing for L&G’s own book. LGC has grown significantly over the last few years and opened new subsidiaries such as CALA (housing) and Pemberton (Private Debt). AUM and Profits from LGC have increased significantly over the past few years. L&G has made a point of keeping alternative asset management largely inhouse while some competitors are outsourcing their portion of alternative assets to external managers like Blackrock. L&G thinks that its focus on the UK market and scale as one of the largest pension companies permits access to highly attractive assets and that the management of alternative assets is one of the most lucrative parts of the business.

Some market participants have voiced concern about the position of alternative assets (and real estate in particular) in a choppy economic environment with higher interest rates. We will see this year if this will turn into a problem for L&G.

Capital, Solvency and IFRS 17

For insurance companies, one of the most important ratios is their Solvency II capital ratio. Like the CET1 ratio for banks, it expresses the ratio of risk currently taken by an insurance companies compared to the capital it has available to cover these risks. Insurance companies need to maintain a solvency ratio of at least 100% under the regulation. Many European insurance companies run ratios at or above 200%, implying a conservative capital management and/or ample capacity to take on additional risks. As of year-end 2022, the L&G solvency ratio stood at a comfortable 236% level. Despite a fairly generous dividend policy, L&G has generated surplus capital over the last few years and improved its solvency ratio significantly during that time.

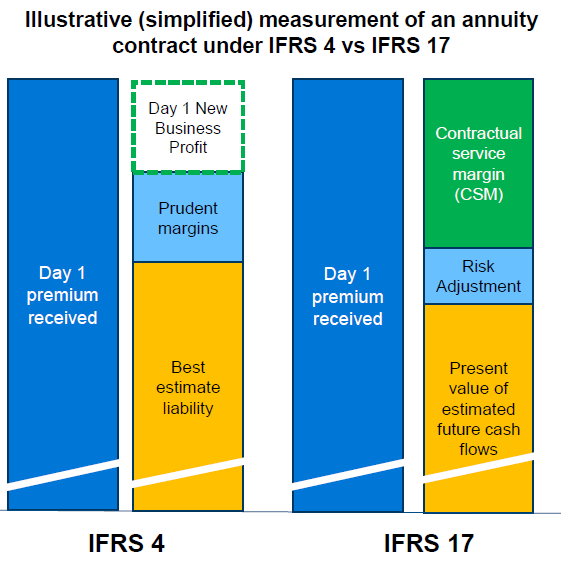

In the insurance world, a new accounting standard named IFRS 17 has been implemented at the start of this year. IFRS 17 governs the accounting of insurance contracts for all companies reporting under the IFRS accounting rules, replacing the previous IFRS 4. Its goal is also to make insurance accounting more comparable across different insurers. The changes are quite fundamental and like most insurance companies, L&G has started to educated their investors on the effects of IFRS 17. Maybe most significantly, annuity contracts such as life & pension insurance will be accounted differently as per the below graph:

Thus far, when L&G entered an annuity contract, the premium received, a cash asset, was booked against its best estimate of a the future liability and a prudent margin, a safety buffer for a margin of error. As the premium was normally greater than the sum of estimated liability plus prudent margin, the insurance company could recognize a Day 1 profit on new business which increased profits of that year and strengthened the company’s equity position. Going forward, the concept for measuring liabilities will change, with the present value of estimated future cash flows replacing the “best estimate liability”. There are some assumptions changes in this position as wells (discount rates, inclusion of certain expenses). Prudent margins will be eliminated and instead, a Risk Adjustment is going to be introduced which is going to be computed according to a Value-at-Risk (VaR) approach. Importantly, there will be not Day One profit anymore. Whatever remains after the estimate of liability plus Risk Adjustement will be booked into a Contractual Service Margin (CSM). The CSM in similar to a “Deferred Revenue” position on other balance sheets and will be released into profits over the lifetime of the contract. Going forward, any assumptions changes (e.g. longevity, investment returns) will be reflected in the CSM and not in the operating profit of a single year like under IFRS 4. Therefore, operating results are expected to be less volatile. The Risk Adjustment (like the IFRS 4 Prudent Margin) will also be released over time if the contract plays out as originally expected. This change will dramatically reduce L&G’s accounting equity by roughly 50% from 10bn to 5bn GBP. However, the CSM will increase future profits. Crucially, the CSM will be part of the Solvency II Capital. My understanding is that all professional investors will economically assess the CSM like equity.

Also, L&G has indicated that IFRS 17 will initially result in a lower accounting profit because the lower Day One Profits on new business will initially outweigh positive effects from CSM releases. I think that the prospect of a much reduced accounting equity and lower accounting profit causes some investor scepticism. However, a change in accounting rules does not change the economic realities of the business. Also, the Solvency position remains the same and L&G can still comfortably write more new business. Rating agencies have indicated that IFRS 17 will not get them to change their views. L&G has indicated to host another investor event on IFRS 17 in May 2023 and will report H1 numbers under IFRS 17 in August, at which point the uncertainty should disappear.

Management & Incentives

For 11 years, L&G has been led by CEO Sir Nigel Wilson since 2012. Under his leadership, L&G underwent a major restructuring in the first half of the 2010s and formulated its current strategy which is built around PRT. Sir Nigel, aged 66 years, announced his intention to retire this January. He will stay in his job until a new CEO has been appointed and a smooth transition will be ensured. So far, no new CEO has been appointed yet and the board is currently conducting a search process for a successor. This situation creates another source of uncertainty for the company and might be weighing on the share price. However, at least to me, the strategy of the Group is mapped out very clearly, so a new CEO will not need to start by launching a major restructuring. However, let’s hope that the succession topic can be resolved quickly because it certainly creates some unrest within top management. The second top executive is CFO Jeff Davies, 46, a dedicated finance expert who was a partner at EY prior to joining L&G in 2016.

Remuneration is transaparent in the annual report and consists of a Base Salary, a Cash Bonus (“Annual Variable Pay”) of 75-150% of the base salary and a Performance Share Plan (PSP).

Sir Nigel is making a base salary of 1.1mm GBP this year, while Jeff Davies is getting 660K GBP. The policy set a target shareholder of 325% of base salary which however appears to be non-mandatory. While Sir Nigel, after 12 years of service, has amassed a considerable block of shares of 888% of his base salary (>9mm GBP), Jeff Davies is falling short here with 162%, just a bit over 1mm GBP.

Overall, I think it is a positive that the size of the central management team is not inflated with just two executives. Moreover, the structure is decentralized with the four businesses each being run by a dedicated segment CEO. In my view, the incentive structure can be improved by increasing the required shareholding.

Financials

Now that I have told you that current accounting rules are going to be thrown into the bin, it is a good time to look at financials put together under these very rules :-) . In my view, the financial track record of L&G is quite impressive. Here is the 12-year overview from their investor presentation:

On a per share basis, earnings, dividends and book value (all under the old IFRS 4) have grown pretty nicely over the last decade. In recent years, profit growth has mostly been driven by new PRT deals and the LGC division. Returns on Equity have have surpassed 15% consistenly over the last decade. The last time the group recorded a loss was in 2008 when writedowns on investments had to be taken. L&G has normally distributed about 50% of their net income via dividends. They rarely repurchased or issued new shares and the share count today is about 5% higher than in 2010. Given the profitabilty of the business and the current cheapness of the stock, I would welcome less dividends and a share buyback program. As a company like L&G is however unlikely to cut their dividend, I hope they can buy back some shares with their surplus capital (solvency is strong), but it will depend on the opportunities they see in PRT deals.

Valuation

As I write this, L&G trades at around 230p/share. Again, accounting methods will change profits and equity, but under IFRS 4 and for 2022, this is a P/E Ratio of 6x, a P/B of 1.18x and a dividend yield (not subject to IFRS4) of 8.4%. This seems pretty cheap for a business which has grown its book value, profits and dividends so consistently. Historically, the Price/Book is also at one of the cheapest levels in the last 13 years:

In other words, despite the consistent positive operating development, rising profits, dividends and book values, the share price since early 2014 is pretty much unchanged (investors still received some dividends for consolation).

IFRS 17 will assign higher P/B and P/E ratios to the L&G share. To me, this is not a big deal. I think that over time, most market participants will count the CSM into the equity position and adjust accordingly. In terms of P/E the change will likely not be that big and the trajectory will improve over time.

The market is clearly sceptical about IFRS 17 but also about the outlook on various fronts. If you have made it up to this point, you will have seen that L&G is a company which has proven that it can deliver great financial results, but is not a great story stock. Let’s sum up here.

Summary

There are a lot of reasons why L&G is a difficult story to invest in:

The business is difficult to understand as one needs actuary skills in order to to able to assess the proper valuation/accounting of long-dated retirement liabilities

The IFRS 17 effects are not precisely known, but it is already clear that there will be a reduction of reported equity by about 50% and an initial decrease in net income.

On the asset side, there are concerns how the difficult environment with respect to higher interest rates and a tighter availability of credit will play out. L&G has considerable exposure in the BBB/BB rating classes and might suffer if default rates increase.

Finally, there are uncertainties around management succession with a successful CEO, who has been in charge for 12 years, stepping down and the successor being unknown.

On the positive side, there are a number of aspects to like about L&G

Clear and reasonable strategy with all four divisions supporting each other and representing important parts of the value chain

Expectation for UK PRT market growth over the next decade

Strong track record in terms of profitability, returns on capital and capital generation, strong Solvency II position and

cheap valuation

There are various investment approaches. I tend to weigh quantitative aspects more than a good story, in particular if I see good numbers. That is why I opened a position in L&G. Time will tell if this was a good call.

I've covered L&G for 10 years, I'm impressed at the coverage of the issues. There are a number of potential tailwinds which don't receive a lot of attention. LGIM's cost income ratio has been rising for some years and I think is close to peaking, this should mean that revenue growth coverts to EBIT growth which has lagged for some time. Longevity reserve releases should also be a natural tailwind in the years ahead as their reserving follows mortality tables which reflect pre-pandemic trends. Over the next 2-3 years this should act as some support to the LGRI earnings. At a more basic level, I think the key to this business is that people value it as a short duration business, yet it is writing policies which will release profits and capital for 15-30 years with zero lapse risk. With no lapse risk, they are uniquely positioned to capture illiquidity premium that banks and asset managers cannot - as they must provide their investors liquidity. Feel free to ask me anything.

(1) Aviva, PIC, Rothesay, Phoenix, Scottish Widows all write bulk annuities. PIC I think is the closest competitor and is less than half the size. I think LGEN has two distinct advantages in scale and investment capability (origination and warehousing of assets via LGC). Knowing you’ve an eligible asset with a yield pickup is an advantage in pricing BPA deals. That said, I think it is a very competitive market and my view is the tailwind is so strong it is supply side constrained. (2) Capital position is as strong as it has ever been and in summary I would agree with your take on how IFRS 17 will be viewed over time (the CSM). (3) this was a genuine surprise. I thought Laura Mason or Kerrigan Procter were obvious internal candidates who have been rotating around the main businesses for years. I have met Kerrigan several times and think he was very capable and I confess when I read the announcement I worried LGEN might suffer some senior management churn. I’ve also met the new CEO when he was a lieutenant at HSBC - I was neither impressed/unimpressed so I’m really in wait and see mode… sorry can’t be more helpful on that point. One thing I would say in general is that I’ve always been more impressed with LGEN second tier management than Aviva and it had had experienced much less management churn (Aviva had been a joke) - this in my view is because LGEN is a much more coherent business having disposed of lots of sub scale adjacent businesses. Aviva still has wood to chop.