Disclaimer: This is not investment advice. The following post is for entertainment purpose only. The author owns shares of Nordwest Handel AG in his personal account and may buy or sell these or any other shares at any time. Trading in these securities is thin and shares are very illiquid. Information presented is not to be relied upon, views expressed may be biased. Please do your own research!

As markets are reaching new highs on an almost daily basis, powered by the AI run and the magnificent seven and crypto sets new record levels hourly, this post is both a therapy for myself and provides a little break for some readers. To be clear, I have no issue with the mag7 but think they are a tad pricey nowadays, at least for me. As for crypto, I have yet to discover its utility to humankind beyond drug traffickers, arms dealers and terrorists but yes, I may just not understand it. However, I anyway prefer productive assets, those that are not “just there” and waiting for a greater fool to pay a higher price but rather produce someting for their owners like rents, interest or earnings. Given the market is so hot in all the glamorous stuff, I will take you to a really unglamorous and boring yet - in my view - productive company and do a deep dive. The investment case comes with some hair and it is clearly not a no-brainer. But I do not think it has been written up and most likely, many readers have never come across the name. So I have the chance to tell you something new. This is a German company which only reports in German, so my article will contain some elements of Denglish - please consider it a learning experience ;-) . If you want to research Nordwest and speak no German, Google Translate may become a good friend.

Business Introduction and History

My favourite blogger just yesterday wrote a great piece on Amadeus Fire, a boring business with an exciting name (highly recommended). In my view, a good boring business should a have boring name and “Nordwest Handel” is certainly not very flashy. Nordwest is based is the lovely city of Dortmund which is probably known to football enthusiasts as home of the local Borussia, Germany’s largest stadium and the German football museum (both a match of Borussia and the museum are highly recommended if you make it to Dortmund). Its industrial structure for a long time was coined by the steel industry but the sector has lost its importance.

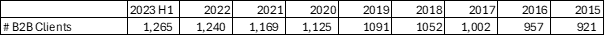

Nordwest is a wholesale and distribution company for steel and construction products, technical appliances, building materials, tools and more. The business comprises elements of trading, distribution, logistics and factoring. Nordwest was started in 1919 as a purchasing group for medium sized retailers who were looking for more market power facing large producers, a function that still largely exists today. The company existed until 1992 as a Genossenschaft (cooperative), a legal structure which is relatively common in Germany. It was converted into an Aktiengesellschaft and listed in 1999. Nordwest is majority-owned 50.1% by Austria’s Dr. Helmut Rothenberger Holding, a group with origins in tool-making and machinery who bought out several other large shareholders. The business is still entirely B2B, i.e. Nordwest services its clients who they call “Fachhandelspartner”. The number of these “Fachhandelspartner” clients has grown steadily over recent years:

If you are interested to see who they are dealing with on the supplier and clients side, here is an article of an event they recently hosted in their “Haustechnik” segment. The client pool for Nordwest is fairly diversified, i.e. they do not overly rely on one particular client:

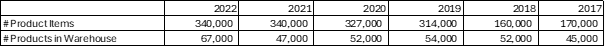

As the number of clients has grown, so has the number of product items Nordwest offers in their system, including those in their own warehouse. The number of articles offered also gets reported in their Annual Report:

What is the value of a “middleman” like Nordwest? Shouldn’t it make sense to cut them out? I think they do have a few reasons to exist:

For many smaller clients (think a local bathroom exhibition), it makes sense to bundle their business and not deal with all the producers directly, in particular if there is a decent service level and reliable delivery. Why do consumers buy so man different items on Amazon?

Nordwest operates their own storage warehouse which acts as an additional “buffer” for certain items and ensures delivery within 24 hours. This allows its clients to better manage their working capital.

Nordwest can order larger quantities and get better prices as it aggregates the business volume as compared to small and medium shops/businesses. This is why the company was founded in the first place and the price advantages can be shared with their clients.

Facing the producers, Nordwest represents a better and easier-to-assess credit risk than some local business. Nordwest is invoiced for all products by the suppliers and takes on the credit risk its smaller business clients.

Nordwest has also established two own “exclusive” brands, Promat (tools) and Delphis (bathroom accessories).

Business Setup & Segments

Per the annual report, the Nordwest business is set up as per the below matrix:

They separate by type of business (“Geschäftsart”) and Product (“Geschäftsbereich”) and do not cover all types of business for all products.

Let’s look at how the different types of business work: In each case, Nordwest is to some extent the middleman but it ist performing different functions. First, there is “Zentralregulierung”

In this segment, Nordwest’s client (e.g. a retailer of industrial company) will order directly from the supplier (e.g. a steel producer) and the goods will be delivered directly aswell. However, Nordwest will be invoiced by the supplier and it will in turn invoice its client. In this setup, Nordwest takes on the credit risk of the purchaser and receives a fee for that from the supplier. Moreover, Nordwest earns a fee from the purchaser for taking on its credit risk (“Delkredereprovision”) and if it pays timely, often can achieve Skonto, a discount on the purchase price. Nordwest has developped NIS, an IT solution which offers the electronic ordering, but also an overview of transactions for its partners on both sides aswell as bundled invoices, with the aim of reducing the adminstrative expense. In this business type, Nordwest largely acts in a similar way as a factoring company.

Nordwest gets a bit more involved in the second business type, the Streckengeschäft. Unlike Zentralregulierung, in this business, the order is given by the purchase to Nordwest and by Nordwest to the supplier while the goods are still delivered directly. In the annual report, they note that this business type is mostly applied in the steel business with international steel producers who are not used to Zentralregulierung.

Finally, there is Lagergeschäft (storage business). Here, Nordwest acts as a real intermediary, buying and paying the supplier, taking delivery in their Central Storage in the town of Gießen, marking up the price and on-selling the inventory to their customer. There is a total of 340.000 products which can be ordered at Nordwest on NIS, 67.000 of them are available at their central storage. Central storage in many cases offers the advantage of immediate availability, i.e. an order can be delivered within one day. The storage offers a “buffer” for products which may not be available by the producer at once. Unline for the other delivery types, Nordwest needs to finance substantial working capital (inventories) and takes the risk that a stored product will not sell. Looking at the numbers, storage is the most profitable business typer for them - we shall see more later.

Products:

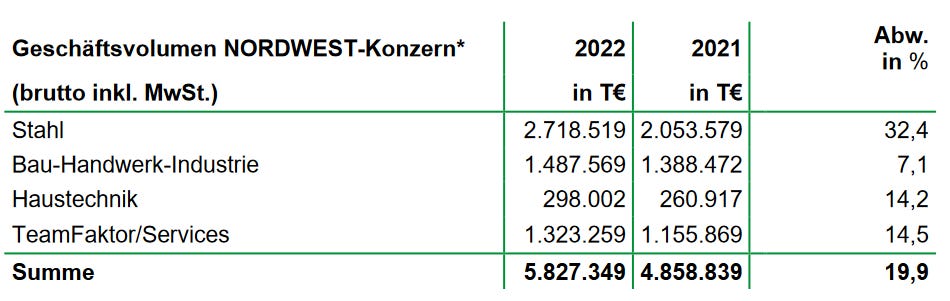

Next we take a look at the various segments. Nordwest’s history is in Steel which is still the segment with the largest business volume and comprises of various steel products. Next, there is Bau-Handwerk-Industry, with tools, materials and other items for the construction, craft and idustrial sectors. Haustechnik is the smalles segment by business volume. Finally TeamFaktor/Services covers the financing/factoring part and generates sales largely from factoring fees, causing relatively low sales numbers per € of business volume

Here are the sales and earnings numbers per segment for 2022 (BHI-Bau/Handwerk/Industrie, S-Steel, H-Haustechnik, DL-Services).

Looking at the 2022 numbers, it becomes clear that Nordwest made its money predominately in the BHI and H segments, i.e. their storage business. In contrast, the steel segment with the business type Zentralregulierung appears to be “empty calories” at first glance, generate huge business volume and sales but contributing moderately to the bottom line.

This impression is also confirmed aas we look at the segment results over the last years:

To be honest, I find the breakdown by segments somewhat puzzling. On one hand, BHI is performing much stronger, than I would have thought, in particular their EBIT margin of 10% looks very decent. Of course, they do more higher-margin storage business and I guess the exclusive brands sit in this segment but still, this is very decent.

On the other hand, the other three segment are close to breakeven and one can wonder about their value to the company. I am somewhat hopeful on the Services segment which has grow its topline nicely while their H1 2023 result was hurt by a specific risk provision which I hope will not recur. Apart from that, my guess is that the segments to some extent cross-fertilize each other, so while steel itself produces poor margins, steel clients may become BHI clients and by higher-margin products. In that sense, I would expect for all the segments to add to the ecosystem. The Nordwest business is clearly about scale so that I would not favour taking out any segment.

Financial Performance:

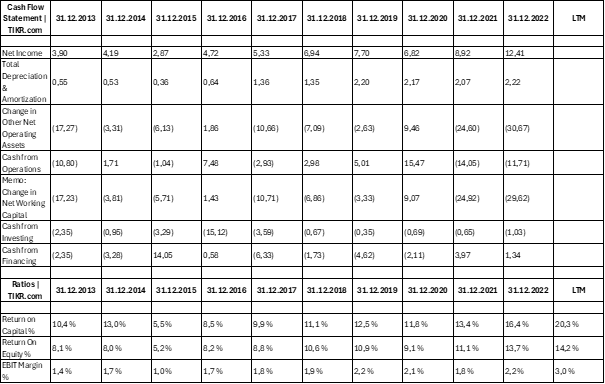

I will compound what is a nerdy analysis anyway by posting a big screenshot of 10y financials from TIKR. TIKR data is not always 100% accurate but in this situation it serves well to provide an overview of the main positions and expose some drivers for further discussion:

Overall, the business has performed well. Sales have doubled over the last ten years while margins have expanded and net profits are up more than 3x. This was achieved without any dilution, i.e. the share count has remained the same. The business was profitable every single year over this period.

Growth has somewhat accelerated in the Covid home investment period since 2020. So 2020-22 may have been a period of tailwind for the business and it may face headwinds from 2023 onwards as can already be seen in the lower LTM revenues.

Returns on Capital have been High Single Digits until about 2017 and double digits ever since. Book Value per share has roughly doubled from 16 to 32 EUR (share price sits around 21 EUR as I type this). Nordwest has paid dividends in most years even though they were cut during Covid. The most recently dividend was 0.80 EUR for a dividend yield just below 4% at current prices. Nordwest has kept their share count stable and neither issued nor repurchased shares.

The income statement shows a growth in bad debt provisions. This reflects the credit risk which Nordwest is taking in its Factoring-like business model. In my view, this reflects a major business risk if not managed properly, in particular if insolvencies spike in the current soft economy.

Another potentially difficult topic is pensions. Nordwest’s pension plan however seems relatively modest compared to their overall business. The DB pension plan was discontinued in 1992 and ever since, the only employees who receive company-funded pension are the management board. So this is not a major concern for me.

The growth of the business over the last couple of years has consumed significant working capital (higher receivables and inventories). This is relatively typical for a distribution business which generates operating cashflow in a downturn while consuming cash in a strong market. Still, Nordwest uses little financial debt for its operations and I expect it to reduce as the business slows. There is little capex beyond the working capital investments.

I have found the reporting of the company to be decent quality, i.e. they provide all the relevant information on a quarterly basis, explain their business quite well and are straightforward in terms of the metrics they use (i.e. no annual “one-off” losses and no adjustment orgies here).

Shareholder Structure, Management & Incentives:

Nordwest Handel is majority-owned by Austria’s Dr. Helmut Rothenberger Holding AG which holds just above 50%. Rothenberger established this majority when they made a takeoffer offer at the price of 18.25 EUR in Q4 2017 and established majority. Back in 2017, the Fairness Opinion prepared for the board by Baker Tilly described the offer as “inadequate from a purely financial perspective”. At that time, the book value per share sat around 19 EUR versus almost 33 EUR in Q2 2023. Also, Rothenberger stated described their interest as purely financially motivated, and explicitly stated they were not seeking operational integration, synergies or a delisting. Rothenberger has its roots professional pipe tools and machines but has built an empire of various industrial companies which are run in a decentralized way. I think they may try to take out remaining shareholders at some point, but have no clue when this may happen. They have not added a single share for 6 years.

Rothenberger controls the supervisory board of Nordwest. Chairman Martin Bertinchamp is an industry veteran and his experience includes serving as the CEO of Metabo and Gardena. After acquiring majority, Rothenberger have not changed management. The management board is led by Jörg Axel Simon who has been with Nordwest since 2005 and on the management board since 2015. The CVs of all management and supervisory board members are online and in my view, this is appears to be a seasoned, professional and experienced team and I would expect to know what they are doing.

At the same time, share ownership of the management board appears to be very low. The CEO owns 2,500 share as per the latest information I could find which is really meagre. In my view, it would be beneficial to incentivize management to better align with shareholder interest. The management board in total made 1.1m EUR in 2022. Variable compensation is largely linked to achieving a positive and growing consolidated EBT. So management is aligned to execute operationally (which seems to work if you look at their financial performance), but their incentives do not give a damn about the share price (which you can see in the share price development).

Valuation and Capital Allocation:

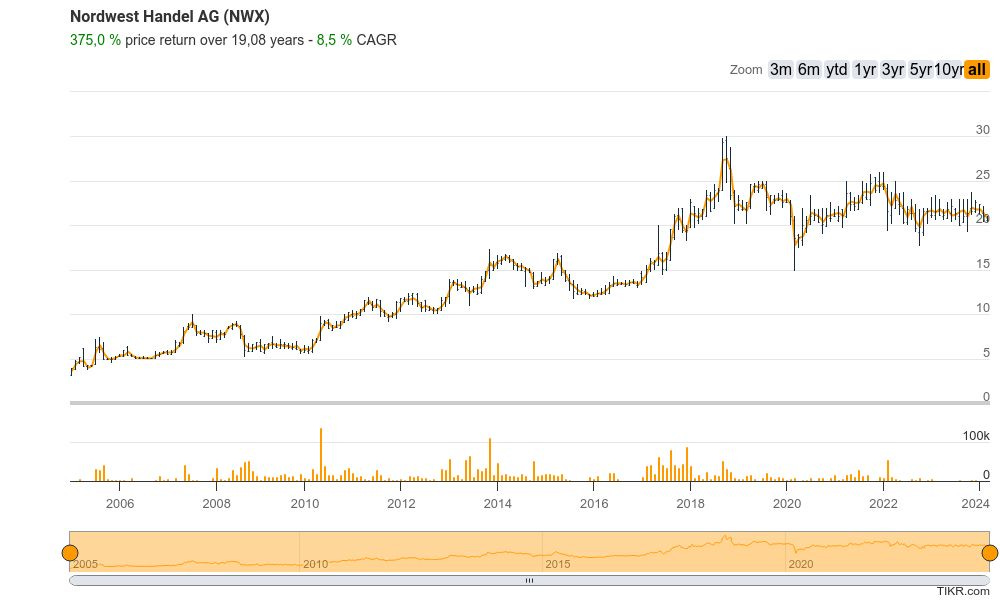

I normally do not show share price charts but will make an exception here. We can see that the Nordwest, despite its respectable financial performance of the company has really gone nowhere and accordingly been a laggard compared to the overall market over the last 5 years:

On the other hand, if we take a longer history, the stock price appreciated by 8.5% p.a. and if you add dividends, you will get closer to an 11% return which I consider respectable:

Nordwest will publish annual results for 2023 on 19 March but they have provided guidance and are expecting a business volume of 4.8b EUR (versus 5.8b in 2022 and 4.9 in 2021) and an EBIT of about 18m EUR (19.5m in 2022 and 13.9m in 2021). As of 30 June, Nordwest had about 16m in Net Financial Debt and normally, due to cyclicality, their cash generation is better in H2 as compared to H1. Nordwest has 3.2m outstanding shares and they trade at 21 EUR apiece. For a market cap of 67m and an Enterprise Value of 83m (using H1 debt). This brings me to an EV/EBIT of 4.6. If Nordwest converts it EBIT into earnings at the same ratio as last year, they should have generated 3.50 EUR/share and the stock would trade at a P/E ratio of 6. Finally, this is trading at a P/B of about 0.65x. All of these figures suggest a very cheap valuation, in particular for a business which has grown over many years (yet not in 2023) and generated double-digit returns on capital. The ratios are also quite low from a historical perspective.

Unlike other corporates, for Nordwest I consider book value a relevant parameter since most of the assets are current (receivables and inventories) and they have few intangible assets. So while I would go so far as to argue that this is a Graham net-net, the discount to book values in my view does provide some downside protection. In addition, Nordwest also owns their own headquarter in Dortmund which was built in 2015.

Given the company is so cheap, what will be done to make the share price better reflect the strong fundamentals? Well, so far not much. The company pays a dividend and is committed to a “profit-oriented dividend policy”, i.e. we may see higher dividends with accelerating profits. I would love to see share repurchases but the trading is very illiquid and the company has never done any. Over the last years, management has used retained earnings well and increased ROE, having had to finance a growing balance sheet. It would however be great if management could communicate more around capital allocation, aswell as step up other investor relatiosn activities (reporting in English, earnings calls, Investor presentations).

Pros & Cons:

+ Interesting and boring distribution business model which is deep-rooted in German SME companies and has enjoyed a growing number of clients over the last few years, pushing economies of scale.

+ Consistent track record of profitability for the last decade+ with recently growing margins and returns on capital, driven by the warehouse/storage segment

+ Cheap Valuation, no matter what metric you look at

+/- Experienced management team which has executed operations really well, however is not incentivized on the stock price ; investor relations are not a priority

+/- Majority owner Rothenberger Group seems to be hands-off, but may at some move for a takeover or, in a bad scenario a take-under.

+/- Three of 4 segments are just barely profitable, causing a high dependence on the warehouse business. This also means there is upside potential if the profitability of the other segments ever improves

-Reliance on construction Germany in a difficut economic time. This may also drive client insolvencies and hurt profits, as Nordwest is taking credit risk.

-No obvious catalyst. This may stay cheap for a long time and get even cheaper without anybody noticing.

-Shares are very thinly traded and not suited for institutionals. Individuals need patience and orders should clearly be limited.

A trading company with negative cash flow from operations year after year. Red flag.

Thanks for the writeup, helps to better understand the company and their segments. Should do well in the long run due to prudent management and cheap valuation.