Disclaimer: This is not investment advice. The author owns positions in the stocks mentioned in this post and may buy or sells stocks or other financial instruments at any time. The analysis presented may be biased, flawed or wrong. Please do your own research.

After, so quieter summer weeks, I am back with a post on two positions recently added to the portfolio. I have not changed much, but received some cash from the resolution of ALJ Regional and sold the position in First Pacific. for a ~20% gain. I still think First Pacific is a very interesting and cheap company and Olivier over at the Emerging Value substack has done a great job covering it. While I would like to get more exposure to the region, I will rather play this through directly operating companies rather than holdings. For now, Delfi and Texhong are the only ones left and I may reduce my position in the latter for other opportunities.

There are two new positions in the portfolio, IDT and United Internet.

IDT Corporation is a company I have followed since reading the classic “You can be a stock market genius” . This is a book on special situations investing and in it, Joel Greenblatt makes the case for spinoffs as the most interesting type of special situation. After reading the book, I searched the internet for spinoff situations (as I reckon most readers would) and fairly soon stumbled over IDT and its founder, Howard Jonas. IDT has been a successful serial spinner since Jonas took over in the early 2000s and thereby created tremendouos value for its shareholders. Jonas has been really good at identifying and growing new business lines, mostly funded with stable cash flows from a traditional communications business. No every spin-off worked well, however overall, the track record is really presentable. At this point, IDT owns three interesting and growing business segments each of which may be spun out at some point:

National Retail Solutions, a Point-Of-Sale-based platform which provides, software, merchant services and advertising.

Net2Phone, providing Contact Center Solutions and (Communications as a Service) and

BossMoney, a digital money transfer business focusing on remittances

I will not dive deeply into the business for now, but rather link you a recent VIC writeup and a (bull case) Alta Fox presentation from 2021. Or you can read this Seeking Alpha piece. The most recent investor presentation may also prove helpful.

Here is the 5 year chart for IDT. The stock was basically forgotten until, in the middle of the Covid Crisis, it was “discovered” as a fintech business and the share price roughtly 10xed within 18 months. Then, fintech fell out of fashion and so While the overall performance is not bad, we are down >60% from the 2021 top when IDT was considered to be a very hot fintech company. Interestingly, their businesses have performed pretty much the way Alta Fox had expected it when they published their 100$ target in 2021. It is just that there is overall more sanity in the valuation of this market segment. IDT overall trades at an EV/EBIT (last 12M) of around 7x. While most of this EBIT still comes from the slowly declining traditional business, the share of the new segments, in particular NRS is growing every quarter and I expect this to continue. There is a potential legal liability with respect to Straight Path, one of their spinoffs, which is creating some uncertainty and means a risk factor. Still, I am overall comfortable enough to allocate a position to IDT. I do think there is a good chance that the new segments, in particular NRS, will continue to grow well and also generate significant earnings. This, combined with the proven capacity and willingness of the Jonas family gives some comfort and while I do not share the AltaFox price target of 100$+, even 40-50 USD would mean a decent upside.

My second new position is United Internet. This company is well-known in Germany but, it seems has a pretty low profile abroad which might make it worth writing up. I first got interested in stocks around the year 2000 when the Technology, Media and Telecom (TMT) bubble dominated the market. The Nasdaq was challenging the Dow and the S&P500 for the most important index and losing money in Cisco Systems seemed as impossible back then as losing money in Nvidia does today. Around that time, there was also a stock-market boom in Germany, fired by privatizations of Deutsche Telekom and Deutsche Post and the Infineon Listing. Germany’s answer to the Nasdaq was Neuer Markt, and every ambitious young person invested there. So did I - and lost a chunk of money. One of the companies at Neuer Markt which I did not invest in was United Internet. 23 years later, United Internet is one of the very few survivors among the former “Neuer Markt” superstars and I have become a proud shareholder.

Business Overview and History

The company was founded in 1988 by Ralph Dommermuth (59 years old) who is still the CEO and owns >50% of United Internet which today is a holding company.

The company was initially started as a marketing company for software providers. Around 1990, they got involved in marketing activities for Teletext and Bildschirmtext (BTX), both early online information services before the internet was available. With the start of the internet in the mid 1990s, a new world of opportunities opened itself. The group started email service GMX which they still owns and is one of the most-used email providers in Germany. Around the same time, they acquired Schund & PArtner, back then the German Webhosting Market leader. Over the next couple of years, the company grew its internet service and webhosting empire, acquiring providers of domains, webspace and email services like Web.de . The company also expanded across Europe into France, the UK, Austria and Poland. In the 2010s, United Internet bought mail.com and moved into the US. In Germany, they bought their largest Webhosting competitor Strato back in 2017 and further grew their ecosystem around webhosting and adjacent services (shops, marketing services, email). Today, this segment of UI is called “Applications” and largely run by their 64% subsidiary Ionos, which itself is also listed.

In the late 2000s, United Internet started to build what is now their “Access” business segment. In 2007, they acquired a 25% stake in Versatel which was starting to build an optical fiber network in Germany. Two years later, the company started to compete with network carriers and offer mobile internet access. Further notable acquisitions were for the rest of Versatel, a stake in Tele Columbus (second largest German cable operator) and the merger with telecommunications provider Drillisch. Today, the merged entity is listed as 1&1 AG. They currently operate as Mobile Virtual Network Operator (MVNO) for wireless communication, using the Telefonica network. 1&1 has about 11m wireless customers in Germany. Moreover, they have >4m broadband clients and rank third in this market after Deutsche Telekom and Vodafone.

The fact that they achieved this (almost) without any network infrastructure shows that 1&1 and Drillisch are marketing experts. They have been good at running campaigns to compete with the top dogs, at sensing which offers/bundles can attract customers and negotiating deals to gain access to the infrastructure they do not own. With respect to the network infrastructure, 1&1 have been changing their strategy. For once, Versatel has run significant investments to grow its optical fibre network which by now has reached 59,000km. Secondly, 1&1, in 2019 acquired a 5G license in the German federal auction and is now building its own network - a courageous plan which causes significant uncertainties (to be discussed below). Here is the snapshot on the company activities from their investor presentation.

Segments & Businesses:

As per the above chart, United Internet divides its business into four segments. Two of these segments are listed: 1&1 AG (formerly 1&1 Drillisch) has been listed for a couple of years while IONOS went publicly only recently, i.e. in 2023:

The Business Access and the consumer application segments are 100% subsidiaries. There are a number of materials available, like the last Annual Report and the H1 2023 Investor Presentation.

Let’s start our journey with the Consumer Applications segment which many readers of this podcast will know already. The company provides fairly simple and cheap, mostly free internet applications such as email addresses, calender functions, cloud storage space and online office. Revenues are generated from customer fees and ads. The segment has about 42m customers, many of whom just have an email address at GMX or Web.de . Also, Consumer Applications is not growing a lot, but at a low single digit rate. What makes it attractive is that it generates high and stable margins (33% EBIT margin) and cash flows, fired by their strong market position which I do not expect to be seriously challenged.

The Business Applications segment is synonymus with IONOS which only went public this year. IONOS strives to be the “leading partner for digitization to Small and medium size businesses” and splits its segments into “Web Presence and Productivity” (Web Hosting, Server Hosting, Ecommerce & Shopbuilder; 90% of revenues and slow growth) and “Cloud Solutions” (Public & Private Cloud, Managed Services, 10% of revenues and fast-growing). Over the past years, the company has invested in its brand and marketing and its cloud capabilities. Given that it is an established provider for domains and websites and well-known, I think they have a good chance to be competitive in the cloud space for SMEs. Also, their “Web Presene and Productivity” segments generates predictable recurring revenues which can be used to fund further growth initiative.

In the IPO, United Internet sold shares for about 300mm EUR. My understanding is that the Listing was mainly driven by Warburg Pincus who had partnered with United Internet and preferred this exit route. United Internet retains a majority (64%) but also generated some cash and repurchased own shares for roughly the same amount. IONOS went public at 18 EUR in February and so far has been a dog, trading at around 15 EUR. Based on their annualized results for H1 (0.68 EUR/share EPS, 150mm EUR EBIT), this equates to both a PE Ration and EV/EBIT ratio in the area of 11-12x - not very ambitious. Notably, United Internet has provided a shareholder loan of 1.1bn EUR to IONOS which will get repaid over time and which we will need to consider when we value United Internet. This shareholder loan does not appear in the consolidated accounts.

Consumer Access is the largest segment and probably also the most controversial one. 1&1 AG is Germany’s third broadband provider with 4mm customers and has about 12mm clients for its mobile service. On the fixed-line side, the company uses the network from 1&1 Versatel while the “last mile” is often provided by Deutsche Telekom or other city networks (1&1 Versatel will be discussed below).

On the mobile side, 1&1 currently operates as a pure Mobile Virtual Network Operator (MVNO), i.e. they do not own any mobile network but rather have to “rent” network capacity to facilitate their clients’ call/data needs. 1&1 has contractually agreed with Telefonica Deutschland, one of the three network providers (next to Deutsche Telekom and Vodafone), to use up to 30% of their network capacity for their own business. The contract with Telefonica will expire at the end of 2025 with United Internet having the right to extend to 2030 and to use all the current and future technology of the network. Thus 1&1 is mostly an intermediary acquiring mobile customers, providing client support and marketing but has no network itself, therefore pays Telefonica Deutschland for providing the network capacity which means lower margins and an unpleasant dependance on someone else. Like in other countries, the German Frederal Network Agency acts as regulatory watchdog, observing the behaviour of the player and (supposedly) fostering competition for the benefit of the customer.

In 2019, 1&1 took part in and acquired a license in the German 5G auction. This enables and obliges them to build a 5G network themselves, reflecting a strategic shift towards vertical integration and becoming a network operator. While there is a strategic logic to this decision, it also takes enormous resources to plan and build an entirely new network - and 1&1 has never done it before. Moreover, they are trying something (fairly) new in terms of technology, building the network as an OpenRAN versus the traditoinoal Single Vendor dRan network. For the netowrk structure and buildout, 1&1 is largely partnering with Rakuten of Japan which have built similar networks before. I am no expert on technical details but interested to hear thoughts from my readers on this. To me, this is both an innovative and risky pitch.

The 5G license alone cost 1&1 about 1bn EUR, payable in arrears until 2030 while building the network infrastructure might in summary require another 4 bn EUR or so . 1&1 has committed to reaching certain milestones on the network buildout to the German Federal Network Agency and is currently behind schedule which gives rise to the risk of penalty payments or even a license withdrawal. For example, 1&1 was supposed to have 1,000 antenna sites by 31 December 2022. They have 193 per 30 June 2023, 40 of which are operating (they blame this delay on unfair competitive behaviour on Vantage Towers which they say favors Vodafone). Also 1&1 is required to reach 25% of German households with its 5G Network by 2025 and 50% by 2030. Still, there is some progress on the network buildout in that 1&1 are now finding antenna sites, have built a number of data centers needed and are also marketing their first 5G bundles to clients. For the coming years, heavy CAPEX requirements are to be expected for building the network.

Recently, 1&1 announced a cooperation with Vodafone on “National Roaming”. Once implemented, 1&1 will be able to use the Vodafone 5G network for its own clients as an MVNO where its owned network is insufficient to provide the client service. So, in my view, 1&1 has three ways to provide 5G to its customers, (1) through their own network which is just getting started and will take years to build, (2) through the Vodafone cooperation which is pre-agreed but not finally signed. Vodafone is expected to provide the second-best 5G coverage (after Deutsche Telekom) initially and (3) thorugh the contract with Telefonica Deutschland which will likely be terminated if and when the Vodafone cooperation becomes enshrined. On this basis, I do not expect a scenario where 1&1 cannot offer 5G to its clients. Also, not all of Germany will switch to 5G instantly, so 1&1 will continue to generate revenues from mobile in the future.

The market clearly does not like the uncertainty here, which is admittedly considerable, in respect to (1) required CAPEX for the network, (2) timing of the buildout, (3) usage of a (perceived) new and untested technology (Rakuten will disagree) and (4) potential penalties from the delays. On the other hand, this is not a one-product biotech company, but a firm with 16m client contracts which despite considerable costs takes generates 4bn EUR in revenues and 700mm in EBITDA. Still, over the last 5 years, the share price is down 75% and the EV/EBIT and EV/EBITDA ratios imply some terminal value risk.

Further, the company has no financial debt beyond the arrears payment obligation for the 5G license.

The final segment to be discussed is Business Access, represented by 1&1 Versatel. Versatel owns 59,000 km of optic fibre networks, including many city networks (they cover all the big cities). The company offers Fiber To The Home (FTTH) / Fiber To The Building (FTTB) and has about 25K directly connected sites, most of which are business or public sector clients. The 1&1 Versatel fibre optic network will also be used to connect the mobile antennas for the 5G mobile network. Within the United Internet Group, Versatel is where most of the CAPEX happens. Within 2022, the company recorded about 950mm EUR of investments in fixed and intagible assets, half of that was Versatel (after IRFS 16, this number is somewhat inflated as it includes newly agreed leases, UI gives a CAPEX of 680mm for the group). Versatel was acquired by United Internet in two steps with United Internet paying 909mm EUR Enterprise Value for the 75% not previously owned in 2014. Around that time, Versatel hat 37,000km of optic fibre network which has grown through acquisitions and building activity to 59,000. The most recent acquisition I coud find was for four city networks in big cities (1,590km) at a price of 42mm EUR.

Germany is pretty much a laggard in fiber connections and has to catch up with the rest of Europe, according to this chart:

On the other hand, there is currently a market consolidation happening and a number of smaller player are selling their networks to the bigger ones. 1&1 Versatel is currently a distant number 3 in the market after Deutsche Telekom (650k km) and Vodafone (160k km).

Management & Incentives

United Internet was founded and is run by Ralph Dommermuth who is 59 years old. While in my mind, there have been rather few outstanding German entrepreneurs in the last decades, Dommermuth is actually a self-made billionaire who started from modest origins. Dommermuth has been CEO of United Internet since it was founded. Early in his career, his strengths were in creative marketing, spotting opportunities earlier than others and having a good feeling for customer needs. He is clearly a courageous and visionary entrepreneur who is not afraid to tackle bigger competitors. If you understand German, there was a decent recent podcast on with Dommermuth going through the various stations of his business life (highly recommended). Dommermuth stems from the rural small town of Montabaur, half-way between Cologne and Frankfurt where the United Internet headquarter is still based today. While Dommermuth gives the impression of being a modest and self-critical guy, he does live in a nice house and engage in millionaire activities such is being a prominent political donor and participating in the America’s Cup. 1&1 is also a main sponsor to Borussia Dortmund.

According to the podcast, Ralph Dommermuth has no plans to retire. His net worth is estimated to be about 2 bn USD, much of this is in shares of United Internet. According to the latest Annaul Report, Dommermuth owns 99mm shares, which would bring his shareholding to about 57%. Notably, Dommermuth bought about 17mm shares during 2022. The share purchase was agreed in late 2021, when the share price was around 34 EUR (versus today’s 16). Clearly, bringing up the share price will have a bigger wealth effect on Mr. Dommermuth than his salary which is zero anyway. When you look at the United Internet complex, you could also invest in 1&1 AG, IONOS or TeleColumbus. I would normally prefer to be invested in the same entity as the guy who is calling the shots - and this is Mr. Dommermuth.

Group Financials

As usual, will present group financials for United Internet over the last decade. As the group has become more complex during the period and there various issues complicate the financials, please treat the table extra carefully. I will explain a few factors below:

In 2012, United Internet was mostly a webhosting business, consisting of the “Applications” segments. This is a decent high-margin and capital light business, generating great returns on capital.

As the company introduced the “Access” segments, it required a more capital for various reasons. First, Unitied Internet paid to buy Versatel in 2014 and Drillisch in 2017, as evidenced by the goodwill position. Also, starting in 2014, United Internet invested more capital into growing its network infrastructure (mostly optic fibre) which shows up in the Net PPE position. Add to that, thirdly, the investment into intangible assets (prominently the acquisition of the 5G license in 2019). For these reasons, the balance sheet has grown by a factor of 10x in 10 years. The nice, asset light business is still there, but it is not alone anymore.

Have these investments paid out? So far not. Revenue growth has been sluggish, because the traditional UI business operate into markets which are more and more saturated. At the same time, some of the investments have not started to generate any revenue (like the 5G license). Profits in the last 3 years have also been hurt by expenses for building the network (some of these costs are not capitalized but rather expensed right away).

All of this causes a poor development of capital returns whereas EBITDA and and gross margins have been fairly stable and revenues have grown mid single digits.

United Internet has about 2.4 bn EUR of financial debt which sits at the HoldCo level. The subsidiaries have little to no debt outside the group. Over the last few years, debt has grown with the telco/infrastructure investments but it is still at a moderate level.

With the IONOS IPO, United Internet reduced its share in this subsidiary. The proceeds of 300mm EUR were used to buy back 14mm shares at a price of 21 EUR (versus today’s 16 EUR).

The company has been paying dividends for years which however have not really grow. Currently, the dividend sits at 0.50 EUR/share

Valuation

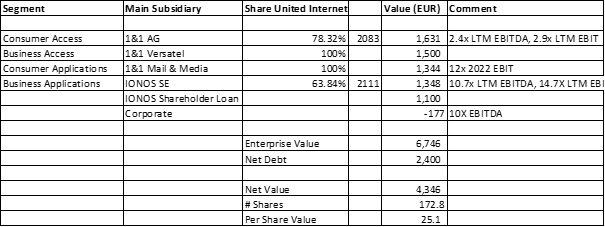

Look at this trainwreck of a chart. The market clearly has little hope that the ambitious plans of United Internet will bear fruit. While United Internet has been profitable and cash generative, the narrative around the company is that 5G will end up as a bottomless pit while the applications businesses are dinosaurs in an increasingly mobile world. Capital returns have been trending down and the share price has rightfully suffered. So what is in the price? The Equity Value of the company is down to about 2.8 bn EUR. Add the 2.4 bn in net debt and we get to 5.2 in EV. What are the various parts worth? Here is a simple table:

I used market prices for 1&1 and IONOS. In the case of 1&1, the market price is historically depressed at 3x EBIT for the reasons above, but we are using it anyway. For IONOS, we are more at 14-15x EBIT and I have assigned the 14x multiple to Consumer Applications aswell, which is a cash cow in my few. Don’t forget that the United Internet has also extended a Shareholder Loan to IONOS, which is a asset from the UI Investor perspective if we do a SOTP. The trickies asset to value is Versatel for which I do not have proper financials. In 2014, Versatel, still much smaller, was bought for 950mm EUR. UI has since invested hundreds of millions in the network and bolt-on acquisitions. The latest of these was 1590km for 42mm. On a per km basis, this would mean about 1.5bn for 59,000km of network. This is likely conservative from a replacement value perspective. If we deduct the net debt of 2.4bn EUR, we will get to an indicative value of 25.1 EUR/share vs. the 16 we are trading at.

Closing Thoughts & Summary

To me, the United Internet complex is an interesting situations. I would not say that the business is flawless - there are challenges in all of their segments. At the same time, the businesses are still (slowly) growing, profitable and cash-generative and in some cases highly so. There is a big uncertainty cloud overhanging the 5G buildout and I have mentioned the issues above. The big question for an investor is how much and for how long the cash flows from the existing businesses will be used for the new network. The uncertainties are more than reflected in the bombed-out share price.

Yet in my view (also in the view of Rubicon Stockpicker Fund), the situation is quite asymmetric. For example, just imagine 1&1 were to double and trade at an outrageous 5.8x EBIT. That would bring the SOTP to 34 EUR. Also, I do think that United Internet has options. A business like 1&1 Versatel, which currently generates negative EBIT, would certainly find a buyer. Shares in 1&1 and IONOS are listed and, depending on price performance, United Internet could buy or sell more. I have not mentioned a portfolio of minority participations incl. Tele Columbus which might be monetized. I would normal not expect for the German regulator to be overly harsh with a challenger company which is one of the best shots to improve competition. Finally, Ralph Dommermuth has proven his outstanding entrepreneurial capabilities more than once and I would not bet against him.

In summary, I am comfortable enough to allocate a small portion of the portfolio to United Internet.

Thank you for this analysis.

If you are interested, there is a comment on United Internet on the last quaterly report of the TGV Rubicon Stockpicker fund (they have a 12.2% position)

Report here : https://valueandopportunity.files.wordpress.com/2023/07/bericht-des-sub-advisors-fuer-das-teigesellschaftsvermoegen-rubicon-stockpicker-fund-ueber-das-erste-halbjahr-2023-englisch-1.pdf

Congrats on Delfi, totally misjudged that one.