Disclaimer: This is not investment advice. This post discusses securities which the author is long and may buy or sell at any time. The information provided may be inaccurate and the views biased. Please do not rely on this report for investment decisions and do your own research.

After some autumn vacation in the Aegean, I am back to cold old Germany and will start blogging again. Markets are volatile and a lot of macro stuff is going on, yet the substack will remain focused on single company investment ideas / write-ups. In this case, inspired by my holiday experience, I will look at two companies from the same sector, Car Rentals companies Sixt and Autohellas and will also cover what unites and separates them. Full disclosure, Augustusville owns Sixt Pref shares while I own Autohellas shares in my personal account. Augustusville uses IBKR as broker and I cannot buy Autohellas shares there. They can however be bought on the Greek and German stock exchanges.

Starting thoughts on the Car Rental Business:

At the first glance, the Car Rental Business looks like a pretty unattractive business to be in.

As a company you have to buy or otherwise fund cars which makes it potentially asset-heavy. This is a financing business.

Secondly, at least in parts of the sector, competition will happen on price. If you rent a car in Mallorca for a week, there is a big number of suppliers with pretty similar offers. Sure you want it to be safe and in a decent condition, but beyond that, you do not care too much who is renting it to you. On the flipside, not every market is as competitive as Mallorca and company reputation play a role. Also, not every client will fish for the best offers, some car rental works in combination with travel agencies, airlines and so on.

Moreover, the sector is vulnerable to economic downturns, political instability, weakness in tourism (e.g. caused by a pandemic).

Some other aspects can be positives or negatives:

Car Rental is probably less a relationship business on the customer than on the supplier side, i.e. the car manufacturers. This relationship is important for both parties. The Car Rental companies want to offer their customers the latest cars (where they can charge better margins). It helps them to have a certain scale to negotiate products and pricing. For the Car OEMs, Rental companies are important as big clients for new cars. Also, they are to some extent a showroom window to get end customers interested in the latest models.

This relationship does not necessarily end with Car Rental Company buying/leasing a car. Car Rental companies are not just buyers of new cars but also significant sellers of used cars. There maybe contracts with the OEMs on what happens to used cars or other ways to offload them. The state of the used-car market does matter.

Another challenge for the Car Rental Companies is demand anticipation. They need to form a view on where how many cars of which type for which purpose will be needed and based on the assessment get the respective cars to the respective place which is a planning / logistics challenge. If you have your cars at the right place at the right time, you may make a lot of money.

I just went over various aspects of the sector very quickly but I think it is becoming clear that this is a complicated business. By “complicated” I do not mean bad per se, but a business where a lot of factors are to be considered and decisions are to be taken at various levels. Scale, marketing, partnerships, demand anticipation, funding - all of these factors do matter and getting just one wrong may put you on the path for failure. The Car Rental business, is not per se a profitable one, in fact there are many examples of companies failing (notably Hertz in 2020). How did two family businesses manage to do really well and we expect them to continue their success? I will start with a lookat the smaller of the companies, Autohellas, and dedicate a separate report to Sixt.

Theodoros Vassilakis and some history on Autohellas:

Let’s get started. And we’ll start with Theodoros Vassilakis (1940-2018).

In 1963, a 23 year-old chap names Thedoros Vassilakis founded a company to trade Texaco-branded products on the Greek island of Crete. Admiring the US business landscape and keen to make his mark on the economy at home, he looked into more US business models to export to Greece where both the tourism and the car rental businesses were in their infacy phase. So, Vassilakis got in touch with the world’s leading car rental company, Hertz Corporation, founded in 1918 and purchased and renamed by John Hertz in 1923. In 1966, Vassilakis was appointed licensee for Hertz on the island of Crete. His fleet consisted of 6 VW Beetles. After expanding both thenumber of cars and islands covered, Vassilakis, in 1974, bought out Hertz Hellas which he renamed Autohellas and struck a licensing agreement to represent Hertz in all of Greece. It was a successful cooperation. Hertz provided industry know-how on car rental, management systems and helped with its car suppliers relations which may determine purchase conditions. Vassilakis was a driven entrepreneur on the ground, understanding the country’s complicated geography and business culture.

Autohellas grew to be the leading car rental company in Greece and, in 1999, went public.

In the same year, Vassilakis was the main founder of Aegean Airlines which has since become the primary Greek airline (which in the process acquired former state airline Olympic). Aegean Airlines is listed in the market and survived both the Greek debt crisis and Corona. Autohellas is both a partner and a shareholder to Aegean Airlines and owns about 11.8% in Aegean (Market Value of the Autohellas share about 50mm EUR)

Hertz was happy enough with the Autohellas cooperation that it signed a new cooperation agreement for 25 years in (1998-23, now extended to December 2025) under which Autohellas can use the Hertz brand and business network and pays licensing fees to Hertz, generating pretty low-risk profits for the Americans on an asset-light basis. At the same time, Autohellas operates all the Car Rental business itself, i.e. buys the cars, operates the offices and looks after repair and maintenance. Hertz appears to have liked the deal and the way Autohellas executed for them. The next years were driven by extending the partnership and Autohellas became the Hertz licensee and took over/opened car rental businesses in Bulgaria (2003), Cyprus (2005), Romania (2007), Serbia (2010), Montenegro (2011), Ukraine (2015) and Croatia (2016). Autohellas is the biggest Hertz franchisee globally.

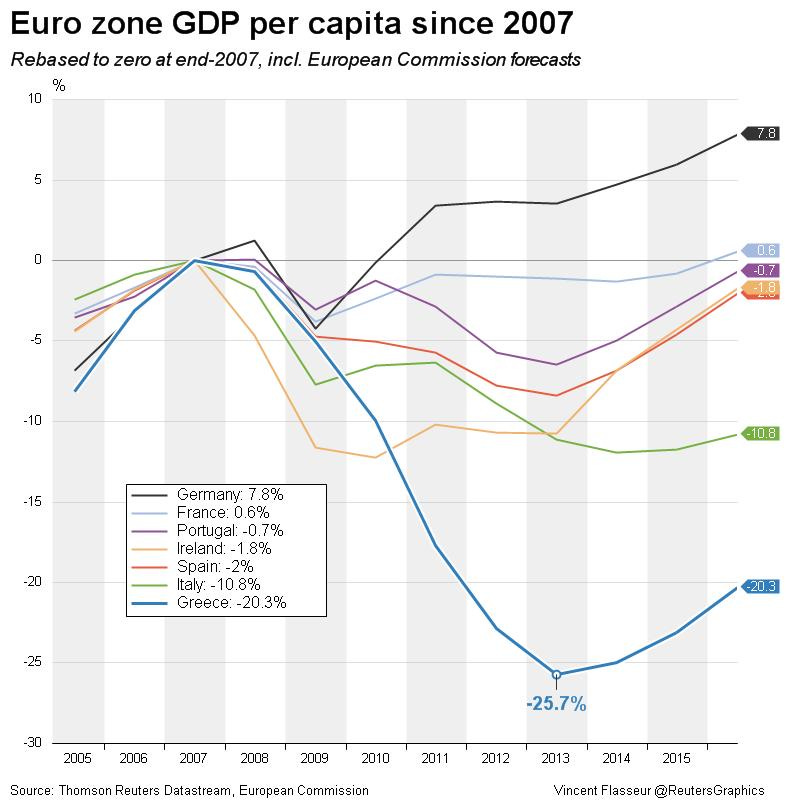

In the early 2010s, Greece was struck by a harsh economic crisis. At that time, Autohellas had two segments, tourism and corporate fleets. Both segments were hit hard, yet tourism recovered fairly quickly while the corporate fleet revenues were down sustainabily in the country suffering from the austerity-regime. The 2010s were, put mildly, extremely difficult for the Greek economy with low demand, high unemployment and a lot of bankruptcies. Investments in Greece dried up and also the tourism sectors suffered.

To Autohellas’ benefit, some foreign competitors cut back their operations in Greece. As an international firm, there was no reason to be in the country. Autohellas did not have that option. Yet it approached the difficult time from a position of financial strength and was subsequently able to seize some opportunities arising in that carnage to expand. This time, expansion was not driven by implementation of the same business model in neighbouring countries under the Hertz umbrella. This time, Autohellas expanded with cheap acqusitions in the Greek Home market in different, yet related segements to Car Rental: In 2016, the company acquired Technocar and Velmar, both previously loss-making on the cheap. These companies are licensed to import and repair Ford, Opel, Seat, Saab, Honda, Alfa Romeo, Fiat, Mitsubishi and Volvo cars. In 2017, the segment added BMW, Mini, Hyundai and KIA. As Greece has no car production, almost no automotive industry, cars and repair parts exclusively get imported and you need a good network in Greece with its complicated geography. In that respect, the car trading business is quite similar to what Autohellas did successfully in its cooperation with Hertz.

The more recent history shows Autohellas further expanding in the same two ways as it has traditionally: They bought the local Hertz partner in Portugal , another Southern European country with an important tourism sector and they set up a joint venture for the distribution of the Stellantis car brands in Greece.

Autohellas today

Autohellas today owns 46,000 rental vehicles and operates 3 segments, Greece Renting, Internatioanl Renting and Car & Parts Trade. Here is the breakdown of revenues and EBT by segment from the Annual Report and some history on the sales of the three segments:

Let’s take a closer look:

Greece Rentals is the original business and still the backbone of Autohellas with the highest margins and profit contribution. Autohellas separates this segment into short-term rentals which is to a large extent driven by touristic arrivals and long-term rentals (aka Fleet Management), i.e. longer-term contracts, typically with Greek corporate customers. During the Greek recession years, both collapsed initially but tourism recovered faster. Short-Term (mostly Tourism) Rent-a-Car is also highly seasonal with more than 50% of the activity happening in the third quarter. In 2021, Greence Rentals generated 7.8mm in EBT in H1 and 36mm in H2. There may have been some Covid easing effect, but for years, profits have been seasonal and geared to Q3. Fleet management is more long term and normally more stable (unless in a Great Depression), but contributes less to the bottom line as the quarterly profit overview since 2015 shows (source: TIKR).

International Rentals is the smallest segment by both revenues and profits. Of the markets Autohellas operates in, the touristic hotspots with the most potential for short-term car rental are Cyprus, Croatia and Montenegro. These markets are however smaller and less well-established locations than Greece - Croatia may have the biggest potential. In the bigger markets like Serbia, Romania and Bulgaria, long-term leasing currently has a bigger role. I have not come across a breakdown of sales per country. After an expansion phase in international markets ended in 2016, Autohellas paused in adding further markets, instead focusing on the Greek expansion into Car Trade & Repairs. During these years, growth in International has been modest. My feeling is that Autohellas faces a tougher competitive position and is lacking the scale in these markets compared to Greece - there may also be less market potential than in Greece.

Therefore, I was a bit surprised to see Autohellas expand into other countries again with its acquisition of Portuguese HR Automoveis, which closed in early October 2022. Per the terms, they will acquire roughly 90% of the Portuguese Hertz/Thrifty franchisee and pay 31.5mm EUR plus up to 7.5mm EUR if certain profitability targets are met. HR Automoveis is expected to generate 75-80mm EUR in sales for 2022 and will thus double the sales of the International Segment. Portugal is a sought-after touristic destination with a solid demand for short-term rental. I have no information on the profitability and capital structure of HR Automoveis. EBT margins of the existing segments are about 12.5% (International Car Rental) and 17% (Greek Car Rental) in 2021. Assuming 12.5% in EBIT margin (might be conservative), HR Automoveis might generate 10mm EUR in EBIT this year in which case Autohellas is buying this cheaply. We will probably see more on HR Automoveis in the next two quarters.

Auto Trade is the newest segment, only added in 2016. I was slightly sceptical of this segement at first as it operates at lower profit margins compared to Car Rental. What made me change my mind was this table:

Look at the Car and Spare Parts Trade & Repair Segment. You see that (1) it generates significant intra-segement revenue. Autohellas in this segement is insourcing a service which they would otherwise need to buy. So it makes strategic sense to do this yourself if you can do it profitably. (2) The segment profit margins of <5% are much slimmer than for Car Rental, notably Distribution Costs are much higher. (3) The segment does not require significant capital. Per the table, Trade & Repair generates >12% RoA and 40% RoE (pre eliminations, but if you allocate them, RoE will still be very high). I think this is a characteristic of Car Dealers which I was not aware of until recently but also saw when I did quick-checks on Motorpoint (UK) and Asbury (US).

Autohellas added new brands to this segment and I think that by now it is quite valuable. I would actually love to see them acquire car dealers in other markets aswell.

Financials:

I like to look at 10y tables with the most important financials, so here is one for Autohellas:

Couple of points:

When the economic crisis struck in 2011-14, Autohellas entered it at moderate leverage. It maintained profitability and delevered its balance sheet before goin on the offense again in 2015 (note growth in total assets).

The company also proved its resilience during Covid times, maintaining profitability also in 2020.

On the funding side, Autohellas is using mostly a mix of bank borrowings with Greek banks. (at rates of around 2.5% in 2021). In addition, Autohellas securitised some ofits lease receivables in two transactions in 2018 (with EIB) and 2021 (with JP Morgan), which in my view is an innovative way of funding. Will higher rates hurt them on the funding side? No too much. In their Annual Report, they estimate a sensitivity of 172K EUR on net profits for interest rate increases by 0.5% - so if we move up by 3%, this may cost a bit more than 1mm EUR in net profits.

There has been small repurchase activity but overall the share count has been stable

Management, Shareholding Family & Capital Allocation:

Autohellas was and still is a family business. To my knowledge, the Vassilakis family in its main holding vehicle owns about 61% of the shares. After Theodoros, the founder, passed away, Autohellas is now run by his son, CEO Eftichios Vassilakis (55).

Educated in the US (Yale, Columbia), Eftichios has been in the company since 1990 and a Managing Director since 2006. I see him as the main driving force behind the expansionary phase which started in 2016. I think he knows the company, the sector and every relevant business address in Greece inside out. Like his father, Eftichios is also Chairman of Aegean Air. On Youtube, I found this video of him presenting Aegean at a Value Investors Event . On concern might be that he is involved with various businesses so he does not fully focus on Autohellas. The Vassilakis family has two more board members, Eftichios’ mother Emmanouela Vassilaki (76) and his brother Giorgios Vassilakis (50). Given their shareholding, the Vassilakis family is clearly incentivized to make Autohellas a success. I understand that some readers have a natural scepticism on European family-owned companies (related party transactions, not shareholder-friendly, intransparent,…). According to their published statements (see Note 36 in their Annual Report), related party transactions are moderate and the key management team in total is getting a compensation of 4.2mm EUR. I think this is pretty okay given the company size and fairly low in relation to the money the family makes on its investments. As far as I am aware, the reputation of the family is excellent and I have not come across any situation when they were taking advantage of minority shareholders. So I do not think this likely but it is certainly a risk.

In terms of capital allocation, Autohellas has reinvested most of their earnings into their business, and in my view done that pretty well. They have also paid dividends every year since 2014 including during the time when capital controls were introduced in Greece and when Covid struck. Furthermore, the company did engage in share repurchases over the last years, however, given the limited trading liquidity, share count did not really reduce. An interesting move happened last month, when the company issued this release that it was planning to reduce its share capital by 1 EUR per share and will distribute such amount this year. By now, the Capital Return has been approved by an EGM. Given the overall uncertain economic climate and their acquisition in Portugal, I find it a remarkable sign of confidence that the company will distribute 49mm EUR to its shareholders. Still, according to their Nebt Debt/EBITDA ratio, their leverage was fairly modest at the end of Q2 and they very likely had a strong Q3. The distribution will increase their leverage by roughly 0.25x EBITDA - it may still sit at or below 2x as I write this. I do not know why the distribution was structured as a capital return rather than dividend but suspect it may be for tax reasons.

Valuation:

Admittedly, I have a soft spot for bottom-fishing. Buying shares of a company which have dropped means you get the same business as an investor who bought 3 months ago - you just get it cheaper and are certain to do better if you the shares are held perpetually. There is a number of these opportunities in the market right - and Autohellas is not one of them.It is rather trading at all-time high levels:

Remember that the business is at least in part vulnerable to shocks and there have regularly been occasions to buy at a cheap price. So buying right now, might not be the best timing (or it might, I have honsetly no idea). Is Autohellas funadentally cheap?

The market cap sits around 540 mm EUR, Enterprise Value maybe around 920mm EUR. This means that the company trades at 9x P/E and 5x EV/EBITDA, based on last-twelve-months numbers. Q3 has very likely been strong based on a record year for tourism in Greece. So as of now, the ratios may even be a bit cheaper. The latest dividend was 46 Cents, so the dividend yield sits at 4.2% (you may get the capital return on top). Not every year may be as strong as the Covid recovery year of 2022 so it might make sense not plan some cushion for the next pandemic, recession or war. On the other hand, the company has demonstrated its capability to emerge stronger from crises. Also, I do expect some tailwind from the Portuguese acquisition and the growing Car & Parts Trade/Repair business. In the long run, I would expect the company to generate more profits than today. Autohellas has been a long-term holding for me and I am still finding it attractive at the current valuation.

Risks

The Hertz contract expires in 2025 and may not be extended. Mitigant: I think this is unlikely as Hertz would need a new partner or go by itself. Autohellas has about 50K cars on the ground and the infrastructure of sales offices and service stations. More likely, Hertz may want to charge a higher fee. This is clearly possible, but Autohellas has delivered riskfree income for Hertz and may also be ablte to do the business itself. So their bargaining position is pretty good.

A recession in Europe looks likely and inflation may hurt travel budgets which may weigh on Autohellas. The business is vulnerable to shocks. Mitigant: The business has a history of resilience and in my view rather become stable.

The family may do something unfriendly to minority shareholders or bad capital allocation decisions. Mitigant: They have not done this so far.

Turkey may start a war with Greece. While unlikely, depending on how this would go, it may be disastruous. No mitigant for this.

Summary

Autohellas is one of the companies I admire a lot. While active in a difficult sector and country, they have over 50 years managed to build a prospering and profitable international business out of nothing (or out of 6 Beetles). It is a family-owned company with a long-term orientation and they have some growth opportunities for their business lines. The valuation looks attractive for a growing company with high returns on capital.

Extremely detailed case study about the stock here in this Fund Letter: https://mcusercontent.com/2511717cdf1bae9a0638c942a/files/c2c02322-09f5-a9e7-0cc2-5c1d5994635c/030923_Bonhoeffer_Partner_Letter_Q4_2022.pdf