Disclaimer: This is not investment advice. This post mentions various micro and nano cap stock which may be risky investments and investment may result in a total loss of capital. The stocks are illiquid and may be difficult and expensive to trade. The author may have a financial interest in these stocks and his views may be biased. He may buy or sell at any time without prior notice. Please do your own research.

As I have written before, I do have a soft spot for micro, nano and pico cap investments. For retail investors willing to do the work, they might be the best chance of scoring real homeruns, for several reasons. These companies are truly forgotten by 99% of investors. Almost nobody cares about them for all sorts of reasons. Institutions cannot invest here, due to size/concentration limits. Accordingly, there is no sell-side analyst coverage. In addition, the companies often trade in orphane markets such as OTC/Pink Sheets or the London AIM market where many investors cannot play. Oftentimes, they do not report and the reporting quality is, well mixed. Some of these firms have even gone “dark” on reporting. In addition, the business models of these firms are often fairly easy to understand and not very complex. There are not hundreds of products and dozens of divisions spread across all continents but often one factory and a handful of products.

While the biggest advantage is probably sitting rather alone at a pond with all kinds of fish, including fat and juicy ones, there are drawbacks aswell. For example, these companies typically have less scale and there are industries where scale matters. They may be more vulnerable to external shocks and go out of business faster. Also, institutionalization often has not happened, i.e. you are more often in a friends/family structure which may not be meritocratic. More practically, it takes some patience to build a decent-size position, another reason why the big guys do not care, and there are stock which do not trade or even a retail size moves the market.

This last reason is why I am not sure if a post like this is a great idea. At 1,500 subscribers, Augustusville is a small publication, but even so, I do not want to be seen pumping illiquid nanocaps - I always found the Wolf of Wall Street disgusting. On the other hand, I want to encourage people to turn the rocks nobody else is looking at. Having done this myself a few times, it is really fun and can be - in my view - financially and intellectually rewarding. At this point, I would like to recommend three sources of great ideas you should follow for really-off-the-beaten-path investment ideas. Alluvial Capital is probably well-known to those who follow me. I am really excited to doing a Twitter Space with Dave in November (follow me on Twitter for details) . Another great manager to follow is hedge fund manager Tim Eriksen who is not shy to invest in really tiny companies and some some cases even goes activist or takes on a management role. Many German followers will be familiar with Smitty Finance who does pretty in-depth videos on orphane videos on Youtube and comes up with a lot of interesting ideas. Finally, No Name Stocks by Dan Schum, more than any other website I am aware of, is the figurehead of pico cap investing. Unfortunately, Dan posts less frequently in the past, yet even the historical posts are worth your time. Dan scored a couple of fantastic winners, with Hemacare being the biggest one as far is I know.

In this post, I hope I can provide some ideas which Dan, Smitty and Dave have not heard of, but I doubt it. I will also not provide full write-ups but rather teasers, basically an invitation to take a closer look. Again, this is not a pumping and pushing blog. So let’s see what is inside the

Euro-Tax is a tiny company based in the lovely country of Poland. It provides cross-border income tax services, mostly to migrant workers in Europe. Thanks to the EU, every European citizen can live and work in every EU country. For example, in Germany we currently have a lot of Poles temporarily working for a few months in sectors such as agriculture, elderly care or construction. These workers pay income taxes in Germany but typically can claim some or all of their taxes back. For this, they oftentimes need to file a tax declaration. Now, even as a German citizen, a tax declaration is cumbersome. But if you are not fluent with the language and do not know the system, it is probably a nightmare. In comes Euro-Tax. Based on your documents, they do the filing for you and, in exchange receive a 10% share of the tax reclaimed. If the reclaim comes out at zero, Euro-Tax is not paid which makes the service a free option for workers. Euro-Tax is not only active in Poland but also reclaiming taxes for Bulgarian and Romanian citizens who work in Germany, the Netherlands, the UK, Ireland, Denmark and Austria. In these countries, Euro-Tax has collected experiences with the tax authorities. They are quite efficient and automatised, i.e. their 170 employees in total do > 50,000 tax filings a year. In my view, there is room to grow from opening new countries where people work (Italy, France, Switzerland), where they come from (maybe the Balkans or at some point Ukraine) or reversing the direction (i.e. Germans working in Poland). I think they can also gain more share in the markets they currently operate. What I really like is that they publish, on a monthly basis, the number of contracts they have signed, a great leading indicator for revenues.

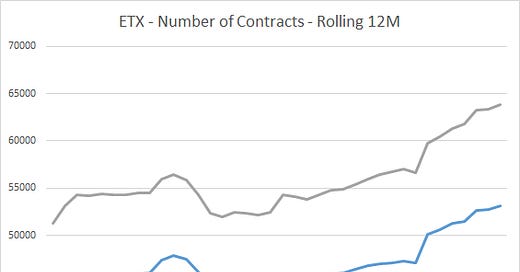

I have been tracking this and created a little graph for the last 3 years (blue - tax contracts, grey - tax plus benefit contracts).

Euro-Tax as of this writing trades around 4 PLN/share. There are 5mm shares outstanding and the number has been constant for years. So we have a market cap of 20mm PLN ( 5mm USD) for the business. The company has no financial debt and needs very little capital to operate. Last year, they reached 28mm PLN in revenue and 2.5mm in net profit (0.50 PLN/share) and paid a dividend of 0.45 PLN/share (11% yield). For 2023, based on the first two quarters and the number of contracts they have signed, I do expect higher profits. Another nice feature for a EUR investor concerned about FX risk is that the revenues are typically EUR/GBP based while the costs are in PLN which is which a weaker PLN should help rather than hurt.

These days, the UK appears to be a great pond to drop your fishing rod with lots of small and micro caps, many of them on the AIM, and a fairly negative sentiment on the economy and the stock market. So you can find many companies there. Today, I am mentioning Comptoir Group, a chain of Lebanese restarurant chains under four different brands. Comptoir has been public since 2016. They expanded until 2019 but never really generated a significant profit. Then Covid struck which resulted in a near-death experience. As all Brits know, it is important not to waste a good crisis and Comptoir used Covid to take out costs and streamline its operations - just because they had to. Still, in 2020, they saw 80% of their equity wiped out. Comptoir came back and in 2022, their revenues was almost back to the 2019 level. Comptoir was profitable in both 2021 (yet massively supported by susidies) and 2022. They reconstituted the board in 2022 to bring in more seasoned restaurant experts Jean Michel Orieux and Beatrice Lafon who are also paid quite well. I do not know much about them, would be interested in more background on them. Also, they stepped up on Investor Communication as you can see in this video presentation of their 2022 Annual Results. What I like about restaurant businesses is that once they capture a follower community, they can scale quite quickly. I do not know if this will happen Comptoir Group and I am clearly not saying they will be the next Chipotle. Yet I personally this that hommos tastes great and Lebanese food may have more potential.

Comptoir Group trades at a market cap of around 9mm GBP and the stock price of just 7p is down 90% from the 2017 level. The LT chart is a trainwreck.

They have about 7mm GBP in net cash if you exclude the 16mm leases (or 9mm net debt if you include leases). So the EV is about 2mm pre IFRS 16 or 18mm post IFRS 16. For 2022, Comptoir showed Adjusted EBITDA (unfortunately they even adjust in the nano and pico space) of 6.3mm post IFRS 16 and 2.8mm pre IFRS 16 and a net income of 600K. So on this basis, it definitely looks cheap toady and eve. On the other hand, it is a vulnerable business as we have seen during Covid, the UK is a competitive market, they are exposed to inflation and have little equity left. So it might be a multibagger - or a zero.

It was also recently mentioned on the Emerging Value Substack.

Paragon Technologies is a nano holding company which trades in the US OTC market. It run by Hesham “Sham” Gad (45) who has been the chairman and CEO since 2014 and owns 28% of the company. You can also find a write-up by Dan Schum.

Hesham Gad seems to be an obsessive admiror of Warren Buffett, he also used to be a Motley Fool author and published The Business of Value Investing. While parrotting Buffett is not the most original idea in investing, building a holding company might well be. Paragon has a market cap of 16.4mm USD and owns the following assets:

100% of SI Systems, LLC, a company which is in the business of Automation Solutions

80% of SED International De Colombia, a Colombian IT distribution business

2 apartments in Las Vegas and

a portfolio of marketable securites (2.4mm USD)

To my knowledge, there is no debt on the holdco level, but only on for SEDI. SI and SEDI were quite profitable in the last years, but this has not always been the case. SI is a fairly small but business produces high margins. SEDI’s margins are slimmer and it is exposed to Colombia risk (currency & political risk). The reporting provides a decent sector breakdown:

As Sham Gad admires Buffett, he is also likely to follow the Buffett playbook on capital allocation. This sounds great but it is also a risk as he may or may not be as good as Buffett in stock picking and buying businesses. Also, like in Berkshire, there has been no dilutive stock-based compensation, but also no dividends nor other forms of capital return, instead a nice Annual Letter.

Net Income for the last 3 years were 2.76 USD (2022), 1.97 USD (2021) and 2.11 USD (2020) per share (4.73mm, 3.35mm and 3.60mm). Despite weakness in Colombia, they made 1 USD/share in H1 2023. So we have a business which, at least over the last 6 years produced outstanding returns on equity and trades at around 1x tangible book and below 5x earnings. So again, I cordially invite you to take a closer look :-)

Namsys is a Canadian company active in the field of Cash Management Software. The company provides technology-enabled solutions to make cash processing more efficient, such as smart-safe monotoring, cash vault management or Cash-in-Transit Tracking. Namsys offers the Cirreon and Currency Controller sofware on a monthly subscription basis. While Cash as a means of payment loses relevance, I expect it to still be around for some time and accordingly efficient cash processing might have a market for some time. Recently, Namsys has been growing revenues in the mid double-digits. They make a 33% Operating Margin (Sofware! :-) ) in in the last 12 months produced 6mm CAD in revenue and 2mm in profit.

The last time I checked, the company had 17 employees. The market cap is 24mm CAD, they have 7mm CAD in cash/short-term investments and no debt, so about 17mm CAD enterprise value for an EV/EBIT of 8.5x. This seems fairly low for a software business which is why management recently launched a buyback (Canadian NCIB) which makes sense given the existing cash pile. Yet, Namsys is very illiquid and it will be interesting to see if they manage to find a lot of shares. There is also not a lot of investor communication at Namsys. They produce one presentation a year for their annual meeting and the SEDAR reporting is quite decent.

Again, all of the ideas presented above are teasers, but no complete analyses. I am not pitching the stocks to you but only inviting you to do more work on them. I turned some rocks and what I see looks interesting but I do not know if it is a golden coin.

Also, more than happy to get you feedback on the above. Maybe you already did some work on the above ideas and would like to share thoughts? Or you found any other nano rocks which I should turn? In any case, I hope you enjoy the post and the ivesting experience.

please consider a better (listener) platform for interviews than twitter ! we need downloads and transcripts.