Disclaimer: This write-up is not investment advice. The author is long shares of Hostelworld and my buy or sell these shares at any time. His views my be biased by his stock ownership, experiences made when travelling hostels or other factors. Please do not rely on any information herein and do your own research.

Hostelworld, another holding in my portfolio , is an online travel agency (OTA) focused on hostels. The company came to my attention after reading about it on VIC , COBF and as a portfolio investment of Rubicon Stockpicker Fund . Also, Value & Opportunity ran a great series on the online travel sector which provide a helpful introduction to the sector. In this write-up, I will be drawing on the above sources and try to make the case for Hostelworld.

Background & Introduction:

Hostelworld Group is a worldwide online hostel booking platform. The company was founded in 1999 and is based in Dublin. Shares trade in both Dublin and (more liquidly) London. As of writing, the share price sits at 103p (1,20 EUR) for a market cap of 120mm GBP (140mm EUR). For full disclosure, I bought my shares about a month back closer to 85p.

After launch, the company bought the hostels.com business in 2003 for about 200mm € and was taken private by private equity in 2009. In 2015, the company went public again at a price of about 185p. After the IPO, Hostelworld initially did well bute then stagnated before investing a lot in its mobile capabilies, mostly its app. Current CEO Gary Morrison joined from Expedia in 2018. In 2020/21, the business, like most travel businesses was struck hard by Covid.

Business Model:

The business model is not that complicated: Hostelworld provides a platform to book hostel stays in 178 countries and across 36,000 properties. Like most OTAs, it is a marketplace business connecting supply and demand for a certain product/service. For each booking processed on its platform, Hostelworld received a fee - in 2021 about 12€ per booking. On the expense side, the company needs to invest in its technology platforms and in marketeing/customer acquisition. The business model is subject to scale and networrk effects. It is asset-light and inflation-resistant yet vulnerable to a pandemic or a travel ban. Exposure to Russia / Ukraine is minor. Here is the revenue split by regions:

Competition:

Given the simple business model, Hostelworld is not the only OTA and a rather small player. Booking, Expedia, AirBnB and Tripadvisor all have more scale, better network effects and thus more power in the travel market. Hostelworld is trying to play a single niche in that market. So, can Hostelworld thrive as a specialist OTA? If not, the shares a probably not worth an investment as the company will lose to bigger players. I do not know how it will play out, but am reasonably optimistic because:

This is a differentiated client segment. A hostel stay is different from a hotel stay. It attracts younger, more budget-concious people who are open-minded for new adventures and experiences and meet other people. There are more solo travellers and less families in hostels than in hotels. In many cases, hostel visitors stay in a hostel because (1) it is cheaper and (2) it provides a different, more adventurous experience, (3) they want to get to know new people.

There is a social aspect of travelling to a hostel versus a hotel.

Hostelworld is trying to capitalize on this aspect by building a community. Social chat functions were recently added to the app, so users can connect and meet with like-minded people.

As such, hostel bookers in many cases may not care to check Expedia / Booking.com when making their plans and I doubt if they are real competitors.

Hostelworld is the biggest player in this segment. There are no other specialized hostel OTAs that I am aware of. Some aggregators and price comparison sites such as hostelz.com do exist, but the other OTAs are all generalist or focused on other segments (like hotels or travel packages). I do not think that any other OTA currently has signed up more hostels and can thus provide access to a bigger “supply” of hostels - even though Hostelworld has not signed up everybody and more work to do in this respect.

The niche is quite small. Hostelworld’s peak revenues (prior to Covid) was <90mm GBP. Now, Booking’s revenues exceed 10bn and Expedia’s revenues approach 10bn. Winning Hostelworld’s business would likely not move the needle for these players. Lastminute and Tripadvisor are smaller but focusing on different segments.

The technological edge is more important. Given that Hostelworld’s users on average are younger and more tech-savvy than those of lastminute.com, it is crucial to for the company to maintain a cutting-edge app. In general, this has been the case, even though there have been hiccups after the latest roll-out which need to be addressed urgently - this is a warning sign.

Hostelworld is also a major shareholder of Goki (provides digital key / locksystems for hotels/hostels) and Counter, a hostel property management tool.

The differentiated client segment provides for interesting add-on opportunities to generate additional revenue. Notably, Hostelworld recently launched “Roamies” in cooperation with G Adventures which enables travellers to book guided small-group adventure tours starting from a hostel, providing another way to get to know other people.

Financials:

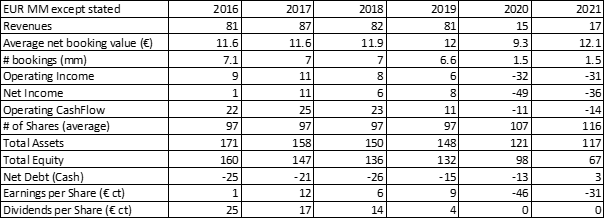

Hostelworld’s financial development since 2016 looks pretty ugly and does not provide many reasons to like the stock. Here is an overview table:

A couple of points to note:

In 2016, Hostelworld was still a growing and cash generative company. It had net cash on its balance sheet. However by 2017, clouds were on the horizon. Growth started to slow down and the company had to handle the changing customer behaviour (people were going to book by app rather than website), necessitating investments and harming growth.

The problem was finally tackled in summer 2018 when a new management team came onboard, led by Gary Morrison. The team started with a strategic review and presented a “Roadmap to Growth” strategy in Q4 2018. This strategy meant an investment into the business (Unique hostel content and improved localization; Improved booking experience (payment types, currencies & online change/cancel); Rate plan configurations; and Improved 3rd party platform connectivity) at the cost of short-term profits and shareholder returns. The previously generous dividend was cut back. Hostelworld made its investments in Counter and Goki. In fact, at the end of 2019, some posittive signs emerged with both bookings and revenue growing.

Then Covid struck and it struck hostels even harder than other travel/accomodation types. Bookings and revenues collapsed by almost 80%. The company was bleeding cash. Even though it had a net cash position when Covid started, it had to introduce three measures in 2020: (1) Raise equity, leading to a share count increase by 20mm (about 20%). (2) Raise debt. Hostelworld agreed and drew a 30mm EUR 5y term loan at a costly margin of 9% above Euribor and (3) Cut costs. The company claims it reduced operating costs by 7mm EUR annually compared to 2019. On the cost cuts, it will need to be seen how sustainable they are.

Here is a chart illustrating just how bad business still was in 2021. It shows bookings and revenues as a percentage of 2019. the 60% mark was never reached:

Management has been more optimistic on the start of 2022. At their AGM they mentioned that in the first week of May, bookings reached 73% of the 2019 level and revenues 97%. They are confident that the 2019 level will be surpassed this summer and that the company will be generating cash again.

Management / Shareholders:

Hostelworld’s CEO is Gary Morrison (54). Prior to Hostelworld, Morrison was Head of Retail Operations at Expedia. A recent interview with Morrison was conducted by the “In the Big Chair” series and can be found here. To me Morrison appears to be knowledgable of the sector. I do like his data driven approache and think that many of his his strategic moves have made sense even though the acquisitions with hindsight were poorly timed (cannot blame him for not foreseeing the pandemic).

CEO Pay and incentives are a weak point of the thesis. In 2021, Gary Morrison had a fixed salaryof about 500K EUR and receieved the same amount worth of Restricted Shares. Since given the difficult situation of the company at the time, some shareholders revolted against the package. More worrisome to me is the lack of share ownership by top management. Both Morrison and CFO Caroline Sherry are required to hold 200% of their salary in shares but none are doing so. I hope that the board enforces that clause. Unfortunately, shareholding there is very muted aswell. Here is an excerpt from the 2021 annual report:

In early 2022, shareholdings have improved a bit with Cawley (175,000), Moloney (50,000) and Shepherd ( 14,266) all buying shares. Still, I would advocate for higher insider shareholding to make sure they eat their own cooking.

Other than that, there are two noteworthy shareholders currently in the cap table, TGV Langfrist Rubicon Fund, a concentrated small cap fund with (in my view) a bunch of interesting ideas and Fairfax vehicle Hamblin Watsa which just invested in May 2022.

Valuation:

I believe that Hostelworld will be turning cash-positive again this year and may start repaying their loan and work on its investment priorities. In my view, it is crucial that the company will not underinvest in its tech, platform and marketing and rolls out new features. I am expecting a profit this year, but no significant free cashflow and certainly no dividend.

Barring any surprises, 2023 will be the year of Hostelworld finally firing on all cyclinders. In my view, that mean for the company to surpass the 100mm EUR revenue threshold. Keep in mind that inflation alone will contribute to this number and that there are new sources of revenue, notably Roamies. In the years 2016-18, Hostelworld achieved Free Cashflow Margins of 23-25%. So I am looking for the company to do 25mm EUR in FCF in the next 2-3 years. What multiple/FCF yield should Hostelworld trade at? Make your own choice - I will for now go with 8x/12.5% FCF yield and look for a valuation of 200mm EUR. As noted above, I bought Hostelworld when it was 20% cheaper than today, but still see some upside from here.

Risks:

Well, there are plenty. Hostelworld is exposed to another wave/worsening of the pandemic situation in autumn/winter which would hit hostels hard once again. Is is also exposed to other external shocks impacting the travel business (travel bans, terror, other diseases, wars). There are execution risks tothe company’s strategy like they experienced around their recent problems when releasing their app with social features. Hostelworld needs to balance the technical and the commercial aspects of its operations, i.e. create a well-running, user-friendly, technically appealing product at a reasonable cost. Also, business growth may well be more sluggish or competition fiercer than expected by me.

Summary:

Hostelworld is a niche Online Travel Agency (OTA) which suffered heavily during the pandemic and are now seeing a business recovery. I believe they can generate significant Free Cash like they did until 2018, and have some interesting growth projects going on. There are clear downside risks here (new pandemic wave, low management ownership, execution) and the valuation has run up quite a bit recently. For now though, Hostelworld remains a top 5 position for Augustusville.

interesting niche idea! need to see how much from 2019 they can recover and if 2021 lockdowns and restrictions are definitively a thing of the past or not.