Disclaimer: This is not investment advice. The author owns shares in the company described in this article and may buy or sell shares at any time. His views may be biased or wrong. Please do not rely on the information presented in the article and do your own research prior to making investment decisions.

One aspect I like about investing is that getting older is actually a positive. You will have more experience, seen more market swings and been in more situations the older you get. Also, if you continue looking at companies regularly, you will build a “library” of companies you have looked at and it is pretty cool to have that. Once you have looked at a company and developped some understanding, it will be easier to refresh you memory. I run regular screens on TIKR for quantitative criteria. Since my portfolio is small and international, I have few restrictions to my eligible portfolio - some are imposed by what trades on IBKR, my broker. There are a few sectors I normally exclude and I am cautious with respect to some countries where the rule of law and ownership is in jeopardy. Apart from that, I will mostly screen for cheapness and return on capital, just like Joel Greenblatt advocated in the Little Book that beats the Market. In one of my recent screen, a company popped up which I owned a while ago and so I took a closer look and liked what I saw - that company is Sweden’s Nilorngruppen AB (the B shares are traded) and this report is about Nilorn.

Background & History:

Nilorn is active in a s special segment of the fashion industry: It designs, produces and distributes woven and printed fashion labels/hangtags and packaging products such as paper bags and boxes. Nilorn started out in the 1970s as a design firm in Boras/Sweden and soon specialized in the design of labels. The production was initially outsourced, but later on, the company also started its own production capacities, at first in Scandinavia before later going European and then global. Today, Nilorn has production sites in Hong Kong, Portugal and Bangladesh and is a very international company. Here is where their employees are based today:

Design & Branding is still the core of Nilorn and they also design labels they do not produce themselves and I think Nilorn can also be thought of as a specialized branding agency rather than a fashion-part producer. Nilorn was first listed in the 1990s and delisted in 2009 when the company was taken over by Traction AB, a listed holding company with interests in a diverse set of listed and unlisted firms. Today, Traction AB is still the holder of 100% of the company’s “A” shares while the “B” shares were relisted in 2015 in Stockholm. The “B” shares today are traded in the Nasdaq OMX Small Cap segment. Traction today controls 26.3% of the share capital and 58.1% of the votes (one A share has 10 votes, one B share only one vote). Also in 2009, Petter Stillström, CEO of Traction, became Chairman of the Nilorn board.

I am not a branding expert and my wife knowns much more about fashion than me (and is in charge of fashion shopping in this house). Still, I feel pretty sure that fashion labels do matter and are important parts of fashion in at least two ways: (1) They provide information to the customer regarding the product, like the material it has been made of, where and how it has been produced and how it is to be maintained. (2) Fashion Labels are an important part of the brand it itself in that their style, colour, material, design and content represent what a brand stands for. Over the years, Nilorn’s financial performance has been relatively successful with decent growth and returns on capital, making it an interesting candidate to look at

Business Overview

Historically a producer of labels in various countries, in the last 15 years, Nilorn has transformed itself into a service company. Rather than just producing the labels, Nilorn focuses on the design and the organizes the production, delivery and logistics into the customer’s supply chain. The offering includes Retail Information Service (RIS) labels which include variable information such as barcodes or price and RFID (Radio Frequency Identification). Here is the sales split by product. Nilorn considers the potential growth of the RFID market as a potential preformance driver for the future.

In their reports, Nilorn underline that it is very important for them to keep their own production bases in Portugal and Bangladesh. These facilities increase the production flexibility, in particular for orders with short lead time and provide the technical know-how of the production, helpful for discussions with customers and external production suppliers. Yet only 19% of revenues are generated from Nilorn’s production.

Nilorn’s customers are normally the brand-owners, who are often based in Europe. The labels however get delivered to the fashion manufacturers, i.e. the factories which produce the fashion. According to the Annual Report, Nilorn has more than 1,000 customers, with the 10 largest accounting for approximately 30 percent of consolidated sales and the 20 largest account for 44 percent of the total.

The labels market is competitive and Nilorn is not not a monopoly business. There are big players like Avery Denison which is however less specialized (fashion labels are just one business line for them). Given that a significant part of the business is in logistics and label producers are to be integrated in the branding and production process, I assume there is some customer loyalty / switching costs. In addition, Nilorn tries to be a leader in terms of sustaible products and technically advanced solutions. Here is how they think they can be competitive:

Finally, Nilorn has been a selective acquiror of smaller label design companies such as Bally in late 2022. Most of these acquisitions have been bolt-on and seem to be inteneded to gain access to a certain client cluster and/or country.

Shareholders, Management & Incentives

Nilorn is controlled by Traction Group, a Swedish holding company. Traction’s CEO Petter Stillström (52) is also the Chairman of Nilorn. Traction was founded by Petter’s father Bengt and took Nilorn private in 2009 before going public again in 2012. Through a dual share class, Traction controls the majority of the votes, but not of the capital at Nilorn. Traction itself is listed and I took a quick glance at their holdings without being overly impressed. Some of the companies are construction and/or mining related, both not my favourite sectors, others relatively expensive.

Traction has a formulated “Ownership Policy”, describing how they would like to rund their companies. In line with the policy, Petter Stillström is active in the board and its nomination committee.

In 2020, there was a CEO change at Nilorn. Previous CEO Claes af Wetterstedt had to resign from the position held since 2009 because he had not properly declared his private taxes. Wetterstedt had been in charge of the company during most of its growth phase and was replaced by former Krister Magnusson, CFO since 2008. A long-term insider to Nilorn, the transition to Magnusson was farily seamless.

Magnusson unfortunately does not appear to be a major shareholder. His CEO compensation package is reported transparently and does not appear to be outrageous:

Financial Performance

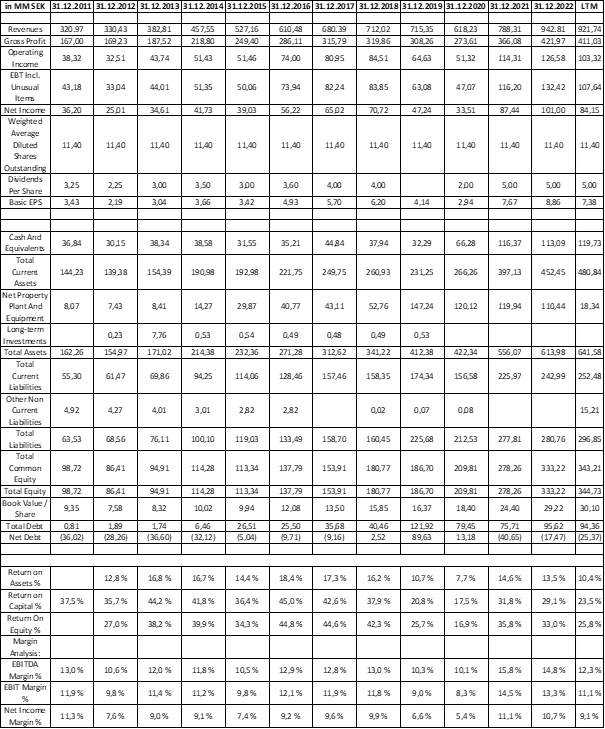

As regular readers of this substack know, I like to compile long-term overview tables on the financials of my companies. Here is the one for Nilorn over the past 11 years:

It becomes immediately obvious that in terms of numbers, there is a lot to like about the company:

Profitable every year over the past 11 years, i.e. since going public again. Profits overall have been growing and returns on capital have been very decent with returns on equity >20% in most years.

The good profits resulted in (1) a growing book value per share (tripled from 10 to 30 in 11 years) and (2) decent dividend payouts of in total 40 SEK/share over the last 10 years versus a current share price around 62 SEK/share.

Conservative balance sheet with an equity ratio >50% and a net cash position.

Share count has been stable so unfortunately no repurchases but no dilution of shareholders either

Nilorn shrank in terms of revenue in the Covid year of 2020 but came back strongly in 2021 and 2022. Q1 of 2023 has been slower but the company is guiding for activity to pick up. There is some cyclicality to the business and it may be affected by economy/industry slowdowns.

The Company has been growing revenues at 7% p.a. (5 years) and 10 % (11 years) and maintained decent profit margins (operating margins >10%). The growth has been somewhat lumpy with revenues at times staying flat while then leaping forward the next year. These results are in line with their declared long-term goals.

In addition to the good numbers, a little plus is that the reporting of Nilorn is quite transparent. Their publish their quarterly results relatively early and do a pretty good job presenting them, including presenting longer term trends and commenting on their weak spots.

Valuation

While Nilorn has been financially successful over the last decade, the market seems to care more about short-term headwinds than the longer term trend. In Q1 of 2023, revenues decreased by 13% compared to 2022 and earnings per share dropped from 2.45 to 0.97 SEK. I do not put too much weight on a single quarter but rather look at ther longer term development. Nilorn is still guiding for a 7% increase in revenues p.a. and an operating margin of 10% or more and I do not see structural reasons why this would not be possible. So, over time, Nilorn should generate more sales and profits.

Yet even on current levels, the company is cheap, trading at around 6-7x EV/EBIT, 7x 2022 PE and a 8% dividend yield. In 2023, profits may be a bit lower than in 2022, as evidenced by the first quarter. Yet the further the year progresses, the easier comps will get and in the next 2 or 3 years, I am pretty confident the company will exceed its strong 2022 result. A capital-light business with these margins in my view could easily trade at 10x EV/EBIT. Add in prospects of higher earnings going forward and I can well see this double. The share price has been much more volatile than the business results, losing 75% in the Covid recession (share price drop from 85 to 22 SEK) before growing more than 5x to about 120 SEK. Since then, it has come back to the low 60s. I think it is cheap here but whoever looks to invest should definitely be prepared for some volatility.

Nilorn is still a very small company with a market cap of about 50mm EUR. For me, this means a long runway for potential growth but it also implies more risk. If the industry consolidates, it is possible that Nilorn at some point may get an interesting target for the likes of Avery Denison. This will of course depend on the plans Traction has for them.

Summary

Nilorn is an interesting nanocap company which has proven it can generate high returns in a cyclical sector. I think their position at the intersection of a specialized marketing agency with special skills in logistics and production is an interesting proposition. The company is facing some short-term headwinds which is reflected in low trading multiples and which I expect to be overcome which is why I opened a position here.

This is not investment advice. Please do your own research. I would be glad to hear the bear case for Nilorn.