Disclaimer: This is not investment advice. The author holds long positions in the shares mentioned in this post. He may buy or sell any shares at any time without prior notification. The post is for entertainment purpose only and the information presented may not be accurate. Please do your own research.

It is party time again. The year in equity markets started with a bang. All-time highs were achieved in most major indices, and the winning streak, in particular of tech, and everything AI-related within tech seems to experience no limits. Sentiment to me feels quite optimistic: A soft landing or ongoing expansion in the US seems pretty much guaranteed, the troubles in commercial real estate will not impact the overall economy and the political uncertainty will not matter much either, because AI is going to advance the planet - or so the narrative goes. Equity indices are up significantly over less than 2 months, with the Nasdaq up 8%, the S&P500 up 7%, the DAX almost 4% and the Nikkei at a new all-time high. Volatility, the index of fear in financial markets, as measured by the VIX, sits between 13 and 14, close to mulit-year lows. The world is a safe place again.

The Augustusville portfolio is behind in the relative performance derby over the last two months and up roughly 1% YTD. As some great psychologists have explained before, people compare themselves to each other and winning a little while everybody else wins bigly is mentally difficult. In this case the defeat feeling is minor, also because the discrepancy is quite moderate. Moreover, I have been in the market for some time and seen a number of ups and downs, tend to think of myself as a fairly stablee character and am using no leverage in investing. This is why I sleep very well - unless the kids have a bad night - and certainly do not lose any sleep over investments. Still, when there is some underperformance, it may be a good idea to analyze it because we may learn something here. Whenever an investment does not work out, there are essentially two conclusions to be drawn:

I made a mistake in doing this investment. In this case, we should sell the position or

The market has it wrong and our analysis was correct. So we should stick to the position or even add at lower prices.

These two possible conclusions imply the contrast in (1) respect/humility versus a generally efficient market, where this are unpredictable and we may get analysis/decisions wrong and (2) self-confidence bordering on arrogance of us knowing better as the market is sometimes inefficient and we want it to be our servant, rather than our judge. Keeping the balance between these two instincts is very important when analyzing when things have not worked out. With these thoughts, I will jump into a review of the the events which affected the portfolio so far. Please see my Investments for 2024 for reference:

Spirit Airlines: The failed merger arb of Spirit Airlines has caught headlines in the media and investor community. The merger was blocked by the judge in charge of the case as anti-competitive, giving the US DOJ a win over the companies. The merger was trading at a big spread, implying its riskiness, still I thought it was more likely than not to go through, based on my (amateurish) read of the case. While Spirit has been the biggest drag on my performance so far, I do not consider it a mistake. Andrew Walker wrote a wonderful piece on “Process versus Outcome” which in my view perfectly summarizes how you can do great analysis and still lose on occasions (while you should win more often). Essentially, it is better to be lucky than smart and I consider myself unlucky on Spirit, but not dumb. I sold the Spirit shares the day the news got out (thesis was broken) and it contributed about -2% to the portfolio performance while a win might have meant +2.5% contribution.

iRobot: Since we are doing failed merger arbs, I took another small hit on iRobot (it was a <0.5% tracking position) after their deal to be acquired by Amazon was terminated as the EU signalled to block it. This one I also exited right away.

Logistec also left the portfolio in early January after its acquisition by Blue Wolf Capital was auccesfully completed. This was pretty much known in late December and no real surprise.

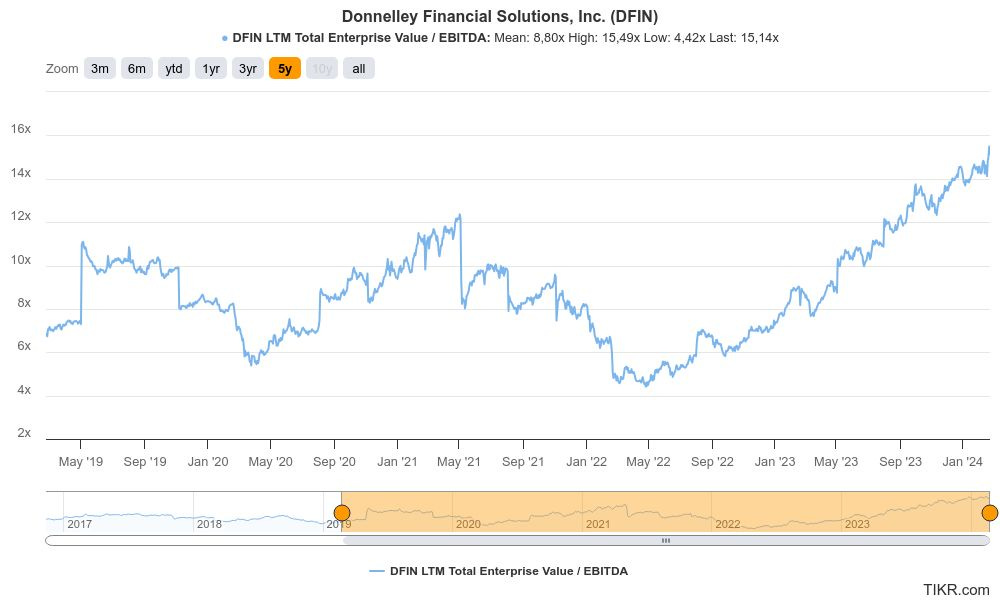

Donnelley Financial Solutions (DFIN): In the 2024 outlook I had hinted at the possibility of exiting DFIN in 2024. We entered DFIN in spring 2022 at a good valuation and a favourable timing. While the business, which is geared to US capital markets activity slowed down over the course of 2022/23, the stock price more than doubled. Given recent optimism on capital markets, some of that may be the expectations game. Still, it cannot be denied that the company valuation became more expensive.

While I believe DFIN has some secular factors running in their favour (Us capital markets will grow over time, the company will do more asset light/software business which generates higher returns on capital), the attractiveness at 15x EBITDA not as good as in the past which is why the position was sold out around 60 USD and a 117% gain was pocketed.

Fairfax Financial: In the Cologne area, where I am based, the “Weiberfastnacht” day (“silly Thursday”) is one of the highlights of carnival which is so important that we call it the fifth season. This year, the silly Thursday was embellished with a Muddy Waters short report on Fairfax, our biggest portfolio position. While I do not think the report itself was silly, the title “The GE of Canada” is my view was. The report itself is mostly criticizing certain accounting practices which it claims to inflate the book value of equity, largely by fudging the value of its equity portfolio held.. There were no allegations of fraud, of insurance reserves or earnings manipulation. After the initial shock, I did not find the report to concerning. I like Fairfax for its earnings power and, in my view, it is not questioned. Fairfax 2023 earnings came in pretty much as expected and I keep on holding the stock which is also one of the biggest portfolio gainers so far this year.

Liquidia: My second big gainer over the last few months has been Liquidia which has more than doubled from my purchase level (sub 7 USD). The story seems to be playing out and we are on track to commercialize the Yutrepia drug. Given the very fast double, I reduced my position a by a third, even tough the portfolio weight by less. I still think this is a good bet and likely to trade higher, but I do not know it well enough to make it a Top3 position.

Delfi: Following some price weakness in the stock, I slightly added to Delfi back in January. The company may be suffering from higher cocoa prices but it may also just be a normal market fluctuation after a rapid run-up, with the stock price doubling from October 2022 to May 2023. Overall, I do like the business of branded consumer products in an emerging market and was therefore happy to add. This trades at around 6x LTM EV/EBIT and I expect it can generate mid-teens ROEs on average. There is currency risk but Indonesia and its chocolate-consuming middle-class will grow from here. Delfi might also be an M&A target for the chocolate majors and remains one of my favourite ideas.

Aplisens: I am a grateful reader of a number of Blogs, but Wintergems by Govro is one of the most outstanding ones. His analysis is first-notch and I have not found a single poor analysis by him - this does not mean I suggest to buy blindly whatever he posts. In a twitter space I co-hosted, Govro pitched the idea of Aplisens, a Polish manufacturer of measuring equipment. He also produced a great write-up which he is sharing for free. Aplisens’ products are often mission-critical. They have to be reliable and dependable and if they are, clients are unlikely to switch. There is an element of recurring revenues (after-sales, service, maintenance, parts) to the business. Aplisens has roughly doubled its revenues over the last 10 year (for a CAGR of 7%), always been profitable and returned on average about 13% on capital. This company trades at and EV/EBIT of 5-6, making it an attractive enough setup for me to enter the portfolio. Thanks Govro!

Corecard: Corecard is another new buy of 2024. I first learned about it on YAVP but decided to stay on the sideline. After a steep decline in share price (-64% in 1 year), my contrarian instincts overwhelmed me and I pulled the trigger. Corecard produces software for the processing of credit and debit card transactions and management of card programs. To my (layman) understanding, the company’s technology is top-notch and capable of processing complex matters (different currencies, different interest rates on various days) which is why it was chosen to process the Apple Card in cooperation with Goldman Sachs. However, Corecard underemphasized business development and became too reliant on this customer, taking a big hit when Apple announced the termination of the partnership with GS and Goldman subsequently trying to cut costs, including to Corecard. Corecard will generate significant revenue from the contract over the next two years, but they need new clients. Still, even at a lower level of business activity, Corecard managed to win clients and grow revenues for processing and maintenance. The company’s equity value stands at 100m USD, yet Corecard has 27m USD in cash and no debt, probably generated about 10m USD in operating cash flow (+6m in working capital improvements) in 2023 and is repurchasing shares. This may be in terminal decline in which case we might lose, but if the business shows signs of life, the setup looks quite attractive to me.

Cake Box: Cake Box is a UK franchise company active in the production of egg-free cakes and bakery products. Since 2016, the company has grown revenues from 6 to 36m GBP. It now has more than 200 stores under its brand. Initially a Covid winner, the share price nosedived from its high close to 400p in November 2021, when questionable accounting practices were disclosed by Maynard Penton (in may view this piece is much better than MW on Fairfax). While the report does not look good fot the company at all, many of the issues addressed, in my view, are not uncommon for smaller early-growth companies and to me indicate sloppiness rather than fraud. Also, it seems like the most significant issues have been addressed per the latest reporting. I bought share at around 160p, 10x EV/EBIT and 5% dividend yield, hoping for the company to grow further from here.

Watchlist: High on my watchlist is the port terminals / services space. There were some great write-ups on Eurokai by mmi and Kamigumi by Govro. After Logistec was sold and Bolloré Logistics will most likely also be exited, having some logistics exposure in the portfolio will probably not harm.

Another company I would like to research more is Washtec. This was also covered and owned by mmi in the past, but I also saw an excellent recent write-up on Michael’s Stock Safari which got me interested.

Twitter Space: On 04 March at 8:15 pm (German time), Andy and I will co-host another twitter space featuring international investors. We will feature a great line-up of investors, including the masterminds behind ToffCap, Pernas Research and Symmetry. Follow Andy (@evfcfaddict) and myself on Twitter, tune in if interested and ask these guys some tough questions!

Global Money Week: I was recently made aware of the Global Money Week, a format organized by the OECD with the goal of offering financial education and improving financial literacy, in particular for younger people and those who have less contact to the topic. In my view, this is a great initiative and the need is huge - I recently learned that in Germany, far more money is spent on gambling rather than regular ETF saving plans. I am still looking for a good format to contribute to financial education (within or beyong the GMW), so if you have a good idea, please let me know. Also, I am sure a lot of the readers of this blog are financially literate - maybe you can also contribute something to this worthy topic?!

Thank you for sharing your honest and insightful update on your thoughts and ideas! Very much appreciated, there is always a lot to learn for me and this substack is a great source of inspiration.

This means a lot to me. Thanks. Nintendo is also part of my Japan MAG5 with Kamigumi, Yamada, overpriced Fast Retailing and an undisclosed position.