Disclaimer: This is not investment advice. The author is long the shares mentioned in this article which has been written for entertainment purposes only. He may buy or sell shares at any time without notification. Views expressed by be biased and / or wrong. Do not rely on this article when taking financial decisions.

So here we go again. The new year has arrived, the clock is reset to zero. Time to look back to 2024 and see what we achieved, what did or did not go well. Since there is already a post on the current positions of the portfolio going into 2025, this one is to reflect on the results of 2024.

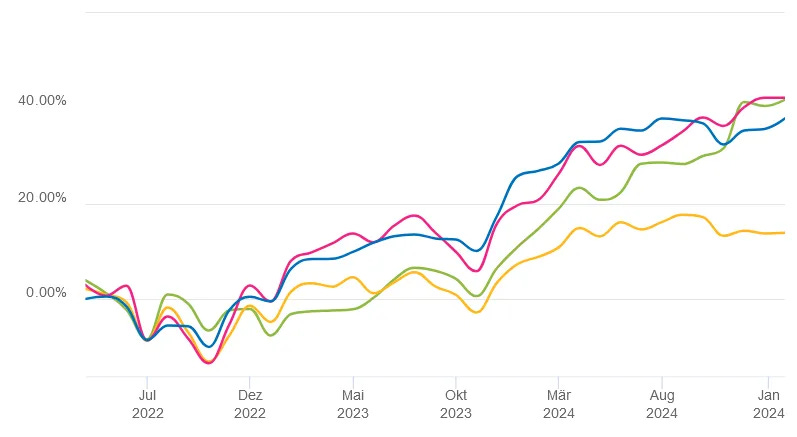

The Augustusville portfolio was up 7.8% pre tax and in EUR in 2024. While it is nice to be up, this performance clearly lacks most large markets with the DAX up 19%, the world indices in EUR up around 25% and US tech markets doing significantly better.

blue - Augustusville Portfolio; red - DAX; green - iShares Core MSCI World (IWDA); yellow - DJ Stoxx 600

I would also like to congratulate those investors who are bravely picking their own stocks and have managed to outperfom the indices. At the same time, I have mentioned before that I am not too interested in the relative performance derby, in particular in the short term. To me what matters are creative ideas and a sound process. I believe that they will result in above average returns over time.

Performance Drivers:

Here are the positions which had a significant impact in excess of 0.5% (positive or negative to the portfolio), sorted by return cotribution:

Adding up the return contribution gets us to 7.3%, already pretty close to the overall result for the year.

Interestingly, while the winners appear to be a fairly diverse set of companies (large, mid and small caps of various countries), the losers are mostly of two types: Failed US merger arbitrage situations and relatively cyclical German companies suffering from the weak economy.

As discussed here before, for a long time, the idea of inserting sprecial situations such as merger arb in the portfolio was to have a component which is less correlated with overall markets, providing some stability. That premise holds true in particular when markets are trading at frothy levels as (in my view) has been the case at the end of 2023 and even more so today. Well, the non-correlation feature somehow worked in that these positions dragged down the performance in a formidable year for the markets. Both, iRobot and Spirit were speculative merger positions with large spreads from the start. The Spirit merger was widely followed and I did dive in quite a lot. Spirit/JetBlue was covered in depth on Fintwit and various blogs. From my perspective, the reasoning that the merger would be anticompetitive was fairly absurd to begin with and it became clear that Spirit might go out of business without it, dealing a greater blow to customers. It turned out that this indeed happened in November 2024. However, the merger was already blocked at the beginning of 2024 by a judge claiming to act in the best interests of customers. It was probably not the first nor the last time that a legal decisions was completely stupid economically. US merger arb had a hard year in general. Amazon/iRobot was blocked, leaving the latter in financial distress, largely because of the regulators trying to prevent Amazon from buying anything. The Albertson’s/Kroger merger was also blocked, maybe more understandably. This comes after a number of high-profile deals which went through, such as Twitter or Microsoft/Activision. Going forward, I will continue to look at special situations but maybe focus more on smaller ones which enjoy less attention unless the setup looks really great. At the same time, it is important to keep thinking probabilistically. Not every bad outcome is the result of a bad process.

Moving on to the “German laggards” above, Amadeus Fire, Hermle and Sixt. All of these are companies I consider to be high-quality. This means that they are moaty businesses which have a track record of profitability, growth and high returns on capital. Amadeus Fire and Hermle, both new additions in 2024, have enjoyed a great run in after the Covid crash but then came back significantly as it became clearer that the German economy is in a structural stagnation, impacting their business and growth perspectives. We were compelled by the sharp drops in share prices on what appeared to be a cyclical slowdown of business activity. However, the share prices fell more from where we invested, which caused the drag on the portfolio. We are not concerned with the business quality of Amadeus Fire, Hermle (or Sixt which we do not own anymore) and believe they remain leaders in their sectors. Even though their profits are significantly down in 2024, they are making money and will emerge strongly once the environment improves, benefitting from their rock-solid balance sheets. Sometimes (and value investors may know that quite well), being too early cannot be distinguished from being wrong. It is hard to get the timing perfect, but maybe, just maybe, we were too impatient on the way in. On the other hand, more than once we have seen situations where we did not act decisively enough and the price ran away. You can establish all kinds of rules around this problem. In summary, we remain convinced of the “German laggards” we own, have added to them on weakness and are considering to add some more if and when appropriate.

Fairfax Financial has been the largest contributor for Augustusville in 2024. Going to the year as second largest position, it generated around 62% during 2024. Fairfax benefitted from the general bull market in the financial sector, the operational excellence of its insurance business which has achieved combined ratios around 95% for many years now, and also from a very clever capital allocation in recent years paying off. The company benefitted from raising interest rates in its fixed income portfolio while at the same time making smart, often contrarian equity investments, sometimes in exotic places like Greece or India. Shareholders equity in the first 9 months increased from 940 USD/share to 1,033 USD/share and Fairfax trades at 1.1-1.2x book value now. They have recently underlined their confidence by buying back 1% of their shares in December 2024.

Supreme PLC was first pitched by FinancialSceptic on his excellent substack. The UK distribution company has grown its business with a well-versed acquisition strategy, buying brand companies cheaply and integrating them in their offering for supermarkets and convenience stores. A large chunk of sales are still in vaping products which have been burdened by regulatory uncertainty around the UK election and policies of the new government. However, it turns out that this “dying” business may actually survive or have a longer tail than anticipated by many. In 2024, Supreme again acquired companies from ongoing cash flow and is growing nicely without taking on debt.

Hortico was up 45% for the year. After two years of relative stagnation in its sales, the business gained steam in 2024. Sales are up by 20% even though margins have come down a little. Still a solid development, in particular as they are exerimenting with adjusting their model towards operating/running garden markets. The company remains debt-free and may generate 1 PLN/share in earnings for 2024.

Millicom has been up 38% and is one of the positive surprises of the year. Remember that for years, investors’ hopes for real muneration have been deferred as the company was dealing with a high debt load and capex needs. It seems like it is finally happening. The company has shown double-digit EBITDA growth in its major markets, resulting a much improved Free Cash Fow generation. In the first 9 months of 2024, Net Debt/EBITDA has come down from 3.3x to 2.6x, close to the target level. Consequently, Millicom has started and paid a dividend of 1 USD/share and initiated a share repurchase program for 150m USD (4% of the market cap) over 3 months. Millicom is also getting rid of their dual-listing structure and will focus on its NASDAQ listing only. In August 2024, French billionaire Xavier Niel made an offer to buy out Millicom shareholders at 24 USD which he later improed to 25.75 USD/share. The offer was rejected by the company due to its “significant undervaluation”. As of November 2024, the Niel group holds 40% of the company’s shares and they may well come back with another offer.

While the Augustusville portfolio is largely small cap, we are free to toss in a large or mega cap from time to time. The reason we rarely invest in large caps is that they are well-covered and it is more difficult to find an edge. You can be one of few people to look at an obscure nanocap and work to build an information advantage but it is hard to do the same in large and mega caps. Small cap stocks are often neglected, forgotten and orphaned. This almost never happens to a DAX or Nasdaq100 company with an army of sale-side analysts covering the company. However, sometimes large cap can be actively hated. This is normally the case after the company has been on a losing streak for some time, many investors have lost money and thrown the towel and it is becoming common wisdom that the stock is now uninvestable. Normally, there is also a real problem at the company. At this point, the market pessimism is so strong that the only way is up. Last year, I decided to watch out more for this type of situation, having missed the rebounds in Meta (7x since 2022) or GE (3x since 2022). So far, we have established two positions, Bayer and Paypal. Paypal looked like a reasonable buy around 60 USD while the business appeared to stabilize, the payment network volume still growing and the new management switching to a more honest reporting of (still ludicrous) stock-based compensation. The company has reduced its number of outstanding shares by 6% over nine months and remains in good financial shape. Let’s see if they can continue to perform.

Thoughts - Process vs. Outcome and Circle of Competence.

Investment returns are partly driven by luck or by factors we cannot control or understand. However, it is a very common and flawed concept in our world to look at an outcome and rationalize it ex post, i.e. “it was clear that this outcome had to happen”. Think of a casino roulette player who played red for 100 EUR and wins. With his 200 EUR, he plays red again - and wins again. He now has 400 EUR and quadrupled his money in two minutes for an infinite IRR (beating every Fintwit investor) and an excellent outcome. Is this casino player a great role model? Well, of course not and this is because his process is poor. The expected value of a roulette game for 100 EUR is about -3 EUR and if you play roulette for long enough, due to the law of large numbers, your return will converge towards that rate of -3% per draw. We all know this and yet, when we see someone win in the casino we ask what the person is doing differently. Perhaps we can learn for him and get “better” at roulette? As human beings we want to rationalize our environment and understand, why events occur. “Out of randomness or luck” is not a very satisfactory answer.

Likewise, financial returns are more random than people like to think, in particular in the short run. This is not roulette - investing requires significant analytical and mental capabilities, it is a game of skill. The longer a track record, the more it converges towards the “expected value” a particular investor can expect to generate which is skill-based.

At the same time, the concept of winning by skill over time is closely coupled with the “circle of competence” concept. No investor can understand all countries, industries and asset classes available. “Circle of competence” mplies to invest in situations which an investor understand because he has experience in the field and the situation makes sense, i.e. offers a favourable risk-reward and a positive expected value to him on a reasonable, rationale as-objective-as-possible basis.

2024, more than many other years, produced eye-popping returns in corners of the market which are on the edge of or outside my circle of competence. The infamous “magnificient seven” (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla) in my view are a weird combination of proven and established superstar businesses with great competitive positions (number 1-5), one company which more than any other embodies the hope and expectation for a the supposedly next big technology (Nvidia, comparable to Cisco in the early internet days) and an overhyped industrial company with questionable accounting practices and poor corporate governance. Note that companies six (to some extent) and seven (more than any) are led by charismatic yet crazy, vastly overpaid executives with a cult-like following. In sum, I can, within my circle of competence, maybe understand the enthusiasm for 5.5 of the magnificient 7. Do I think it rationale to pay the prices we have seen? Rather not.

It gets crazier still because crypto had a record year. I have tried various times to understand the investment appeal of Bitcoin. I understand it is scarce (unlike fiat money) because supply is physically limited. It is however not the only asset class with limited supply. The same applies to prime Manhattan real estate, Picasso paintings or any commodity. The supply of Paypal shares has even been deflationary, dropping by 6% in recent months. Bitcoin is still not useful in transactions, nobody is buying groceries or fuel with it. And it remains an asset with no utility other than speculation, i.e. it produces no cash flow and is not good for anything else. So while I can understand that a Bitcoin purchase produced a great gain in the last year (like 130% on a EUR basis), i.e. a great outcome, I cannot blame myself for missing it, because it is outside of my circle of confidence (in other words: I am probably too stupid to get it). From the perspective of this investor, if you cannot understand what is going on, based on your experience and reasonable calculation, your process has to dictate you to stay out. We need to to have the discipline to know what we are doing and only do what we can understand.

This includes passing on a game of roulette from time to time even if the person next to us just quadrupled their money.

Why not in Sixty anymore?

Think many of us could learn from 2024 that higher quality cyclicals can still trend down for longer than we initially wanted to believe.

(warning: quasi-rant)

crypto, and bitcoin mostly, is the backbone of global C2C (criminal-to-criminal) transactions. the largest trans-national criminal groups are often state backed, so sanctions avoidance is a natural fit for exponential growth in crypto.

the reason that mainstream financials, and politicians, want to be involved is to get toll fees on transactions (via exchanges) and possibly custody. having both parties involved lessen chances of KYC and other obstacles. interest in holding crypto for their own investments is mainly for show.

this seems the only use case that has solid evidence.