Note of Caution: This is not investment advice. The author of this post will likely have biased views on the shares discussed which are risky instruments. Investment may result in total loss of capital. Please do our own research. Author is long shares mentioned in this post at the time of writing, yet may buy or sell these shares at any time

Market & Activity Update

By standard definitions a bear market is characterized by a drawdown of >20% from the market top. Last week, the S&P500 fell below that mark which other leading DM indices haven been short off for a while. A lot is going on with inflation, interest rates and central banks activity and lending conditions clear appear to be tightening as indicated by govies rates and credit spreads. Is is easy to determine areas economically vulnerable to tightening financial conditions like pre-profit venture/early growth companies, the housing market or the European periphery. As a result, debates have shifted from whether a recession might be ahead to if it has already started or will strike later this year / early next year. On the other hand, some more hopeful investors sense chances to buy this dip as stocks have clearly become cheaper than 6 months ago.

What has Augustusville been doing during this period? Well, not much. Since posting the portfolio , we did not sell anything, and used the 15% cash (a) to add slightly to existing positions and (b) open a small merger arbitrage basket.

Given the general uncertainty about markets, many arbitrage spreads blew out signifcantly over the last few weeks. There are reasons for that like buyers trying actively to get out of deals as they realize to have overpaid in a dropping market or buyers not managing to get their financing arranged as they often rely on debt. Even taking this into account, the current opportunity set in risk arbitrage appears to be huge considering that around 90% of announced deals are completed. Also, I like that the merger arb investment is self-liquidating (if it works) and is less correlated with the general market (I should be careful with this kind of statement since my supposedly less correlated “special situations” have suffered the worst in the recent rout). I am not discussing names here but am planning to do a portfolio update for end of Q2. For a great overview on US arbitrage situations, it is worth checking Asif Suria’s “Inside Arbitrage” with weekly updates.

Other than the merger arb stuff, I did not get into frantic trading as there were little news on the portfolio companies. As a small investor, we cannot normally act faster than the market nor spend all day watching price moves (I have a day job, two kids, a wife, friends and hobbies). I have no idea of how deep the bear market will be. While stocks became cheaper, I do not share the view that everything is a screaming buy. We come from very, very lofty valuations in many cases and the repercussions of the recent moves in inflation / interest rates are in many cases still ahead. Following David Merkel’s model , there may well be more pain ahead for stocks.

A write-upon Fuchs Petrolub

As mentioned in my portfolio overview, Augustusville is holding shares in Fuchs Petrolub (Stammaktien/Common Shares). It is the only German holding in the portfolio at the moment, so I guess I cannot be accused of a home bias.

Fuchs was founded in the midst of the global depression in 1931 by 21-year old Rudolf Fuchs in the city of Mannheim. Starting off as a distributor for American-purchased motor oil, the company moves into the production of motor oil, then other lubricants. In 1963, after the death of his father, Manfred Fuchs, Rudolf’s son took over at age 24, leading the company for 41 years before passing on to his son Stefan Fuchs in 2004 who is now 53 years old. Today, the Fuchs family still holds a majority (about 55%) of the voting common shares of the company. The corporate headquarters is based at the Rhine river, directly opposite from BASF’s huge Ludwigshafen chemical production plant.

Today, the company today produces and distributes automotive and industrial and metal-processing lubricants as well as lubricating greases which are used for a wide range of industries . Here is a sales breakdown by industry:

The company is pretty globalized and acts in >50 countries on all continents.

It claims to have serve 100,000 customers with 10,000 products, many of which are tailor-made for specific customers/processes. Fuchs also claims to be the world’s largest independent lubricant manufacturer. “Independent” means that one group of Fuchs’ competitors are lubricant producers intergrated into oil multis. These have the advantage of sourcing the most important ingredient for the products, crude oil (and some of this derivatives) in-house and potentially very cheaply. Here is how Fuchs assesses the competitive landscape:

How can Fuchs be competitive? Well, they are biggest firm fully dedicated to lubricants. Lubricants is not just a smallish segment for Fuchs but it is the essence of the company and they employ all their resources here. Fuchs also claims to have long-standing client relations, be close to its clients and move faster than oil multis. On the other hand, it is more global and has a stronger R&D than other independent firms. My impression is that (1) for certain processes, theright lubricant is a specialized, almost tailor-made product and not a commodity (that is why Fuchs offers 10,000 products. (2) Lubricants are normally an essential/necessary ingredient in order to run processes / machines efficiently. At the same time they are only a tiny fraction of production costs (e.g. when compared to machine capex). These features make Fuchs a genuinely attractive business. There is some stickiness to the product - once you found the right lubricant, you will not easily switch it because a competitor is 5% cheaper at the risk of endangering your machine. This permits Fuchs some pricing power, leading to attractive margins. Further, there is a constant need for lubricants as long as processes are running.

Risks to the business model

While generally attractive, there are risks to the business model. The company’s relaince on externally purchased ingredients, namely oil products makes it vulnerable to both price swings in the oil price and a shortage of supply. The chair of the suppervisory board in his 2021 letter mentioned:

“the unexpectedly difficult general conditions that marked 2021: Global automotive production suffered from semiconductor shortages; disruptions in supply chains led to supply shortages of key raw materials and sharply rising material costs, as well as bottlenecks and rising transport and logistics costs. All of this came on top of sharp rises in oil and gas prices, which weighed on our margin.” (Source: Annual report )

In my view, the margin vulnerability mentioned here is probably more temporary in nature. Fuchs over time will be able to pass on higher input costs to its customers (oil price swings happened a lot in the last 90 years). So I am not too concerned here. Still, the volatility may also mean that the company in the long run will need to tie up more cash in inventories and have more working capital - which is not great for cash flows.

A more secular risk that gets some attention is the reliance on automotive (45% of revenues) and specifically the internal combustion engine (ICE). I do believe that the risk is real, yet unlikely to strike right away. Firstly, the ICE is not going away in three years apruptly but rather of a decade gradually. Secondly, once they are not being sold anymore, there is still an aftermarket which is quite important for Fuchs. Thirdly, lubricants will also be needed for electric- or hydrogen-powered vehicles. So, Fuchs must not miss this trend, but will adjust. There are clear signs that they understand this and working in this direction.

Financials:

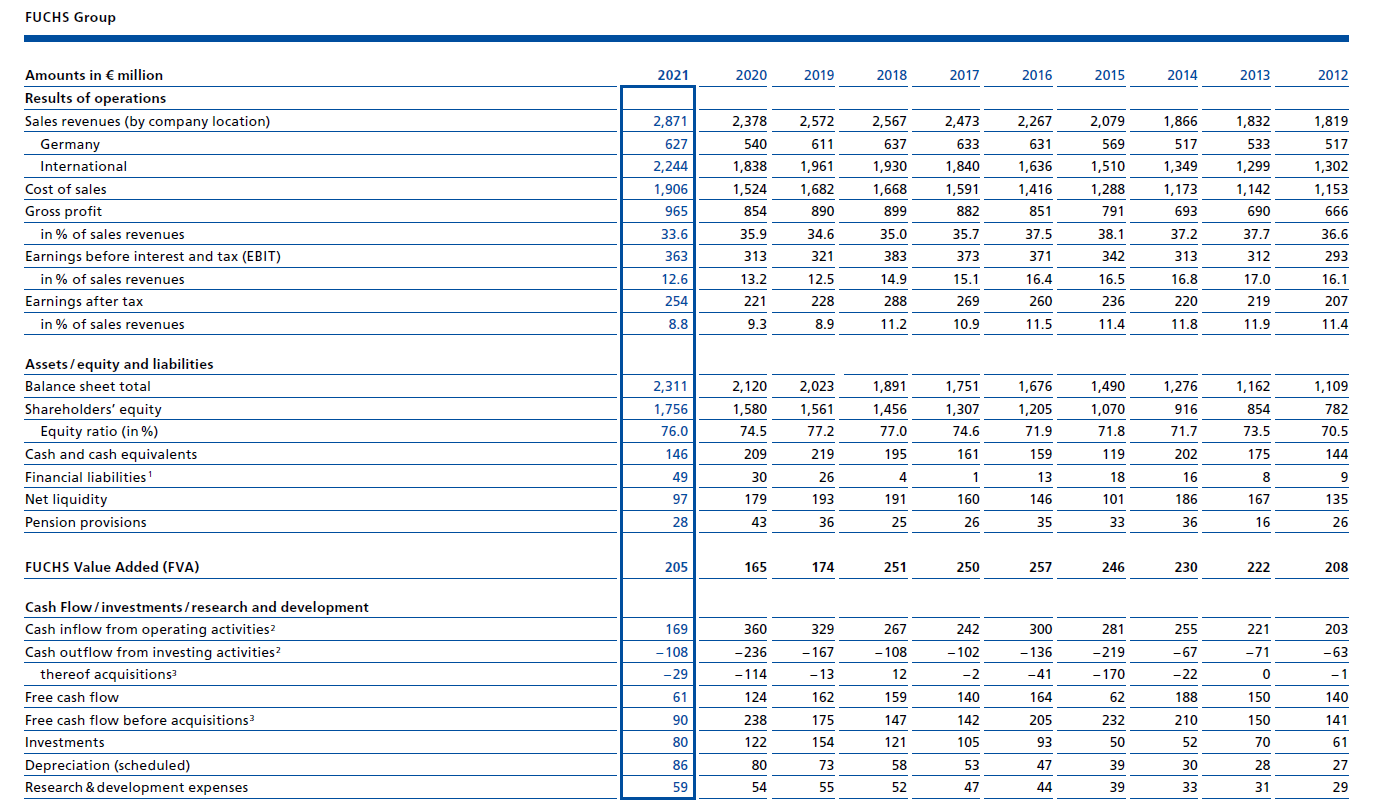

While there is a lot to dislike about the German capital market, a good tradition for decent companies is a 10y overview they publish with their annual reports. Here is the one from Fuchs:

(1) Revenues have been growing fairly slowly but steadily by a bit more than 50% over a 10-year period. At the same time, Fuchs did not manage to meaningfully increase its profit. Earnings after tax were very consistent between 200-260mm EUR p.a. over the entire period - but there was no growth here, due to margin erosion from 2017 or so - look at the EBIT margins which were at 16-17% until 2016 and then declined to 12-13% in 2019-21. While 2020/21 were probably impacted by Covid, pressure on margins started earlier than that. Operating cashflow trends looks similar to net earnings, yet somewhat worse in 2021 which is primarily due to (in my view temporary) working capital effects.

(2) Fuchs’ internal performance measurement system FVA (Fuchs Value Added) is defined as

Improving EBIT is a priority for the company. They are aware that EBIT margins have been weakening and target to get these back to around 15%. While FVA is not very innovative, I like the fact that they do have their internal performance system and that they do not use adjusted numbers. To some extent (input cost), the company cannot control its EBIT margins. So, one of the more interesting questions will be what margins to expect going forward.

(3) As margins have been weakening, Return on Equity has also come down from >25% to just above 15%, which ist still a decent level. The company is financed very conservatively. There is no debt on the balance sheet and over 10 years, Fuchs retained about 1 bn in earnings, bringing its book equity from 0.8bn to 1.8 bn.

(4) In terms of capital allocation, Fuchs did pay a progressive dividend over the last 10 years and I guess they will try to keep doing that. The yield is 4-5% at current prices, so it is not negliblible (Dividends are not normally my primary motivation to invest). More interestingly, Fuchs which last bought back shares in 2013/14 (roughly 100mm EUR). They announced a new 200mm EUR buyback program for about 4-5% of the company shares a few days ago, mentioning the goal to improve the capital structure. I consider this to be a expression of conficence that mangement indeed thinks the current share price is (too) low and the share an attractive investment.

Management

As mentioned above, Fuchs is led by the third generation of the founding family which still owns a majority of the common shares. In my view, there is no question about Stefan Fuchs being incentivized well. This is his family’s company. From what I have read, the management team seems to be quite down to earth. They are aware that they need to have an innovative, customer-centric organisation and recruit top talent to make that work. There seems to be the long-term-orientation typical for some German “Gründer”-led companies which have the reputation to think in decades rather than quarters. The balance sheet shows a preference for financial (over?)conservatism and some investors might hope for the company moving more aggressively, e.g. on buybacks.

Valuation

There are 139mm Fuchs shares outstanding and the commons trade around 23.5 EUR - so you can buy the company for about 3.3 bn EUR. Fuchs has 100mm EUR net cash for an EV of 3.2mm EUR. The company did 363mm EUR in EBIT last year (EV/EBIT of 9). If they can get their margins back to 15%, EBIT will be closer to 450mm EUR (EV/EBIT closer to 7). This is, in my view, a fairly low-risk company which never showed a loss since going public and capital returns of 15%+. Historically, Fuchs traded closer to 10-15x EBIT (except for the financial crisis). Assuming they can make 450mm in EBIT and trade at 10x, this would be a bit less than 50% upside from today’s valuation (Source: TIKR)

Summary:

I see Fuchs as a German “Mittelstand” family owned company with a long-term orientation and a well-incentivized and experienced CEO. The company has a history of both stability and profitability. Their first share buyback since a decade indicates that they think there stock is cheap and/or their balance sheet has too much cash. The company is trading at cheaper multiples than at any point in the last ten years.

There are risks to the Fuchs thesis, namely supply-chain issues worsening both invetories/wocrking capital and margin and an over-reliance on ICE and linked products. I can get comfortable with both types of risks. Therefore, Augustusville is long common shares of Fuchs Petrolub.

Why common and not preferred?? I will explain in a little addendum below.

Addendum: German Prefs versus Common shares

Note that there are common and pref shares outstanding and tradable in Fuchs and as of this writing, the prefs trade at 25.5 EUR and commons around 23.5 EUR per share. As with most German pref/common situations, both share types represent the same economic interest in the capital of the company. The main difference is that under normal circumstances, common shareholders have the right to vote at the AGM whereas pref shares are typically non-voting. On the other hand, pref shares typically are entitled to a preferential and higher dividend. In the case of Fuchs, the pref dividend per share is 1 Cent higher than the common dividend (1,03 vs. 1,02 EUR) . So the you can buy the common at a 2EUR (8%) discount, lose 0,01 EUR (1%) p.a. on the dividend and get a voting right. Also, the Stefan Fuchs family owns overwhelmingly common shares. So if you want to invest alongside the founding family and CEO, the commons are the way to go.

Why would anybody buy the prefs then? The answer is that some people have to because the Pref are part of Germany’s Midcap MDAX index whereas the common share are no constituent of any major index. So if you have to track the index at a low tracking error, you may have to go with the pref. For me as a small-size proft maximizer, it is clear that the common shares are the way to invest in Fuchs.

Readers less familiar with the German pref/common phenomenon (and too young to have lived through the epic Volkswagen short-squeeze might be interested to learn that there is still a considerable yet shrinking number of companies in Germany with a dual share class structure (common and pref) but in most cases the common shares trade at a premium as they are included in the indices. A decade ago, Valueandopportunity had a list of German dual-share class companies and provided still-relevant thoughts on them. On my side, I looked at both BMW and Sixt which trade at considerable common/pref spreads, with the common being in the index and trading at a significant premium in both cases. I would not advocate a Long-Short strategy here, but if you find a company which looks attractive anyway, the dual-structure can provide a way to bump your returns - you do not even need for the gap to close as the effect will materialize through higher dividend yields. Happy hunting!

Hello Carsten,

There is a YouTube video of Fuchs Petrolub employee making a presentation(https://bit.ly/3OziYKC). You may have watched it. At 9 minute mark you can see global lubricant demand in volume regressed from 2007~2016. And @ 9:52 the share of Asia Pacific increased from 45% to 53%, that probably means ASP went down. Also in that video he mentioned American consumer basically chose the cheapest lubricant as they see it practically as a commodity. Maybe in mission critical application end users will demand quality over price, however the industrial equipment and machinery segment is only 11%, so perhaps that doesn't move the needle.

Also the trends pointing to lubricant usage will continue to go down: 1. Efficiency improvement in fluid transmission design in machinery 2. Advancement in lubricant technology 3. Electrification of automobiles. You can also see it in BP Castrol KK’s (5015 JP) numbers. BP Castrol KK is a lubricant company in Japan, one can observe revenue and bottom line decline over the years.

From a moat point of view, big part of lubricant manufacturing process is mixing and blending, there is no secret sauce. The process is a mature one what's left is efficiency gain. I don’t see how Fuchs have advantage over major oil companies in that regard. Oil companies have other advantages such as sourcing, scales of economics, pricing power, sales channels, R&D budgets…etc. In other words being independent is probably a detriment instead of a merit.

Curious on what you think.

Andy

Hi Carsten, very much enjoy your substack. Thank you.

Do you see catalysts that would bringt Fuchs Margins and Return on Capitals back to previous highs?