Disclaimer: This is not investment advice. The author is long at the time of writing is long shares of Ibersol, Muehlhan and 3U and may buy or sell any stocks mentioned at any time without further notice. Shares mentioned are risky investments and may be illiquid. Please do your own due diligence.

Recently, there have been a number of special situations linked to the sale or partial sales of businesses in various European Companies. In 2022 (last year that is), the valueandopportunity Blog covered the Exmar and 3U situations. I invested in both, realized some gains on Exmar and am still holding on to 3U at this point. On Fintwit and other blogs, there has been coverage on this situations at Centrotec and Muehlhan, both German microcaps who will hold a lot of cash.

In this post, I will present another name on this theme, it is Portuguese restaurant operator Ibersol, hoping to provide an interesting idea and get some feedback from my readers on aspects I may not fully grasp.

Ibersol

Ibersol is running quick service restaurants in Spain, Portugal and Angola, mostly for big international brands like Burger King, Pizza Hut and KFC, but also for some smaller brands. An overview of the restaurants is to be found here:

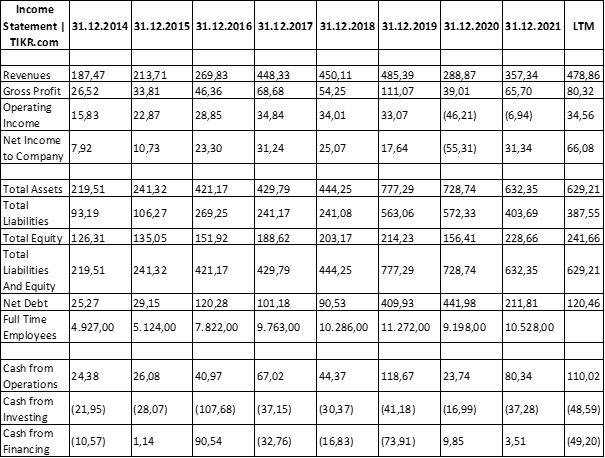

In general, I think the operation of fast-food restaurant to be an attractive business even though there were numerous headwinds in recent years, ranging from the economic crisis in Southern Europe to the pandemic when nobody went out to eat. Overall, the company still showed a respectable performance over the last years. Apart from Covid, Iberosol has been consistenly profitable and growing. They have beeen reinvesting their cash flow to grow.

At the end of 2021, the company was suffering from Covid and in repsonse did a painful share issuance of 10mm shares at around 4.00 EUR/share. The capital increase was done thorugh a rights issue and open to all shareholders. It may have been necessary at the time, yet might have been avoided given the events unfolding in 2022.

Ibersol at the time of writing trades at a market cap of 237mm EUR and TIKR reports 120mm EUR in net debt (including leasing liabilities), for an enterprise value of 357mm EUR. In the last 12 months, they achieved an EBIT of 35mm EUR (10x EV/EBIT multiple) and an EBITDA of 98mm EUR (3.6x EV/EBITDA). Q4 2021 and Q1 2022 may still have been impacted by Covid.

Sale of Burger King Restaurants

In August, Ibersol agreed the sale of two of its holdings, Iberkng and Lurcha at a price of ~260mm EUR (enterprise value), to Restaurant Brands Iberia, a company controlled by PE firm Cinven. The sale was concluded at the end of 2022 . In their Q3 2022 report, Ibersol are breaking down the impact of the transaction. From the table above, you can see that there are 149 Burger King out of a total of 552 restaurants (27%). The Burger King restaurants contributed overproportiantely in terms of revenues and profit. Here is an overview:

On this basis, Ibersol may lose 37% of their revenues and 50% of their net profits without Burger King. I was lazy and made a 12M estimate for the remaining/continued operations which gets me to 54mm in EBITDA, 19mm EBIT and 10mm Net Profit. I do not think. Let’s assume this is what the company makes this year.

Out of the 260mm EUR purchase price, I think there will be about 160mm EUR in capital gains . I am not a Portuguese tax expert. The tax rates I found are 25-28%, also a half of the capital gains are tax-exempt for individuals, but I do not know about corporations. I will assume they pay 28% on the full 160mm EUR capital gain and leave it to readers to correct me. Views are appreciated. For now, I will assume net proceeds from the sale of 215mm EUR.

This will turn their 120mm EUR Net Debt into 95mm EUR net cash. Note that per IFRS 16, this net debt includes 80mm EUR in lease liabilities. They are a significant position for Ibersol as they have longer-term rental contracts for a number of their locations and are classified as financial liabilities for future rent payments on their balance sheet. Also, under IFRS 16, interest expenses on lease liabilities are to be recognized. It hasbeen argued that this is not the right way to handle leases. If you have a 5-year rental contract and want to move out, you can normally do this if you find someone else stepping in. The same does not apply to financial deb.

These accounting twists have quite an impact on valuation ratios and it is easy to make mistakes here. In my view, there are two ways to handle this. Either you (1) include the lease liabilities in net debt and the “lease interest” in interest expense or (2) you exclude both. (1) will lead to a higher EV and a higher EBIT(DA) than (2). Importantly, it is flawed if you just include one position but exclude the other.

Unfortunately, unlike the ideas mentioned at the top of this post, I cannot offer a negative EV or Net Cash>Market cap. Depending on how you calculate, you can end up with an EV/EBITDA of 1.3 or 2.7 and EV/EBIT of 4.3 or 7.5. One way or another, I do think these are fairly cheap valuations, given that this should be a good quality and stable business and I would expect upside to their results from here. Amrest, a larger company from Poland with similar activities trades at 18x EBIT / 5.3x EBITDA according to TIKR.

Management and Capital allocation

Ibersol is majority-owned (59%) by ATPS which is a holding company for its founders and leading managers, Antonio Teixeira and Antonio Pinto De Sousa. They have grown the company steadily over the decades.

In connection with the 2021 capital increase, Ibersol for the first time implemented a dividend policy and decided to pay out 20% of its profits going forward. The first payout of 0.135 Cents was made in 2022. I am no big fan of dividends right after a capital increase as this only benefits the taxman, but it is good that there is some focus on returning capital. Also, in December, they made one share repurchase of 0.1% of their capital

The big question is of course: What will they do with the Burger King Cash. In terms of shareholder remuneration I am pretty sure they will at least pay according to their dividend policy. Assuming they make a net profit of 125mm EUR, paying out 20% of that would mean a dividend of 57 Cents or 10% of the market cap - and leave the company with a massive net cash position.

They might distribute more through dividends or buybacks: Spending their net cash position (after lease) of about 94mm EUR might mean a shareholder return of 2.15 EUR/share - and the company would still be debt free while historically, they were always net debt - so they might do more.

Given the expansive history of Ibersol, it is also possible to see them do an acquisition to try and grow. This depends on potential targets in the market. Also, the fact that they sold their Burger King restaurants indicated that they will not empire-build at any cost. I judge management to be serious and competent and they have skin in the game, but a grave mistake might blow up the thesis. I expect to learn in the course of Q1 regarding their capital allocation plans.

Summary:

Ibersol is an interesting special situation in a Portuguese small-cap company. It is not as clean as the net cash situations like Exmar and 3U, in particular as they are trading cheaply but not below net cash and I do not know management intentions on returning capital. On the other hand, the underlying business, albeit smaller, shouldbe producing decent capital returns reliably. On this basis, I decided to open a small position in Ibersol. As usual, your feedback is highly appreciated.

Thanks for the article! I was just a while ago looking at the company.

I invested in $DOM in London, the master franchise for Domino's. They sold their ownership in their business in Germany, but the share price did not much react to it in my opinion. I'm not sure how they will use the cash.

I think Ibersol has a lot more self-operated restaurants which have/will face big cost pressures - hopefully the cash won't be burned in the kitchen. Considering to open a small position though!

Great write up and v interesting situation.

Any insight into ongoing CAPEX requirement? I can’t tell if the ~31m EUR CAPEX in 9m to Sep 22 includes the discontinued Burger King sites or not.

Very cheap on EV/EBIT but potentially not on EV/EBITDA - CAPEX if the above CAPEX numbers are reflective of ongoing CAPEX need.

Ideally what I’m trying to estimate is maintenance CAPEX, to give me a "steady state" EBITDA - CAPEX - tax yield %