Note: None of the below is meant to be investment advice. Your author tends to have a lot of stupid ideas and may have sleppt too little and/or drunk too much. He is long the stock mentioned below and his views may be biased. PLEASE DO YOUR OWN RESEARCH!!!

After the initial portfolio ramp-up post, I got a lot of feedback and also gained a number of subscribers - many more than I had expected. Thank you all for your interest in my works aswell as sharing your own views/thoughts/questions.

With this post I will look at another portfolio companies. I will follow the ranking provided in my initial “Ramping Up Post” even though the weights are changing over time. Also, as a general comment, I have not been doing anything in the volatile last couple of days. That means that there is also some cash left to be deployed. I do have a watchlist and am mostly considering special situations right now, given the market environment. Also, I am typically pretty bad as market timing and my general sentiment is short-term cautious but long-term optimistic - meaning that I usually want to buy shares but also want them to become cheaper first. Moreover, I am expecting a “funding round” for Augustusville around end of June which I will probably use to upsize existing positions.

With that introduction, let’s take a look at DFIN:

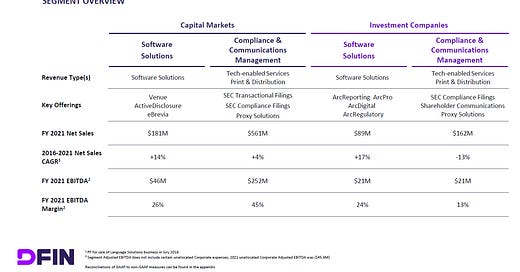

Donnelley Financial Solutions (DFIN) is a financial communications and data services business which was spun off from RR Donnelley (RRD), formerly the world’s largest commercial printing company, in 2016. The company has two business units called “Capital Markets” (740mm USD revenue, 40% EBITDA margin in 2021) and “Investment Companies” (250mm USD revenue, 17% EBITDA margin in 2021). Each of these units has two revenue type - which the company calls “Software Solutions” and “Compliance and Communications Management”. Here is an overview taken from the company presentation:

The company’s main purpose is to help companies with their financial regulatory compliance. A big topic for DFIN is SEC filings. All companies have to prepare SEC filings on a regular basis (10K, 10Q) or if certain events occur (IPO, M&A transaction). There are clear rules and quality standards on what these filing need to include and the format they have to be presented in and DFIN helps clients to comply, either by providing financial reporting software (e.g. ActiveDisclosure) or managing the filings altogether (CCM business). DFIN claims to be the #1 SEC filer with 110,000+ SEC filings in 2021. DFIN’s ArcSuite products integrate the workflow of investment companies to create, manage and distribute financial reporting. The company also offers data room solutions in the context of M&A transactions. In my view, DFIN is a “pick and shovel” business for US capital markets.

Stability/Cyclicality of the business: DFIN’s business offers both elements of great stability and high cyclicality: It is stable because regulatory filings will always have to be made. Compliance and SEC filing requirements will not go away. Also, there is a recurring element in the business. Once you have started doing business with DFIN, the switching costs may well be higher than what you pay the company. The software solutions business unit operates on a SaaS model and generates recurring revenues.

On the other hand, the business massively depends on how “hot” capital markets are. It boomed last year when there were a lot of IPOs, SPACs and merger activity and the transactions-based revenues will likely shrink when the market is in recess. Over time, however, capital markets have only become bigger and I expect for that to continue. In 2021, 52% of DFIN’s revenues were compliance-based while 48% were transaction-based. It is clear that we cannot just extrapolate from the 2021 result.

Over time, DFIN managed to become more efficient and drove margins, in particular as the Print segment shrank (and unfortunately, the number of employees receeded) and tech and software picked up:

Management: DFIN is lead by CEO Daniel Leib and CFO David Gardella. Both of them and the rest of the executive team have been pretty much RRD/DFIN for life. All of the six top executives are aged between 47 and 55 years old so may have a few more years to go. While management deserves no credit for the market environment, they were instrumental in getting DFIN in shape after the spin.

Leib owns 1.1%, Gardella 0.4% of the company. Executive Compensation includes base salary (780K for Leib, 425K for Gardella), cash bonus (125% target for Leib, 100% target for Nardella) which is mostly linked to Adjusted EBITDA and Software Solutions Sales Growth and ShareUnits. In the boom year of 2021, Leib made a total of 6mm USD, Gardella 2mm USD which feels generous but not out of line given the company’s profitability.

Financials & Capital allocation: Here is an overview of selected items of the DFIN financials statements since 2016 (source TIKR):

Firstly, I am fully aware that 2021 was an exceptional year and is probably on representative of a normal capital market environment. Market transactions (and related filings) will not remain at that level and DFIN’s transaction business will see tailwinds from there.

Surprisingly, in the boom year of 2021 revenues still stand roughly where they were in 2016. Part of that may be explained by the sale of their Language Solutions business in Mid 2018, but it is still does not appear great at first glance. Margins and Operating Income were declining until 2019 before picking up in 2020 and going through the roof in 2021. In my view, DFIN was carry a lot of “empty calories” after the spin. It incurred significant restructuring costs as the pprinting segment got downsized and it cut its headcount by 40%. At the same time, the effects of a more favorable product mix were kicking in. Software revenues grew from 136mm in 2016 to 200mm in 2020 (10% CAGR) and 270mm in 2021 (15% CAGR) which is one driver of higher margins.

Despite a lot of transitioning, the company consistently generated positive cash flows and used them to pay down its debt. DFIN also refinanced its debt at cheaper conditions. More recently, DFIN announced a share repurchase program and is looking to repurchase 150mm USD of its shares (16% of the market cap at current prices) by the end of 2023 which the company is executing quite aggressively, havin repurchased 1mm shares in March and another 600K shares in April (31.8mm shares remain outstanding). Despite the repurchase, DFIN expects to be net cash by 2024 and expects to generate an average of 100mm USD in FCF for 2022-26.

Valuation: Given the business will continue to be cyclical, I will stick with the company’s average FCF projection of 100mm USD a year for the next 5 years. That is lower than what they achieved in 2020 and 2021. There will likely be headwinds from last year but also structural tailwinds from the product mix. The market will not go away. The financial position of DFIN is solid and share buybacks may provide a kicker to returns.

So, at 100mm USD FCF, DFIN, currently priced at a 935mm USD market cap, goes for an FCF yield of 11% or 5x EBITDA (assuming 50% EBITDA-FCF conversion). In my view, that is cheap for a highly profitable and cash-generative business.

Assuming that in 5 years, revenue stands at 1.1bn USD (low single digit growth), EBITDA margins reach 30% and the company trades at 6x EBITDA with no net debt, we might look at a double. There is further potential upside from share buybacks.

Also, it is possible for the company to be bought out by PE or a strategic (like Broadridge Financial).

Risks:

The biggest immediate risk is a major economic financial crisis which will dramatically shrink economic activity and DFIN’s transaction-based revenue. While DFIN’s share price has come come by half from its high of 52 USD, it may still be too early to enter the stock. In that scenario, I would not expect for DFIN to go the way of the dodo bird, but we might look at a much lower stock price.

Lees likely but still possible, there may also be unwise capital allocation/stupid acquisition or competition emerging from some unexpected corner.

Summary:

DFIN is the interesting case of a business which has improved structurally and shoud have some long-term tailwinds yet. It is highly profitable and cash-generative.

On the other hand, it is clearly cyclical and may well have over-earned in the recent market boom, implying shorter term headwinds.

I like the fundamentals of the “picks and shovels” business for the capital markets and, claiming to be in for the long term, am comfortable enough to deploy capital here. At the same time, depending on the amplitude of a potential market drawdown, I may be too early here.